What qualifies as proof of funds?

Can cash be proof of funds

No, not cash as in a briefcase full of money cannot be uses as a proof of funds. The lender has no way of sourcing this as it could be a loan. The money would need to be deposited into a bank account and seasoned for two months.

Cached

What does proof of funds verify

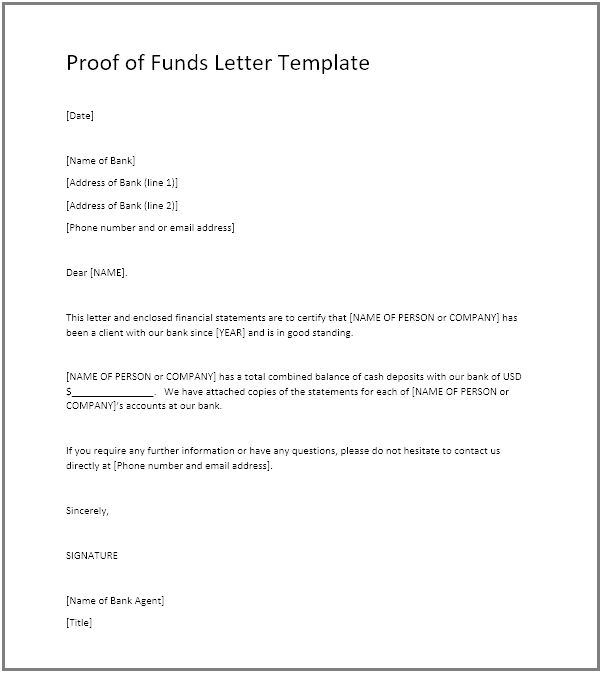

You can apply for a proof of funds verification from your bank. This letter should be signed by authorised bank personnel and must include the following points: Details of the bank, including name, address, and contact information. An official statement from the bank verifying the concerned individual's financial …

Cached

Can you submit an offer without proof of funds

Short of the proverbial briefcase full of cash, the seller has no guarantee that the buyer actually has the funds they say they have, unless they have a document to prove it; many sellers won't accept a cash offer without a POF.

Cached

Can 401k be used as proof of funds

Vested funds from individual retirement accounts (IRA/SEP/Keogh accounts) and tax-favored retirement savings accounts (401(k) accounts) are acceptable sources of funds for the down payment, closing costs, and reserves.

Can I use credit card statement as proof of funds

The documents required as proof of purchases and expenses include the following: Invoices. Credit card statements and receipts. Cash register tape receipt.

What is hard proof of funds

A hard money Proof of Funds letter is a letter issued by a hard money lender informing sellers and their agents that its client is pre-approved to purchase a property within a certain price range.

Can I call a bank to verify proof of funds

Having the buyer get a certified statement from the bank is the easiest way! Verify funds coming from the buyer's bank account by calling the bank lender even if you are provided contact information for the bank lender, this allows you to verify if the bank institution and the lender are legit.

Is it normal for a realtor to ask for proof of funds

No, a Proof of Funds letter is not always required. If you are buying from a homeowner with no agent, it may not be necessary. However, when an agent is present, and multiple offers are on the table, the agent will want to see Proof of Funds.

Can the seller see proof of funds

Proof of funds in real estate is a document that shows how much money you have available to purchase a home. Sellers typically like to see proof of funds letters, also known as verification of funds letters, to ensure you can cover the costs associated with obtaining a mortgage, such as down payment and closing costs.

How do I prove my 401k is financially hardship

To make a 401(k) hardship withdrawal, you will need to contact your employer and plan administrator and request the withdrawal. The administrator will likely require you to provide evidence of the hardship, such as medical bills or a notice of eviction.

Do banks consider 401k for mortgage

Is my 401(k) an asset 401(k)s are nonphysical assets and your lender will likely take them into consideration when assessing your mortgage application. Be sure to consult with a financial advisor to make sure there won't be negative consequences if you use your 401(k) to buy a house.

Can I use my bank statement as proof

What can be used as proof of address Here are some of the most common documents that count as valid proof of address: Bank statement; Utility bill for gas, electricity, water, internet, etc.

What can be used as bank proof

Accepted forms of proofBank statements.Internet banking account screens.Deposit slips.Cheques.Download 'Proof of account balance' document from bank (blank out account balance)

What is a soft proof of funds

Thousand on XYZ property with a specific property.

What is liquid proof of funds

A proof of funds letter is a document providing evidence that a borrower has enough liquid assets, or cash, to buy a home. Homebuyers need this paperwork to demonstrate to the seller that they can cover purchase costs, including the down payment and closing costs.

How do I ask my bank for proof of funds

Make sure it's in a liquid account like a savings or checking account. Submit a request to the bank. Ask your bank for a proof of funds letter. It can usually get the letter to you within a few days, typically no more than one week.

Why don t banks verify funds

Bank Policies May Pose Challenges

Some banks make check verification difficult or impossible. They may require you to visit a branch in person. Or, they may only verify the account exists, not whether it has any funds, in order to protect their customers' privacy.

Do I have to prove where my down payment came from

The general rule for documenting down-payment funds that will originate from a checking or savings account is that they must have been there for at least two or three months. This is known as “seasoning.” Lenders ask borrowers to provide two or three months of statements for their checking or savings account.

How do you show proof of transaction

A receipt or bank statement is the most common way to provide proof of payment. Receipt copies can be obtained from the seller either online or in person. If you need to use a bank statement, access it through your online bank account.

What proof do I need for a 401k hardship withdrawal

You do not have to prove hardship to take a withdrawal from your 401(k). That is, you are not required to provide your employer with documentation attesting to your hardship. You will want to keep documentation or bills proving the hardship, however.