What qualifies as tax deduction?

What would be considered tax deductions

Some of the more common deductions include those for mortgage interest, retirement plan contributions, HSA contributions, student loan interest, charitable contributions, medical and dental expenses, gambling losses, and state and local taxes.

Cached

What are 5 examples of deductions

Don't overlook the 5 most common tax deductionsRetirement contributions.Charitable donations.Mortgage interest deduction.Interest on college education costs.Self-employment expenses.

What are three examples of tax deductions

Itemized DeductionsStandard deduction and itemized deductions.Deductible nonbusiness taxes.Personal Property tax.Real estate tax.Sales tax.Charitable contributions.Gambling loss.Miscellaneous expenses.

Cached

What deductions can I claim without receipts

10 Deductions You Can Claim Without ReceiptsHome Office Expenses. This is usually the most common expense deducted without receipts.Cell Phone Expenses.Vehicle Expenses.Travel or Business Trips.Self-Employment Taxes.Self-Employment Retirement Plan Contributions.Self-Employed Health Insurance Premiums.Educator expenses.

What are 4 types of deductions

Payroll deductions fall into four different categories – pretax, post-tax, voluntary and mandatory – with some overlap in between.

Can you write off gas on taxes

If you're claiming actual expenses, things like gas, oil, repairs, insurance, registration fees, lease payments, depreciation, bridge and tunnel tolls, and parking can all be deducted."

How can I reduce my taxable income

How Can I Reduce My Taxable Income There are a few methods that you can use to reduce your taxable income. These include contributing to an employee contribution plan, such as a 401(k), contributing to a health savings account (HSA) or a flexible spending account (FSA), and contributing to a traditional IRA.

How to get a $10,000 tax refund

CAEITCBe 18 or older or have a qualifying child.Have earned income of at least $1.00 and not more than $30,000.Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children.Living in California for more than half of the tax year.

What does 100% tax deductible mean

When something is tax deductible — meaning that it's able to be legally subtracted from taxable income — it serves as a taxpayer advantage. When you apply tax deductions, you'll lower the amount of your taxable income, which, in turn, lessens the amount of tax you'll have to pay the Internal Revenue Service that year.

Can you write-off gas on taxes

If you're claiming actual expenses, things like gas, oil, repairs, insurance, registration fees, lease payments, depreciation, bridge and tunnel tolls, and parking can all be deducted."

Can I claim my phone bill on my taxes

Where to deduct your cell phone bills. As a freelancer or independent contractor, the IRS requires you to add Schedule C to your tax return. You'll use this form to report all your business income — as well as any business expenses you write off, from your home office expenses to your cell phone bill.

What are the most common types of tax deductions

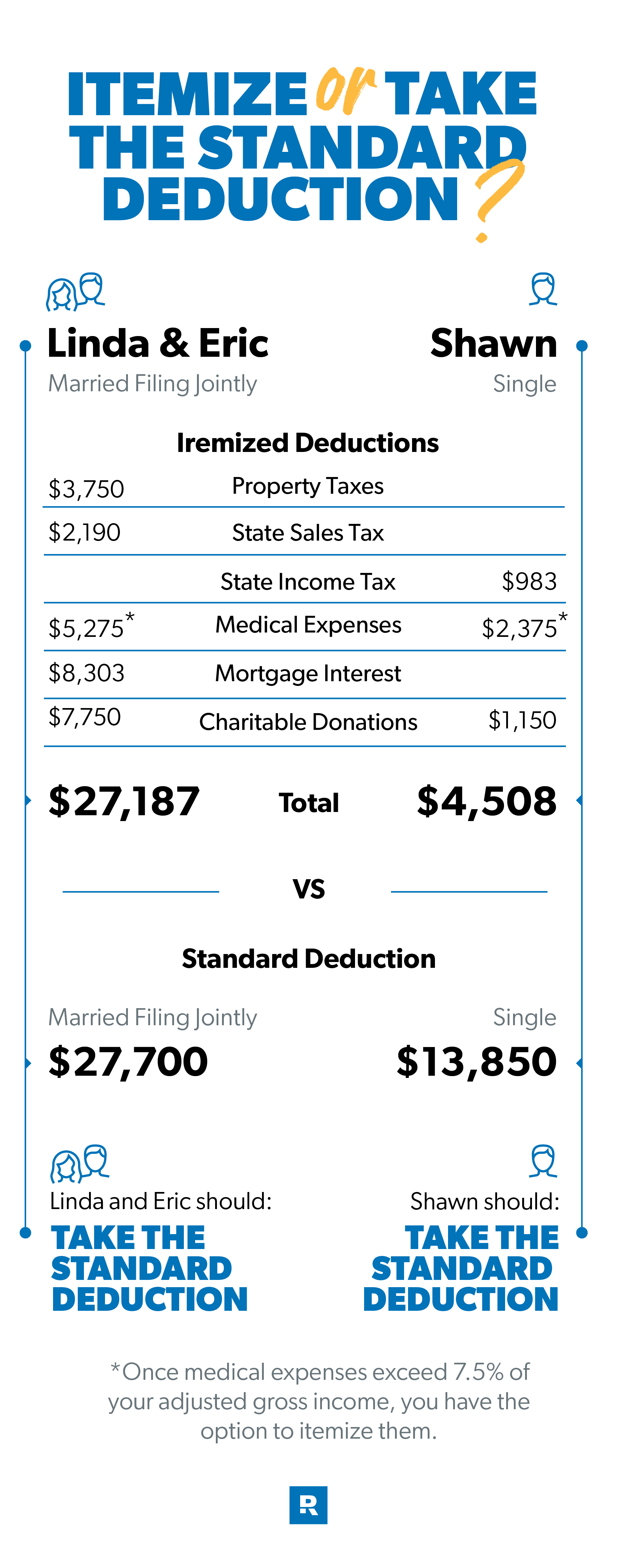

Examples of itemized deductions include deductions for unreimbursed medical expenses, charitable donations, and mortgage interest. Whether you choose to itemize or take the standard deduction depends largely on which route will save you more money.

Can I write off my car payment

Car loan payments and lease payments are not fully tax-deductible. The general rule of thumb for deducting vehicle expenses is, you can write off the portion of your expenses used for business. So "no" you cannot deduct the entire monthly car payment from your taxes as a business expense.

Is it better to write off mileage or gas

Here's the bottom line: If you drive a lot for work, it's a good idea to keep a mileage log. Otherwise, the actual expenses deduction will save you the most.

Is it better to claim 1 or 0 on your taxes

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How can I lower my adjusted gross income

Adjustments to income that reduce AGI include but aren't limited to:Contributions you made to an IRA or 401(k)Student loan interest paid.Alimony paid.Contributions to health savings accounts (HSAs)Moving expenses for certain members of the Armed Forces.

What can I claim to get a bigger tax refund

Among the most common tax credits for the 2023 tax year:Child Tax Credit. You can claim a $2,000 child tax credit for each qualifying child under 17 in your household.Child and Dependent Care Credit.Earned Income Tax Credit.Energy-Efficient Home Improvements.Electric Vehicle Credit.

What helps you get a bigger tax refund

4 Ways to Get a Bigger Tax RefundConsider Your Filing Status. Your filing status can have a significant impact on your tax refund, regardless of whether you're single or married.Claim Your Credits.Don't Forget the Deductions.Max Out Your IRA.

What expenses are non deductible

Non-deductible business expenses are those that are not directly related to your business. This includes things like meals and entertainment, car payments, and home office deductions. While these expenses may be necessary for your business, they cannot be written off on your taxes.

How much do tax write-offs save you

To calculate how much you're saving from a write-off, just take the amount of the expense and multiply it by your tax rate. Here's an example. Say your tax rate is 25%, and you just bought $100's worth of work supplies, which are fully tax deductible.