What qualifies for education credit?

What expenses qualifies for an education credit

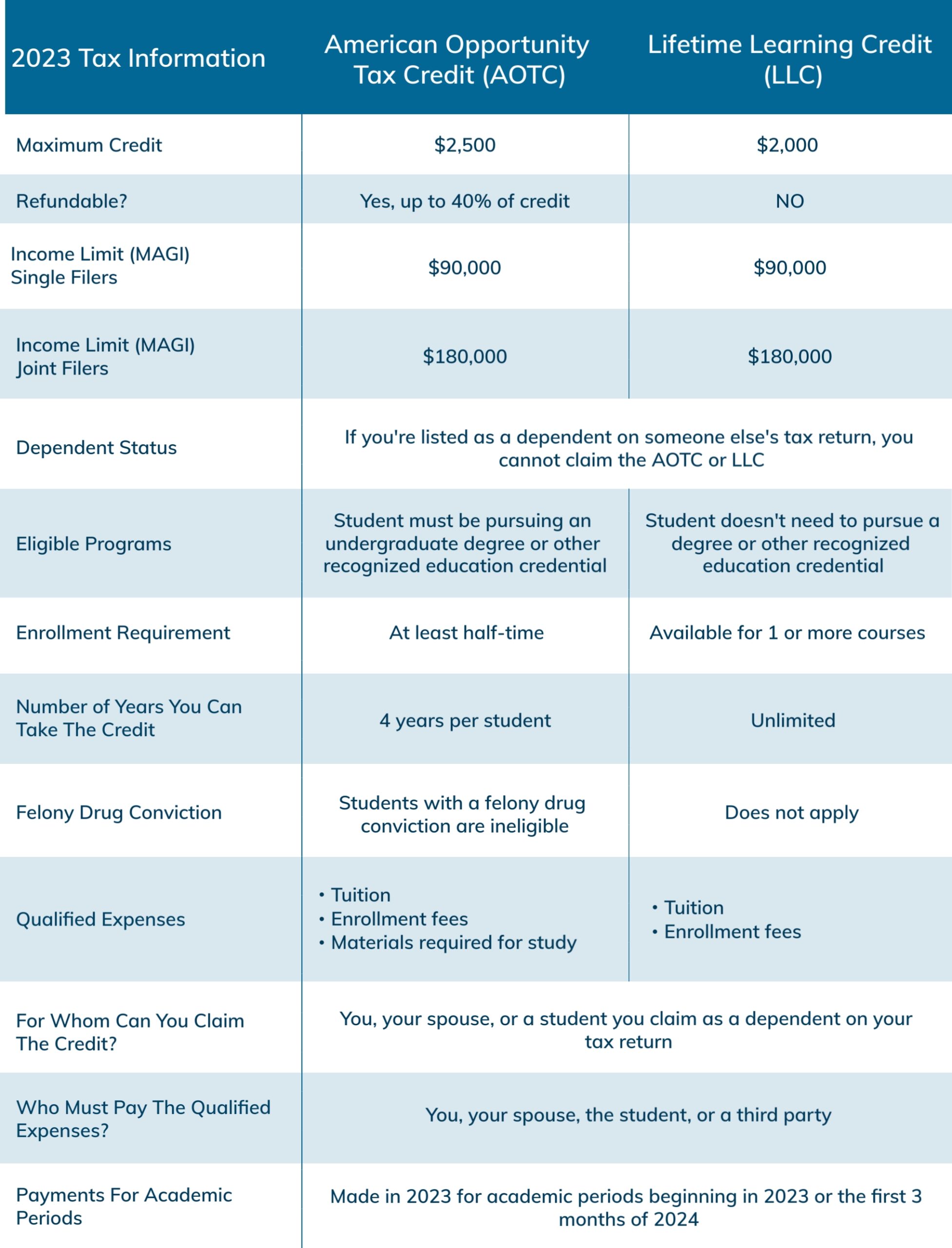

Qualified expenses are amounts paid for tuition, fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution. You must pay the expenses for an academic period* that starts during the tax year or the first three months of the next tax year.

Why am I not eligible for an education credit

To get a credit for education expenses, you have to pay tuition or related costs for yourself, your spouse, or a dependent on your return. If you paid tuition or other education expenses for someone who's claimed on another person's return, you won't qualify.

How do I get the full $2500 American Opportunity credit

To be eligible for AOTC, the student must:Be pursuing a degree or other recognized education credential.Be enrolled at least half time for at least one academic period* beginning in the tax year.Not have finished the first four years of higher education at the beginning of the tax year.

What income is too high for education credit

You can get the full education tax credit if your modified adjusted gross income, or MAGI, was $80,000 or less in 2023 ($160,000 or less if you file your taxes jointly with a spouse). If your MAGI was between $80,000 and $90,000 ($160,000 and $180,000 for joint filers), you'll receive a reduced credit.

Cached

What is not a qualified education expense

What Education Expenses do Not QualifyTransportation costs.Student health fees and medical expenses.Room and board, or any other living expenses.Insurance, including property or renters insurance for students.Costs of sports, games, or hobbies that are not required for your degree program.

Can I deduct a computer or laptop that I bought for school

The cost of a personal computer is generally a personal expense that's not deductible. However, you may be able to claim an American opportunity tax credit for the amount paid to buy a computer if you need a computer to attend your university.

Can I still graduate if I don’t have enough credits

Having too few credits means that they will not be able to get their high school diploma. However, even if they have the necessary credits to graduate, it might be less than what is required for them to get into their dream college.

Why can’t I claim my tuition on my taxes

You can't claim the tax break if your income is higher than a certain threshold either. If your modified adjusted gross income is above $80,000 (or above $160,000 for joint filers), you can't qualify for the deduction. Note also that this is an above-the-line deduction.

Do you have to pay back the American Opportunity Tax Credit

American Opportunity Tax Credit

Up to $1,000 (or 40 percent of the total credit) is refundable even if a filer doesn't owe income tax. If you don't owe any taxes, you will receive the entire $1,000 as part of your tax refund .

How do I know if I got the American Opportunity credit

If you paid qualified educational expenses during a specific tax year to an eligible intuition, then you will receive Form 1098-T. Colleges are required to send the form by January 31 each year, so you should receive it shortly after that. Some colleges may make it available to you electronically.

Can you claim education credit with no income

If the AOTC had been claimed four years for you, the Lifelong Learning Credit is a nonrefundable credit which means with no income you would not get a refund.

What qualifies as higher education IRS

It is any college, university, trade school, or other post secondary educational institution eligible to participate in a student aid program run by the U.S. Department of Education. This includes most accredited public, nonprofit and privately-owned–for-profit postsecondary institutions.

Which type of expense is not covered under an educational assistance plan

Meals, transportation, and lodging cannot be reimbursed. Supplies and equipment (other than textbooks) can only be reimbursed if they cannot be kept after the course is completed.

Can you write-off things you buy for school

An eligible educator can deduct up to $250 of any unreimbursed business expenses for classroom materials, such as books, supplies, computers including related software and services or other equipment that the eligible educator uses in the classroom.

Is a laptop 100% deductible

You can deduct the full amount of the gadget in the year it was acquired under IRC Sec. 179, or you can amortize it over a number of years (generally 5 – 7 years), deducting a fraction of the cost each year. Most people opt to deduct it all at once.

What happens if I don’t get enough credits

Having too few credits means that they will not be able to get their high school diploma. However, even if they have the necessary credits to graduate, it might be less than what is required for them to get into their dream college.

What degree requires the least amount of credits

Generally, a bachelor's degree will require a minimum of 120 credits, an associate degree will require at least 60 credits, and a master's degree will require anywhere from 30 to 60 credits.

Is a laptop a qualified education expense

The cost of a personal computer is generally a personal expense that's not deductible. However, you may be able to claim an American opportunity tax credit for the amount paid to buy a computer if you need a computer to attend your university.

What college expenses are tax deductible for parents

The American Opportunity Tax Credit is based on 100% of the first $2,000 of qualifying college expenses and 25% of the next $2,000, for a maximum possible credit of $2,500 per student. For 2023, you can claim the AOTC for a credit up to $2,500 if: Your student is in their first four years of college.

How do I know if I qualify for the American Opportunity Credit

You, your dependent or a third party pays qualified education expenses for higher education. An eligible student must be enrolled at an eligible educational institution. The eligible student is yourself, your spouse or a dependent you list on your tax return.