What kind of windows qualify for tax credit?

How do I know if windows qualify for tax credit

Am I eligible for a windows, doors and/or skylights tax creditThis must be for your primary residence (you live here most of the time).This must not be for a new home or a rental.The replacement windows, doors or skylights must be ENERGY STAR-certified products.

Cached

What windows are tax deductible

If you replaced your old windows with new energy-efficient windows, skylights, doors, or other qualifying items in 2023, you could be eligible to claim a windows tax credit of up to $600. Current energy tax credits for window replacement have been extended until December 31, 2032.

Cached

Are replacement windows tax deductible 2023

New 2023 Tax Credit Changes

Last year, the 2023 Tax Credit for installing efficient windows and doors was only 10% of the product cost with a maximum credit of $500. Now in 2023, it has significantly increased to 30% of the product cost with a maximum credit of $1100.

What qualifies as an energy-efficient window

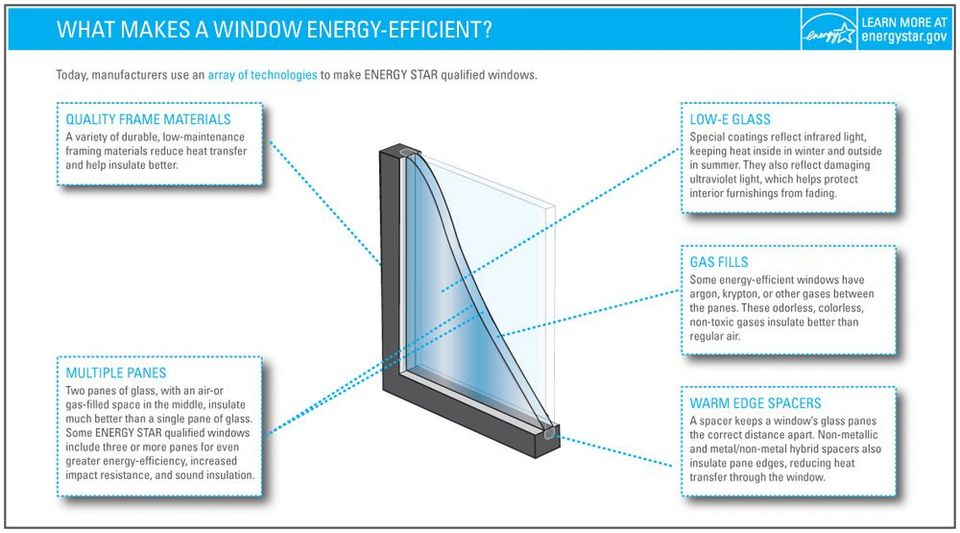

In summary, a double or triple-pane vinyl window with Low-E glass is the most energy-efficient window option.

Do new energy-efficient windows qualify for tax credit

You may be able to take these credits if you made energy saving improvements to your principal residence during the taxable year. In 2023, 2023 2023, and 2023 the residential energy property credit is limited to an overall lifetime credit limit of $500 ($200 lifetime limit for windows).

Can I claim impact windows on my taxes

Many hurricane windows and doors from ASP Windows are Energy Star rated and compliant. That means they are qualified for this tax credit. Most vinyl impact windows meet energy star requirements and are the type of impact window that best reduces your energy costs.

Can I deduct my energy-efficient windows

You may be able to take these credits if you made energy saving improvements to your principal residence during the taxable year. In 2023, 2023 2023, and 2023 the residential energy property credit is limited to an overall lifetime credit limit of $500 ($200 lifetime limit for windows).

Does energy-efficient windows qualify for tax credit

One of the primary federal tax credits that homeowners often overlook is the tax credit for doors and windows. The federal tax credit for 2023 gives homeowners a 30% tax credit worth up to $1200 if they install energy-efficient features such as windows and doors.

What home improvements are tax deductible 2023

More In Credits & Deductions

If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit for improvements made through 2032.

What is the IRS exemption for 2023

The personal exemption for tax year 2023 remains at 0, as it was for 2023, this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

How do I know if my windows are ENERGY STAR rated

What do I look for ENERGY STAR® certified windows have a sticker. The sticker has product identification information printed on it including the manufacturer's name, model number, testing metrics such as U-factor, certification number, as well as the blue ENERGY STAR® logo.

What is the Inflation Reduction Act window tax credit

Beginning in tax year 2023, homeowners can earn an energy tax credit of 30% of the cost of new windows, up to a maximum $600. This structure is part of the Inflation Reduction Act of 2023, which extends and increases benefits of the Energy Efficient Home Improvement Credit (EEHIC).

How does the 30% tax credit for energy efficient windows work

Beginning January 1, 2023, the amount of the credit is equal to 30% of the sum of amounts paid by the taxpayer for certain qualified expenditures, including (1) qualified energy efficiency improvements installed during the year, (2) residential energy property expenditures during the year, and (3) home energy audits …

What qualifies for energy tax credit in 2023

Energy Efficient Home Improvement Credit

1, 2023, the credit equals 30% of certain qualified expenses: Qualified energy efficiency improvements installed during the year which can include things like: Exterior doors, windows and skylights. Insulation and air sealing materials or systems.

Are energy-efficient home improvements tax deductible

If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit for improvements made through 2032. For improvements installed in 2023 or earlier: Use previous versions of Form 5695.

How does the 30% tax credit for energy-efficient windows work

Beginning January 1, 2023, the amount of the credit is equal to 30% of the sum of amounts paid by the taxpayer for certain qualified expenditures, including (1) qualified energy efficiency improvements installed during the year, (2) residential energy property expenditures during the year, and (3) home energy audits …

Are there tax credits for low E windows

Beginning in tax year 2023, homeowners can earn an energy tax credit of 30% of the cost of new windows, up to a maximum $600. This structure is part of the Inflation Reduction Act of 2023, which extends and increases benefits of the Energy Efficient Home Improvement Credit (EEHIC).

What is the 2023 elderly deduction

If you are at least 65 years old or blind, you can claim an additional 2023 standard deduction of $1,850 (also $1,850 if using the single or head of household filing status). If you're both 65 and blind, the additional deduction amount is doubled.

What is the new IRS rule 2023

Standard deduction increase: The standard deduction for 2023 (which'll be useful when you file in 2024) increases to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: The income tax brackets will also increase in 2023.

What is the new lifetime exemption for 2023

Lifetime IRS Gift Tax Exemption

Also for 2023, the IRS allows a person to give away up to $12.92 million in assets or property over the course of their lifetime and/or as part of their estate.