What kind of loan can I get to fix my house?

Are renovation loans a good idea

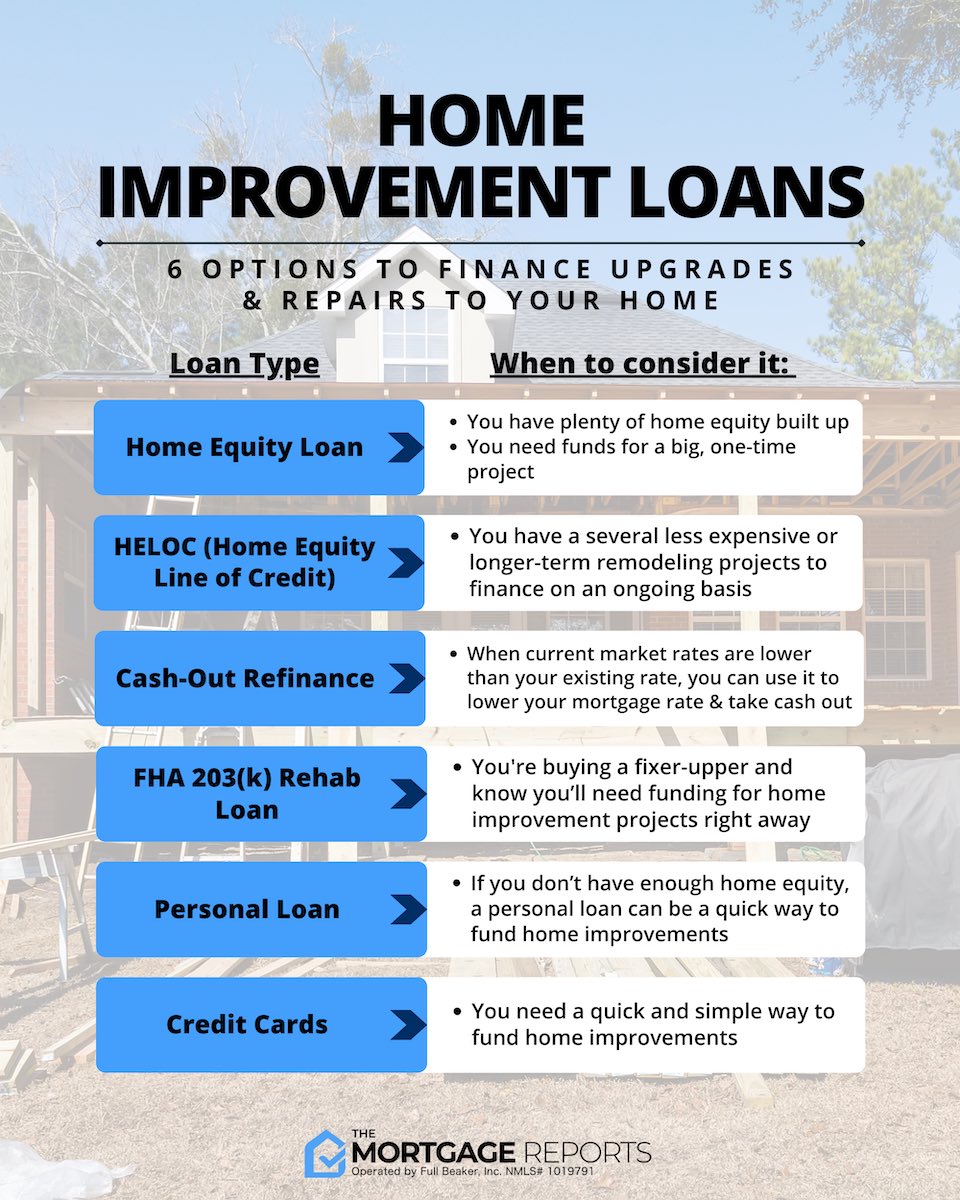

Home improvement loans are an important tool for homeowners who need to make essential or cosmetic changes to their space. Because they come with fixed interest rates and let you borrow a large lump sum at once, they are a useful way to make the payments more manageable.

What is the downside to a home equity loan

Home Equity Loan Disadvantages

Higher Interest Rate Than a HELOC: Home equity loans tend to have a higher interest rate than home equity lines of credit, so you may pay more interest over the life of the loan. Your Home Will Be Used As Collateral: Failure to make on-time monthly payments will hurt your credit score.

What is the average length of a home improvement loan

The term length of your home improvement loan depends on the type of loan you choose. Personal loan terms range from 12 to 60 months. Loans backed by your mortgage tend to have longer repayment periods.

Cached

Can renovations be loans

With a renovation loan, you need not tap into your savings and worry about cash flow. However, like a personal loan, a renovation loan comes with an interest rate, and it varies between banks. Note that a renovation loan can only be used for the intended purpose and cannot be diverted towards any other area of spend.

What are the pros and cons of home renovation loans

The pros of a home improvement loan include building credit with on-time payments, being able to undertake large projects without having all the money up front, and increasing your home's value. The cons include the potential for fees and a high APR, as well as credit score damage if you don't make the payments.

What is a renovation loan

A renovation loan gives homeowners the funds to make necessary or desirable renovations to a home or access to the credit to make those changes. Renovation loans come in a variety of packages including simple personal loans or government-sponsored loans to get the job done.

Can you pull equity out of your home without refinancing

Home equity loans and HELOCs are two of the most common ways homeowners tap into their equity without refinancing. Both allow you to borrow against your home equity, just in slightly different ways. With a home equity loan, you get a lump-sum payment and then repay the loan monthly over time.

What credit score is needed for a home equity loan

620

What is the minimum credit score to qualify for a home equity loan or HELOC Although different lenders have various credit score requirements, most typically require you to have a minimum credit score of 620.

How much interest will I pay on a home improvement loan

about 6.50 percent to 36 percent

Home improvement loan rates currently range from about 6.50 percent to 36 percent. That said, the actual rate you'll get will depend on multiple factors, such as your credit score, annual income and debt-to-income ratio.

What would the payment be on a 50000 home equity loan

Loan payment example: on a $50,000 loan for 120 months at 7.50% interest rate, monthly payments would be $593.51. Payment example does not include amounts for taxes and insurance premiums.

What is the difference between a refinance and a top up loan

While refinancing is the act of switching to a new home loan, home loan top-ups are when you increase your existing home loan, allowing you to borrow more by using the equity in your home.

What is top up financing

A Top up loan meaning an extra loan is a financing option that is offered over and above the existing loan amount for products such as home loan and personal loan. The top-up loan is offered to customers who have an existing relationship with the lender, have a good credit score and have repayment ability.

Are home renovations worth the money

Remodeling can boost the return on investment (ROI) of a house. Wood decks, window replacement, and kitchen and bathroom upgrades tend to generate the highest ROIs. For cost recovery, remodeling projects generally must fix a design or structural flaw to earn back the cost of construction.

Is it better to pay off mortgage or renovate

Not only would you save money in interest costs, and reduce your repayment amount, but the renovation will (hopefully) increase the value of your home. If you're not looking at putting your home up for sale anytime soon, paying down the mortgage as fast as possible before renovating is often the sensible thing to do.

What is a 203k FHA loan

FHA's Limited 203(k) program permits homebuyers and homeowners to finance up to $35,000 into their mortgage to repair, improve, or upgrade their home.

What is the cheapest way to get equity out of your house

HELOCs are generally the cheapest type of loan because you pay interest only on what you actually borrow. There are also no closing costs. You just have to be sure that you can repay the entire balance by the time that the repayment period expires.

Do you have to pay back equity

When you get a home equity loan, your lender will pay out a single lump sum. Once you've received your loan, you start repaying it right away at a fixed interest rate. That means you'll pay a set amount every month for the term of the loan, whether it's five years or 30 years.

Can I take equity out of my house without refinancing

Sale-Leaseback Agreement. One of the best ways to get equity out of your home without refinancing is through what is known as a sale-leaseback agreement. In a sale-leaseback transaction, homeowners sell their home to another party in exchange for 100% of the equity they have accrued.

How much can you borrow from a home equity line of credit

Borrowers can usually get up to 85% of their home's equity when borrowing a HELOC. However, from that amount comes your current outstanding mortgage balance. Between all loans, you can have 85% of your home's value outstanding at once.

How do I borrow money from equity in my home

A HELOC is a revolving line of credit that allows you to borrow against the equity you've built up in your home. During the draw period, you can borrow funds up to a certain limit set by the lender, carry a monthly balance and make minimum payments, much like a credit card.