What kind of credit score is needed to lease a car?

What minimum credit score do you need to lease a car

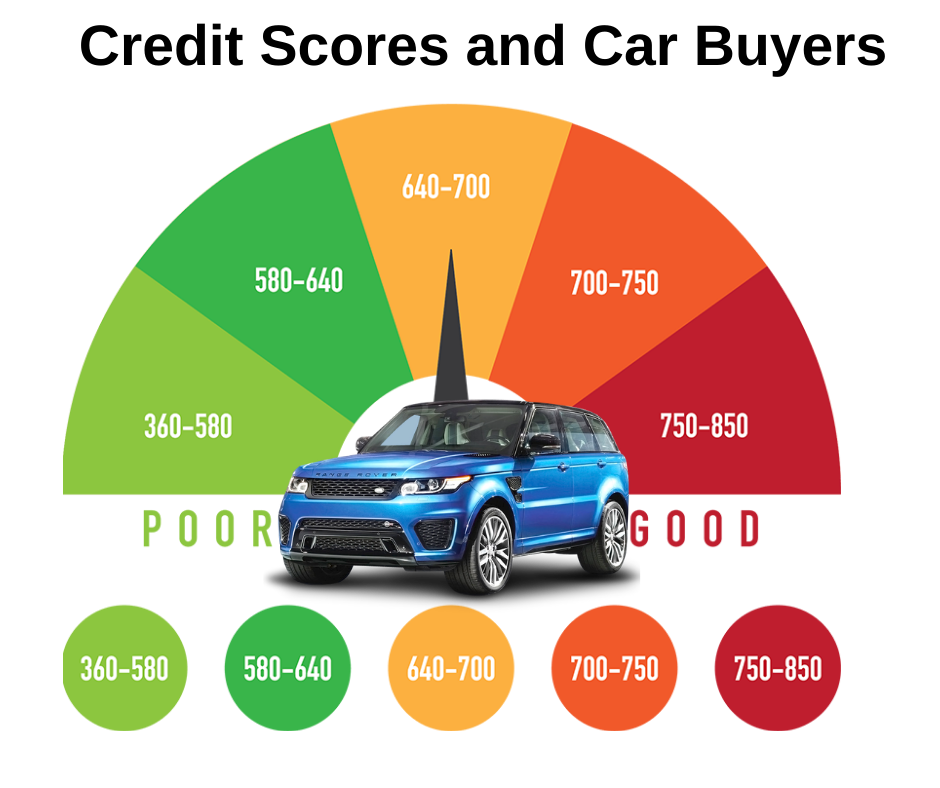

The typical minimum for most dealerships is 620. A score between 620 and 679 is near ideal and a score between 680 and 739 is considered ideal by most automotive dealerships. If you have a score above 680, you are likely to receive appealing lease offers.

Cached

Can I lease a car with a 600 credit score

According to the Experian State of the Automotive Finance Market report, the average credit score among those who leased new cars in the second quarter of 2023 was 736. If you have a credit score of 600 or lower, you'll likely have trouble getting approved for an auto lease.

Cached

How much is a lease on a $45000 car

How much is a lease for a $45,000 car Using our calculator, we input a $5,000 down payment, an assumed $25,000 residual value, an interest rate of 7% and a term of 36 months (three years). It resulted in monthly payment of $606 before taxes.

Can I lease a car with a 500 credit score

Can I lease a car with a 500 credit score Yes. You can still lease a car with a credit score of 500. You may have to go through special channels to get approved, such as making a larger down payment or getting a co-signer.

Cached

Is it easier to lease or finance a car

“While buying a car for the long term can very well be more expensive, it's easier to take out a loan than it is to lease on a bad credit score,” says Borghese. After the loan is paid off, the driver will no longer have the burden of monthly payments on the car.

What car company is best to lease from

Best Car Brands To LeaseKia's affordable lineup of cars and SUVs can be significantly more affordable than brands like Toyota.This Month's Best Lease Deals.Dodge makes power-packed cars & SUVs you simply won't find from brands like Toyota.Jeep leases can be hit-or-miss due to low residual values and high lease rates.

Can I get a 40k car with 600 credit score

It's essential to be knowledgeable about how your auto loan process will be different than someone with a higher score. You might not have the same options, but you can still get an auto loan with a 600 credit score.

Why leasing a car is smart

Lower monthly payments

Instead of paying for the entire value of the car, your monthly payments cover the vehicle's depreciation (plus rent and taxes) over the lease term. Since you're only financing the depreciation instead of the purchase price, your payment will usually be much lower.

How much should I save before leasing a car

It's recommended you spend no more than about $2,000 upfront when you lease a car. In some cases, it may make sense to put nothing down and roll all of your fee costs into the monthly lease payment.

Does leasing a car build credit

If you're approved for your lease, you can use it as an opportunity to boost your credit score, which could give you more leverage when it comes time to upgrade. Just make sure to stay on top of your payments. Lease payments are reported to the major credit bureaus the same way finance payments are.

Can I get a car with 550 credit score

You can still qualify for a car loan with such a score, but you may notice a higher interest rate compared to what can be normally expected. Depending on how long the loan period is, a 550 credit score will get your interest rates between 15% to 20%.

Is it financially smarter to buy or lease a car

Buying a car typically makes more financial sense than leasing one, since you get to keep the vehicle as an economic asset and avoid higher finance charges and upfront costs. There are certain benefits that leasing has over outright buying a car, such as making high-end vehicles more affordable.

What is the biggest downside to leasing a car

Cons of Leasing a CarYou Don't Own the Car. The obvious downside to leasing a car is that you don't own the car at the end of the lease.It Might Not Save You Money.Leasing Can Be More Complicated than Buying.Leased Cars Are Restricted to a Limited Number of Miles.Increased Insurance Premiums.

What is the best month to lease a car

Most new models are introduced between July and October, so this is the time that you should try to lease to maximize your savings.

What credit score do I need to buy a $20000 car

Key Takeaways. Your credit score is a major factor in whether you'll be approved for a car loan. Some lenders use specialized credit scores, such as a FICO Auto Score. In general, you'll need at least prime credit, meaning a credit score of 661 or up, to get a loan at a good interest rate.

What credit score do you need to buy a $40 000 car

For favorable terms and a low interest rate, you need to reach at least 700 – 749, with a higher score ensuring even better terms.

What are 2 major disadvantages to leasing a car

Cons of Leasing a CarYou Don't Own the Car. The obvious downside to leasing a car is that you don't own the car at the end of the lease.It Might Not Save You Money.Leasing Can Be More Complicated than Buying.Leased Cars Are Restricted to a Limited Number of Miles.Increased Insurance Premiums.

Is it smart to put money down on a car lease

Monthly Payments: A sizable car lease down payment will reduce your monthly lease amount, but it's unlikely to save you money in the long run, thanks to the lower money factor — and thus lower interest rates — on a lease.

Is leasing a car financially smart

Benefits of leasing usually include a lower up-front cost, lower monthly payments compared to buying, and no resale hassle. Benefits of buying usually are car ownership, complete control over mileage, and a firm idea of costs. Experts generally say that buying a car is a better financial decision for the long term.

Can I get a car with a 480 credit score

Many lenders require a credit score above 650 to get a standard car loan. However, if you have a credit score of 550, 480 or even lower, and the bank or dealership denies your application, it is still possible to get a car loan. In fact, there is no score that is officially too low to get a car loan.