What line is recovery rebate credit on 1040?

What line item is recovery rebate credit

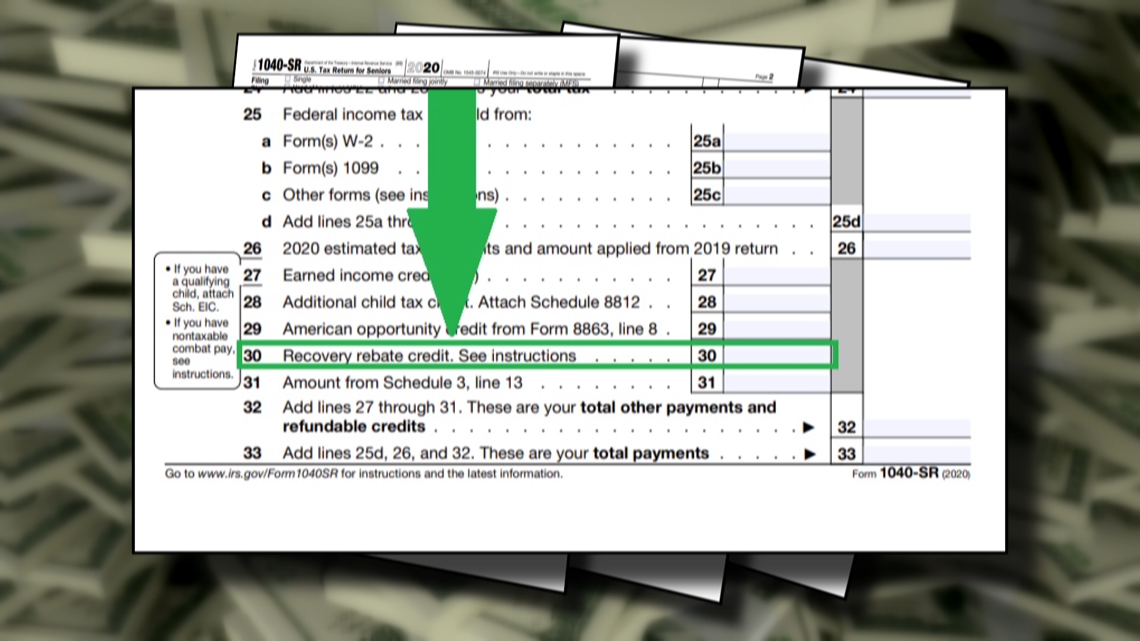

The Recovery Rebate Credit is a new line item on the 2023 Tax Return and is in the same place on the 2023 Return, listed on line 30 on the 2023 1040 form.

Cached

Where does recovery rebate credit go on tax return

You report the final amount on Line 30 of your 2023 federal income tax return (Form 1040 or Form 1040-SR). The recovery rebate credit is a "refundable" credit, which means you'll get a tax refund if the credit is larger than the tax that you would otherwise have to pay.

Cached

How do I know if I received the recovery rebate credit

You qualify for the recovery rebate credit only if the IRS didn't give you a stimulus payment, or if you received a partial payment. To find out you whether you missed out on money you were entitled to, you can contact the IRS, review your IRS online account or use the tax agency's Get My Payment tool.

Cached

What is line 10 on 1040 rebate

Line 10 is used to determine the maximum income you can have to qualify for the stimulus based on your filing status. Line 11 If your income is above the threshold on line 10, the stimulus payment is reduced by 5% of the excess over the threshold.

Cached

Where do I put the recovery rebate credit on Turbotax

Go to the Federal Section (on left side navigation panel) Select COVID-19 Relief (on left side navigation panel) Select Recovery Rebate Credit.

Is recovery rebate credit included in tax return

Your 2023 Recovery Rebate Credit will reduce any tax you owe for 2023 or be included in your tax refund.

Where do I enter my recovery rebate credit on Turbotax

Go to the Federal Section (on left side navigation panel) Select COVID-19 Relief (on left side navigation panel) Select Recovery Rebate Credit.

What is the line 30 on the 1040

Line 30 on 2023 Form 1040 and Form 1040-SR is used to claim the Recovery Rebate Credit. File a complete and accurate return – even if you don't usually file taxes – to avoid processing delays that slow your tax refund.

Who got the recovery rebate credit

Generally, you are eligible to claim the Recovery Rebate Credit if: You were a U.S. citizen or U.S. resident alien in 2023. You are not a dependent of another taxpayer for tax year 2023.

Is the recovery rebate credit the same as a stimulus check

This program was more commonly known as the stimulus checks or payments as the stimulus checks were advance payments of the Recovery Rebate Credit. You may have received the first and/or second Economic Impact Payments (EIP), or COVID-19 related stimulus payments.

What is line 22 on 1040

Line 22 instructs you to subtract line 21 (your total tax credits) from line 18 (additional taxes you may owe). Line 23 requires you to write in certain other additional taxes you paid, like self-employment tax, as found on Schedule 2, line 21. Line 24 shows you your total tax after you add lines 22 and 23.

Where do I enter RRC in to TurboTax

If you're completing your tax return on your own, the credit can be claimed on line 30 of Form 1040 or Form 1040-SR. Instructions for completing this line are included in Form 1040's instructions.

Can I claim the recovery rebate credit on my taxes

If you didn't get the full amount of the third Economic Impact Payment, you may be eligible to claim the 2023 Recovery Rebate Credit and must file a 2023 tax return – even if you don't usually file taxes – to claim it.

Where do I claim my recovery rebate credit on TurboTax

That information is used to fill out the correct tax forms and claim any credit that you are eligible for on your tax return. If you're completing your tax return on your own, the credit can be claimed on line 30 of Form 1040 or Form 1040-SR.

Where on TurboTax do I enter stimulus check

Where do i enter stimulus payment amount for 2023Type stimulus in Search in the upper right.Click jump to stimulus.Say Yes or No to It looks like you qualified for the stimulus, did you get any paymentsIf you said Yes TurboTax will show you the check amounts you were supposed to get.If that's correct say Yes.

What is line 30 on Form 1040 Recovery Rebate credit

Line 30 on 2023 Form 1040 and Form 1040-SR is used to claim the Recovery Rebate Credit. File a complete and accurate return – even if you don't usually file taxes – to avoid processing delays that slow your tax refund.

What is line 35 on 1040

Calculating your tax refund or bill

Calculate your refund amount by subtracting line 24 from 33 and then writing the result on line 34. Line 35 is for direct deposit of your refund. You will write in your bank account number, the bank routing number, and what kind of account it is (checking or saving).

Who qualifies for the $1400 recovery rebate credit

Your eligibility for the Recovery Rebate Credit is based on your 2023 income. If your income was less in 2023 than it was in 2023, you may be eligible for the credit (or an additional payment) even if you weren't eligible (or got a reduced amount) based on your 2023 income.

What is the $1400 recovery rebate credit

The 2023 Recovery Rebate Credit includes up to an additional $1,400 for each qualifying dependent you claim on your 2023 tax return. A qualifying dependent is a dependent who has a valid Social Security number or Adoption Taxpayer Identification Number issued by the IRS.

What is line 23 on 1040

Determine How Much You Owe

That's what the final section of Form 1040 is for. It's called, appropriately enough, “Amount You Owe.” On Line 23, subtract Line 19 from Line 16 to get the amount you owe. On Line 24, enter any penalties owed if applicable.