What medical expenses are tax deductible 2023?

What are the new deductions for 2023

The 2023 standard deduction for taxes filed in 2024 will increase to $13,850 for single filers and those married filing separately, $27,700 for joint filers, and $20,800 for heads of household.

What medical expenses can I deduct from taxes

The IRS allows you to deduct unreimbursed payments for preventative care, treatment, surgeries, dental and vision care, visits to psychologists and psychiatrists, prescription medications, appliances such as glasses, contacts, false teeth and hearing aids, and expenses that you pay to travel for qualified medical care.

Cached

What is the 2023 elderly deduction

If you are at least 65 years old or blind, you can claim an additional 2023 standard deduction of $1,850 (also $1,850 if using the single or head of household filing status). If you're both 65 and blind, the additional deduction amount is doubled.

Can you deduct health insurance premiums

Health insurance premiums are deductible if you itemize your tax return. Whether you can deduct health insurance premiums from your tax return also depends on when and how you pay your premiums: If you pay for health insurance before taxes are taken out of your check, you can't deduct your health insurance premiums.

Are vitamins tax deductible

A14: Yes, but only if the supplements are recommended by a medical practitioner as treatment for a specific medical condition diagnosed by a physician. Otherwise, the cost of nutritional supplements is not a medical expense.

What is the IRS deduction for seniors over 65

The standard deduction for seniors this year is actually the 2023 amount, filed by April 2023. For the 2023 tax year, seniors filing single or married filing separately get a standard deduction of $14,700. For those who are married and filing jointly, the standard deduction for 65 and older is $25,900.

What is the extra standard deduction for seniors over 65

If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. If you are legally blind, your standard deduction increases by $1,700 as well. If you are married filing jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,350.

How much can I deduct for medical and dental expenses

Medical and Dental Expenses

| Standard Deductions for 2023 and 2023 | ||

|---|---|---|

| Filing Status | 2023 Standard Deduction | 2023 Standard Deduction |

| Single | $12,950 | $13,850 |

| Married filing separately | $12,950 | $13,850 |

| Head of household | $19,400 | $20,800 |

Can I deduct Medicare Part B premiums on my taxes

We follow strict editorial standards to give you the most accurate and unbiased information. Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction.

Can I deduct my health insurance premiums

Health insurance premiums are deductible if you itemize your tax return. Whether you can deduct health insurance premiums from your tax return also depends on when and how you pay your premiums: If you pay for health insurance before taxes are taken out of your check, you can't deduct your health insurance premiums.

Are prescription glasses tax deductible

You can deduct the costs for prescription eyeglasses and eye exams on your tax return. But they must be a part of your itemized medical deductions, which need to exceed 7.5% of your adjusted gross income.

How much money can a 72 year old make without paying taxes

To be taxed on your Social Security benefits you need to have a total gross income of at least $25,000, or $32,000 for couples who file jointly. If you earn more than that – at least $34,000 for an individual or $44,000 for a couple – you will see up to 85% of your benefits payments subject to tax.

What age do you stop filing federal taxes

65 or older

At What Age Can You Stop Filing Taxes Taxes aren't determined by age, so you will never age out of paying taxes. Basically, if you're 65 or older, you have to file a tax return in 2023 if your gross income is $14,700 or higher.

Is there a federal tax deduction for being over 65

If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. If you are legally blind, your standard deduction increases by $1,700 as well. If you are married filing jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,350.

Are there special tax deductions for seniors

Single people age 65 or older can claim an additional $1,850 on their standard deduction while those in married couples can claim an additional $1,500 for each spouse age 65 or older.

Can I deduct dental insurance premiums on my taxes

Can you deduct dental insurance premiums on your taxes Yes, dental insurance premiums you paid in the current year are deductible on your taxes. This is also true for the premiums of your spouse, dependents, or children under 27. But you need to itemize the deductions on your tax return to claim this benefit.

Can I deduct health insurance premiums

Health insurance premiums are deductible if you itemize your tax return. Whether you can deduct health insurance premiums from your tax return also depends on when and how you pay your premiums: If you pay for health insurance before taxes are taken out of your check, you can't deduct your health insurance premiums.

What is the Medicare Part B deductible for 2023

If you have questions about your Part B premium, call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778. If you pay a late enrollment penalty, these amounts may be higher. 2023 Part B deductible—$226 before Original Medicare starts to pay.

At what age is Social Security no longer taxable

Social Security benefits may or may not be taxed after 62, depending in large part on other income earned. Those only receiving Social Security benefits do not have to pay federal income taxes.

Are dental expenses tax deductible

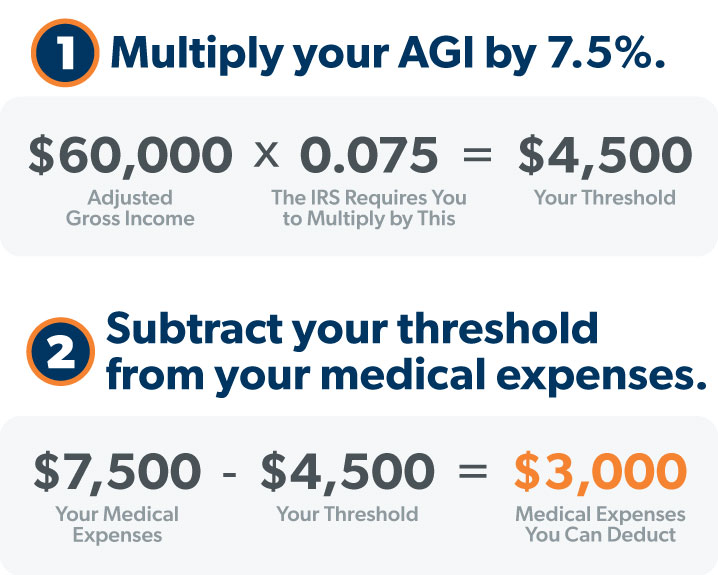

Medical expenses include dental expenses, and in this publication the term “medical expenses” is often used to refer to medical and dental expenses. You can deduct on Schedule A (Form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI).