What proof does the IRS need to claim a dependent?

What are the four requirements to claim a dependent

To claim a child as a dependent on your tax return, the child must meet all of the following conditions.The child has to be part of your family.The child has to be under a certain age.The child has to live with you.The child can't provide more than half of his or her own financial support.

Cached

Does the IRS verify dependents

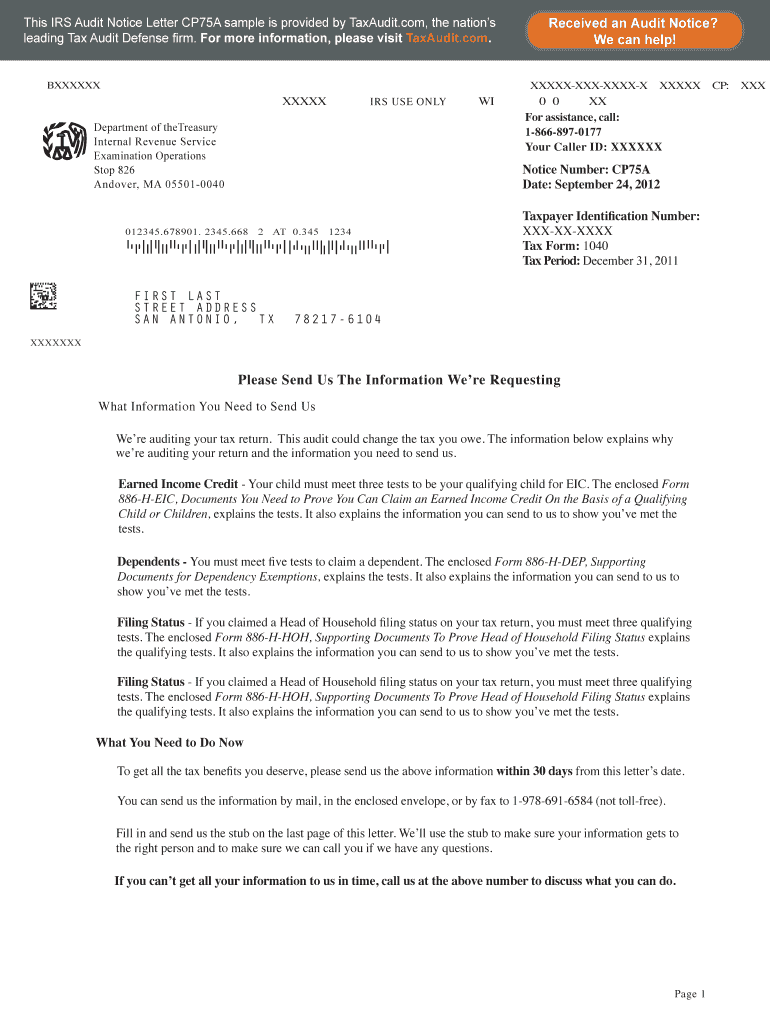

How the IRS Handles Dependent Audits. The IRS will first attempt to determine which taxpayer isn't entitled to claim the dependent. It will send an audit notice to that individual.

Cached

What are the 6 requirements for claiming a child as a dependent

There are seven qualifying tests to determine eligibility for the Child Tax Credit: age, relationship, support, dependent status, citizenship, length of residency and family income. If you aren't able to claim the Child Tax Credit for a dependent, they might be eligible for the Credit for Other Dependent.

How do you prove a dependent

a copy of the child's or dependent's birth certificate, and. a copy of your birth certificate, and. a copy of the birth certificate of the child's or dependent's parent to whom you're related.

CachedSimilar

How does the IRS determine who claims a child

You can claim a child as a dependent if he or she is your qualifying child. Generally, the child is the qualifying child of the custodial parent. The custodial parent is the parent with whom the child lived for the longer period of time during the year.

Can I claim an adult as a dependent

To be a dependent, the adult must be a close relative or living with you, earn less than the exemption amount for the tax year, and receive more than half of their support from you. You can claim the $500 tax credit for other dependents if the adult qualifies and you earn less than $200,000 as an individual.

What is the penalty for falsely claiming dependents

Because you are technically filing your taxes under penalty of perjury, everything you claim has to be true, or you can be charged with penalty of perjury. Failing to be honest by claiming a false dependent could result in 3 years of prison and fines up to $250,000.

How do you prove that your child lives with you

The letters must show:The name of the child's parent or guardian. The child's home address. The address must match yours.Daycare records or a letter from your daycare provider. If the daycare provider is related to you, you must have at least one other record or letter that shows proof of residency.

How do I report someone to the IRS for a child

Instead, use Form 14157 AND Form 14157-A. Submit both to the address on the Form 14157-A. o If you received a notice from the IRS about someone claiming your exemption or dependent. Follow the instructions on the notice.

How do you prove you can claim a child on taxes

The dependent's birth certificate, and if needed, the birth and marriage certificates of any individuals, including yourself, that prove the dependent is related to you. For an adopted dependent, send an adoption decree or proof the child was lawfully placed with you or someone related to you for legal adoption.

Who Cannot be claimed as a dependent

Usually, any person who filed a joint return (as a married person) cannot be claimed as a dependent on anyone else's tax return. To be claimed as a dependent, a person must be a U.S. citizen, U.S. resident alien, U.S. national, or a resident of Canada or Mexico.

Can I claim my 30 year old boyfriend as a dependent

You can claim a boyfriend or girlfriend as a dependent on your federal income taxes if that person meets certain Internal Revenue Service requirements. To qualify as a dependent, your partner must have lived with you for the entire calendar year and listed your home as their official residence for the full year.

What happens if someone claims your child on taxes without permission

After the IRS decides the issue, the IRS will charge (or, “assess”) any additional taxes, penalties, and interest on the person who incorrectly claimed the dependent. You can appeal the decision if you don't agree with the outcome, or you can take your case to U.S. Tax Court.

How do I stop someone from claiming my child on my taxes

The custodial parent must fill out IRS Form 8332 (Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent) which states they do not intend to claim the child as a dependent on their upcoming tax return.

Can I sue my ex for claiming child on taxes

Bottom Line: If your former partner has wrongfully claimed the children as dependents on their tax return, you can file a motion to enforce the divorce decree or separation agreement and get the dependent credits you are owed.

How do you prove your child lives with you

The letters must show:The name of the child's parent or guardian. The child's home address. The address must match yours.Daycare records or a letter from your daycare provider. If the daycare provider is related to you, you must have at least one other record or letter that shows proof of residency.

Can you claim adults as dependents

You can claim adults as dependents if you follow certain rules. To be a dependent, the adult must be a close relative or living with you, earn less than the exemption amount for the tax year, and receive more than half of their support from you.

What adults qualify as a dependent

The IRS defines a dependent as a qualifying child (under age 19 or under 24 if a full-time student, or any age if permanently and totally disabled) or a qualifying relative.

How many months does someone have to live with you to claim them as a dependent

The person must live with you the entire year (365 days) or be one of these: Your child, stepchild, foster child (placed by an authorized placement agency), or a descendent of any of these.

Will the IRS tell you who claimed your child

If so, you need to know the IRS is prohibited from telling you who claimed your dependent(s). Due to federal privacy laws, the IRS can only disclose the return information if the victim's name and SSN are listed as either the primary or secondary taxpayer on the fraudulent return.