What kind of account is fees earned?

Is fees earned an asset or liability

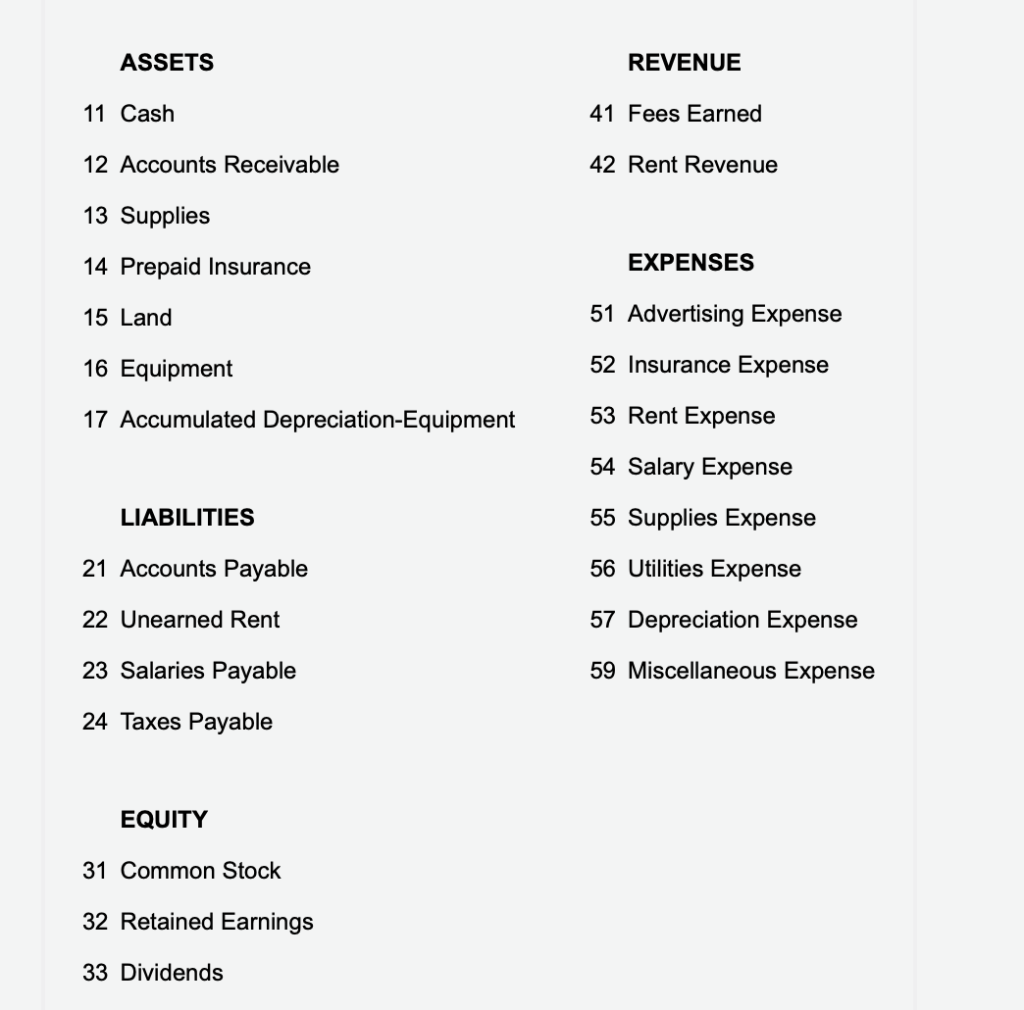

In accounting, fees earned is a revenue account. Similar to all revenue accounts, it increases equity. Recording fees earned usually results in the increase of an asset account such as cash or accounts receivable however, this does not affect the classification of the fees earned as an equity account.

Cached

Is fees earned a credit account

Fees earned will always have a credit balance because it is a revenue and ALL revenue accounts have credit balances.

Cached

Is fees earned an accrual

(Under the accrual basis of accounting, fees earned are reported in the time period in which they are earned and not in the period in which the company receives payment.)

Cached

Is fees earned a debit or credit in accounting

Fees earned (Income) are Credited (Cr.) As per the golden rules of accounting for (nominal accounts) incomes and gains are to be credited. So, fees earned are credited to the financial books.

Cached

Are fees considered an expense

Operating expenses are the expenses related to the company's main activities, such as the cost of goods sold, administrative fees, office supplies, direct labor, and rent. These are the expenses that are incurred from normal, day-to-day activities.

Is cost an expense or liability

Expenses are the costs of a company's operation, while liabilities are the obligations and debts a company owes.

Is unearned fees earned a debit or credit

Unearned revenue is a liability for the recipient of the payment, so the initial entry is a debit to the cash account and a credit to the unearned revenue account.

Is unearned fees a credit

Unearned revenue is originally entered in the books as a debit to the cash account and a credit to the unearned revenue account. The credit and debit are the same amount, as is standard in double-entry bookkeeping. Also, each transaction is always recorded in two accounts.

What is an example of an accrual account

What is an example of accrual accounting An example of accrual accounting is when a company records a sale of goods as revenue when the goods are shipped to the customer, even though the customer has not yet paid for the goods. This is done to record the amount of money the company is owed for the goods.

What type of account is unearned fees

liability

Unearned revenue is recorded on a company's balance sheet as a liability. It is treated as a liability because the revenue has still not been earned and represents products or services owed to a customer.

Is fees earned a debit

Fees Earned is a CREDIT balance account. Therefore, it increase with a CREDIT and decreases with a DEBIT.

How do you record fees in accounting

To record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or advertising expense) and a credit to accounts payable or cash, depending on whether you've paid for the expense at the time you recorded it.

What are expense fees in accounting

An expense in accounting refers to the money spent and the costs incurred by a company in pursuing revenue. Simply put, account expenses are the costs involved in running a business, and collectively they contribute to the activities involved in generating profit.

What falls under expenses in accounting

An expense is a cost that businesses incur in running their operations. Expenses include wages, salaries, maintenance, rent, and depreciation. Expenses are deducted from revenue to arrive at profits. Businesses are allowed to deduct certain expenses from taxes to help alleviate the tax burden and bulk up profits.

What expenses are liabilities

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses.

Is a cost account an expense

Bookkeeping Guidebook. Cost Accounting Fundamentals. The difference between cost and expense is that cost identifies an expenditure, while expense refers to the consumption of the item acquired.

What is the account of unearned fees

Unearned fees are current liabilities that is presented on the balance sheet of a company. It represents the amounts paid prior to receiving goods or services. Since the company still owes the customer the delivery of goods or services, the amount must remain in the liability account until the service is performed.

Where does unearned fees go on a balance sheet

Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and thus has unfulfilled obligations to their customers as a result. Unearned revenue is treated as a liability on the balance sheet because the transaction is incomplete.

What are the two types of accrual accounting

There are many types of accruals, but most fall under one of the two main types: revenue accruals and expense accruals.

What are 2 examples of an accrued expense account

Examples of accrued expensesLoan interest.Wage expenses.Payments owed to contractors and vendors.Government taxes.Property rental costs.Utility expenses.Rent expense.Computer equipment.