What score does TransUnion start on?

What does your TransUnion credit score start at

Scores in widely used models, including VantageScore 3.0, range from 300 to 850. In addition to “good,” VantageScore 3.0 classifies other ranges as well. A very poor credit score is in the range of 300 – 600, with 601 – 660 considered to be poor. A score of 661 – 720 is fair.

Cached

What score does TransUnion use

VantageScore® 3.0 credit score

TransUnion uses the VantageScore® 3.0 credit score. Get more information about VantageScore.

CachedSimilar

Is TransUnion usually the lowest credit score

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Cached

Which credit score do you go by TransUnion or Equifax

Is Equifax more accurate than TransUnion Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Cached

What credit score do you start off with

Some people wonder whether the starting credit score is zero, for example, or whether we all start with a credit score of 300 (the lowest possible FICO score). The truth is that there's no such thing as a “starting credit score.” We each build our own unique credit score based on the way we use credit.

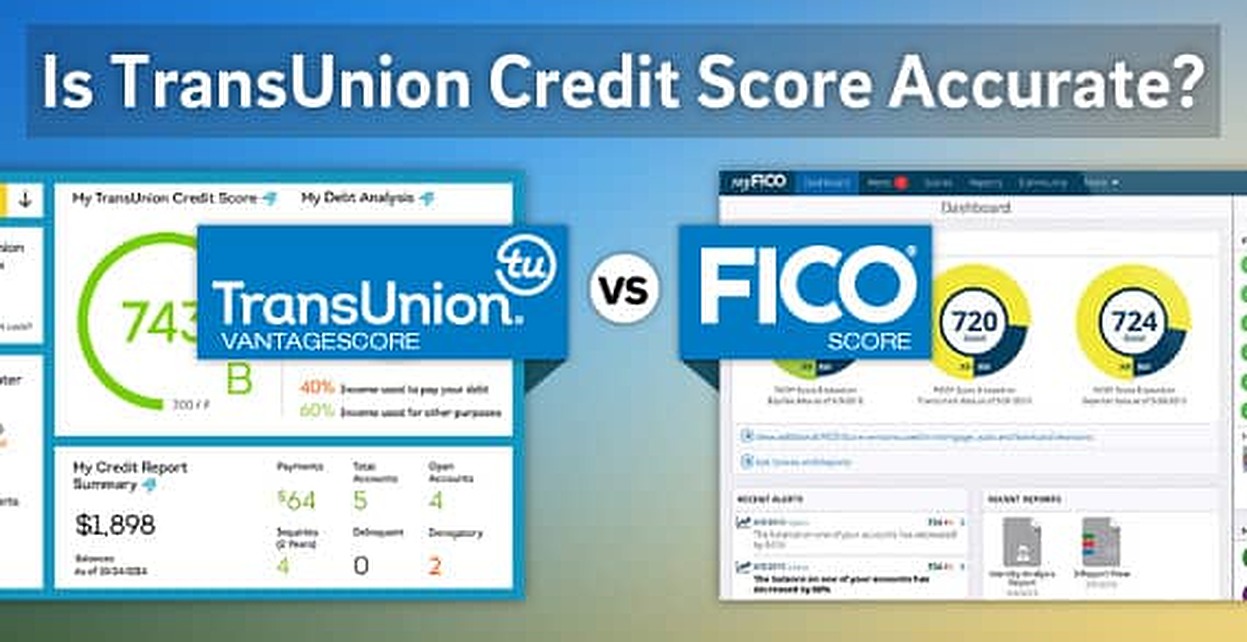

Why is TransUnion score lower than FICO

When the scores are significantly different across bureaus, it is likely the underlying data in the credit bureaus is different and thus driving that observed score difference.

Is FICO or TransUnion more accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Which score is more accurate TransUnion or Experian

With multiple options available, you may be wondering which of these sources is the most accurate. Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

Is TransUnion more important than FICO

The Three Bureaus and FICO

For example, an apartment manager who checks your credit may only look at Experian while a credit card company might only look at TransUnion. FICO was developed as an alternative to these bureaus. Many lenders prefer FICO because it paints a more holistic picture of the potential borrower.

Which credit score is the most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Why is TransUnion score higher than Equifax

Equifax and TransUnion have different scores because slightly different information is reported to each credit reporting agency. In addition, TransUnion reports your employment history and personal information. Equifax's different credit scoring model results in lower scores.

What credit score does an 18 year old start with

The credit history you start with at 18 is a blank slate. Your credit score doesn't exist until you start building credit. To begin your credit-building journey, consider opening a secured credit card or ask a family member to add you as an authorized user on their account.

How long does it take to get a 700 credit score from 500

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

How far off is Credit Karma

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.

Which of the 3 credit scores is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Do banks use Experian or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Is Experian or TransUnion more accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Which of the 3 credit scores is usually the highest

Which credit score matters the most While there's no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

Is TransUnion usually the highest score

TransUnion vs. Equifax: Which is most accurate No credit score from any one of the credit bureaus is more valuable or more accurate than another. It's possible that a lender may gravitate toward one score over another, but that doesn't necessarily mean that score is better.

How to get a 650 credit score at 18

How to start building credit at age 18Understand the basics of credit.Become an authorized user on a parent's credit card.Get a starter credit card.Build credit by making payments on time.Keep your credit utilization ratio low.Take out a student loan.Keep tabs on your credit report and score.