What kind of credit is 615?

What kind of credit score is 615

Fair

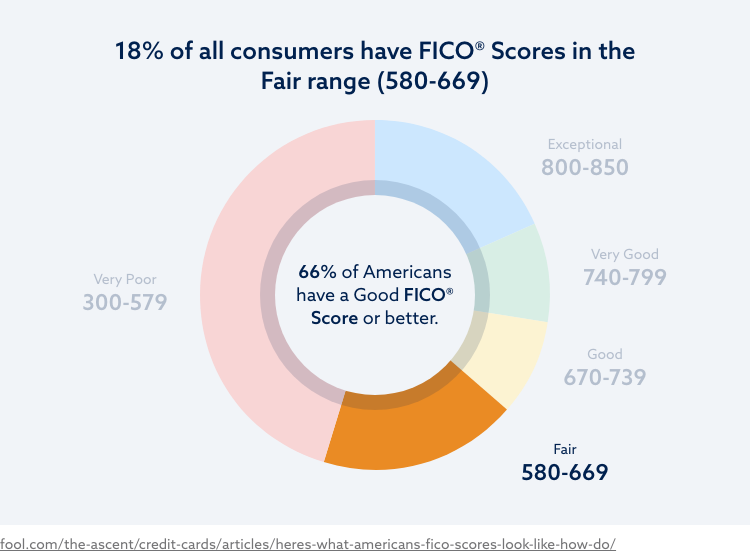

A FICO® Score of 615 places you within a population of consumers whose credit may be seen as Fair. Your 615 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Cached

What can you get with a credit score of 615

What Does a 615 Credit Score Get You

| Type of Credit | Do You Qualify |

|---|---|

| Unsecured Credit Card | YES |

| Home Loan | YES (FHA Loan) |

| Personal Loan | MAYBE |

| Auto Loan | MAYBE |

Cached

Can you get a loan with a credit score of 615

Yes, you can get a personal loan with a 600 credit score — there are even lenders that specialize in offering fair credit personal loans. But keep in mind that if you have a credit score between 580 and 669, you'll generally be considered a “subprime” borrower — meaning lenders might see you as a more risky investment.

Cached

Can I buy a house with a credit score of 615

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

Cached

How to go from 600 to 750 credit score

6 easy tips to help raise your credit scoreMake your payments on time.Set up autopay or calendar reminders.Don't open too many accounts at once.Get credit for paying monthly utility and cell phone bills on time.Request a credit report and dispute any credit report errors.Pay attention to your credit utilization rate.

What can a 700 credit score do

A credit score of 700 can help you achieve some of your financial goals, such as buying a house, replacing your car, or even plans like remodeling your home. That's because you are more likely to qualify for loans that will help you achieve these goals than someone with a fair credit score or worse.

What is the lowest credit score to buy a car

In general, you'll need a credit score of at least 600 to qualify for a traditional auto loan, but the minimum credit score required to finance a car loan varies by lender. If your credit score falls into the subprime category, you may need to look for a bad credit car loan.

What credit score is needed for a $350 000 house

Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

What credit score is needed to buy a $250 000 house

While credit score requirements vary based on loan type, mortgage lenders generally require a 620 credit score to buy a house with a conventional mortgage.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

How long does it take to go from 600 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

How bad is a 600 credit score

Your score falls within the range of scores, from 580 to 669, considered Fair. A 600 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

Do I really need a 800 credit score

Generally, the rule of thumb is you'll need to have a credit score above 760 in order to receive the best terms on loans and/or mortgages. In other words, having a credit score of 800 puts you within the top credit score range and will help you qualify for the best terms, whether it's for a mortgage or a personal loan.

What credit score do I need to buy a $20000 car

Key Takeaways. Your credit score is a major factor in whether you'll be approved for a car loan. Some lenders use specialized credit scores, such as a FICO Auto Score. In general, you'll need at least prime credit, meaning a credit score of 661 or up, to get a loan at a good interest rate.

Is it hard to buy a car with a 600 credit score

A credit score of 600 won't necessarily keep you from getting an auto loan, but it's likely to make that loan more expensive. Taking steps to improve your score before you apply for a car loan can put you in the driver's seat and make it easier to negotiate the best possible loan terms.

Can a person with a 500 credit score buy a 45k house

Anyone with a minimum credit score of 500 can apply for an FHA loan. But if you already have a 620 or higher credit score, it makes more sense to go for a conventional mortgage.

How long does it take to build credit from 500 to 700

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

How long does it take to build credit from 600 to 700

Bringing Your Score Back Up

It usually takes about three months to bounce back after a credit card has been maxed out or you close an unused credit card account. If you make a single mortgage payment 30 to 90 days late, your score can start to recover after about 9 months.

How to get credit score from 620 to 700

How To Get A 700 Credit ScoreLower Your Credit Utilization.Limit New Credit Applications.Diversify Your Credit Mix.Keep Old Credit Cards Open.Make On-Time Payments.

What credit score do you start with

zero

Some people wonder whether the starting credit score is zero, for example, or whether we all start with a credit score of 300 (the lowest possible FICO score). The truth is that there's no such thing as a “starting credit score.” We each build our own unique credit score based on the way we use credit.