What medical bills are tax-deductible?

Are medical copays tax deductible

It's possible to receive a tax break for medical expenses by itemizing deductions, but a standard deduction could still end up being the better option. Medical expenses that can qualify for tax deductions—as long as they're not reimbursed—include copays, deductibles and coinsurance.

Cached

Can the IRS take my tax refund for medical bills

Federal law allows only state and federal government agencies (not individual or private creditors) to take your refund as payment toward a debt.

Is mileage to and from medical appointments tax deductible

Track Those Miles

Traveling back and forth to all those appointments counts. For 2023, the medical mileage rate is 18 cents per mile. Trips to pick up prescriptions, dental appointments, follow up appointments, emergency visits, and more are all included. Don't miss out on this valuable deduction.

What if your medical expenses exceed your income

You are allowed to deduct all qualified medical expenses if they are more than the annual adjusted gross income (AGI) limit. The IRS does not have a gross cap on medical deductions because you must itemize all medical expenses and deductible expenses on Form 1040, Schedule A.

Do all medical expenses go towards deductible

In these plans, usually any money you spend toward medically-necessary care counts toward your health insurance deductible as long as it's a covered benefit of your health plan and you followed your health plan's rules regarding referrals, prior authorization, and using an in-network provider if required.

What qualifies as a qualified medical expense

Some Qualified Medical Expenses, like doctors' visits, lab tests, and hospital stays, are also Medicare-covered services. Services like dental and vision care are Qualified Medical Expenses, but aren't covered by Medicare.

Does IRS ask for proof of medical expenses

You are not required to send the IRS information forms or other proof of health care coverage when filing your tax return. However, it's a good idea to keep these records on hand. This documentation includes: Form 1095 information forms.

What does the IRS consider qualified medical expenses

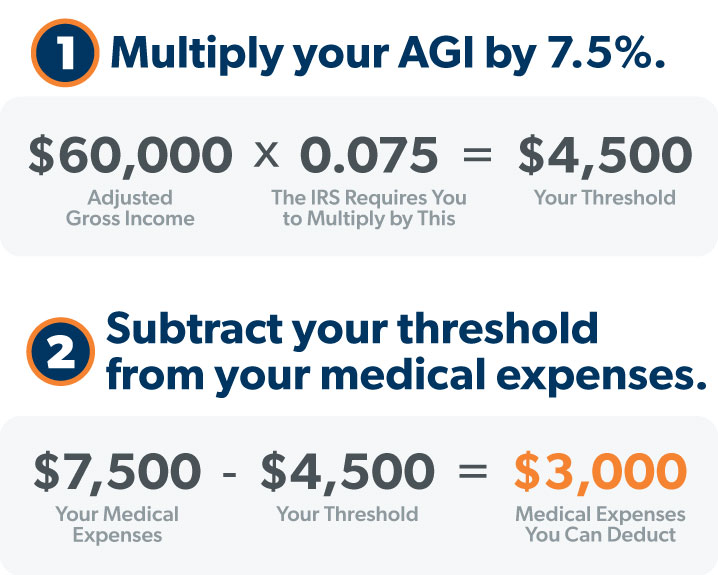

Medical expenses include dental expenses, and in this publication the term “medical expenses” is often used to refer to medical and dental expenses. You can deduct on Schedule A (Form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI).

What are IRS qualified medical expenses

Medical expenses are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body. These expenses include payments for legal medical services rendered by physicians, surgeons, dentists, and other medical practitioners.

How much does IRS allow for medical mileage

22 cents per mile

How much does the IRS allow for medical mileage The 2023 medical mileage rate is 22 cents per mile. For the first six months of 2023, the IRS allowed 18 cents per mile for medical purposes. From July 1, 2023, the medical rate increased to 22 cents per mile.

What is the max you can claim for medical expenses on taxes

How to claim medical expense deductions

| Filing Status | 2023 Standard Deduction |

|---|---|

| Single | $12,950 |

| Married Filing Jointly | $25,900 |

| Married Filing Separately | $12,950 |

| Head of Household | $19,400 |

Apr 24, 2023

What doesn’t count towards medical deductible

Money you paid to an out-of-network provider isn't usually credited toward the deductible in a health plan that doesn't cover out-of-network care. There are exceptions to this rule, such as emergency care or situations where there is no in-network provider capable of providing the needed service.

What is not deductible as a medical expense

You may not deduct funeral or burial expenses, nonprescription medicines, toothpaste, toiletries, cosmetics, a trip or program for the general improvement of your health, or most cosmetic surgery. You may not deduct amounts paid for nicotine gum and nicotine patches that don't require a prescription.

What expenses are not allowed as deductible medical expenses

You may not deduct funeral or burial expenses, nonprescription medicines, toothpaste, toiletries, cosmetics, a trip or program for the general improvement of your health, or most cosmetic surgery. You may not deduct amounts paid for nicotine gum and nicotine patches that don't require a prescription.

What deductions can I claim without receipts

10 Deductions You Can Claim Without ReceiptsHome Office Expenses. This is usually the most common expense deducted without receipts.Cell Phone Expenses.Vehicle Expenses.Travel or Business Trips.Self-Employment Taxes.Self-Employment Retirement Plan Contributions.Self-Employed Health Insurance Premiums.Educator expenses.

What is not considered a qualified medical expense

Medical care expenses must be primarily to alleviate or prevent a physical or mental disability or illness. They don't include expenses that are merely beneficial to general health, such as vitamins or a vacation.

What are not qualified medical expenses

Medical care expenses must be primarily to alleviate or prevent a physical or mental disability or illness. They don't include expenses that are merely beneficial to general health, such as vitamins or a vacation.

Does the IRS verify medical expenses

However, the IRS now keeps track of who has medical insurance, and they can easily check this. Of course, if you have a major surgery or hospital stay, you could easily claim legitimate expenses for this deduction, even with insurance.

Are medical expenses 100% tax deductible

Medical expense deduction 2023

For tax returns filed in 2023, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income.

Are dental bills tax deductible

If you itemize your deductions for a taxable year on Schedule A (Form 1040), Itemized Deductions, you may be able to deduct expenses you paid that year for medical and dental care for yourself, your spouse, and your dependents.