What should I include with 941x?

How do I prepare for 941x

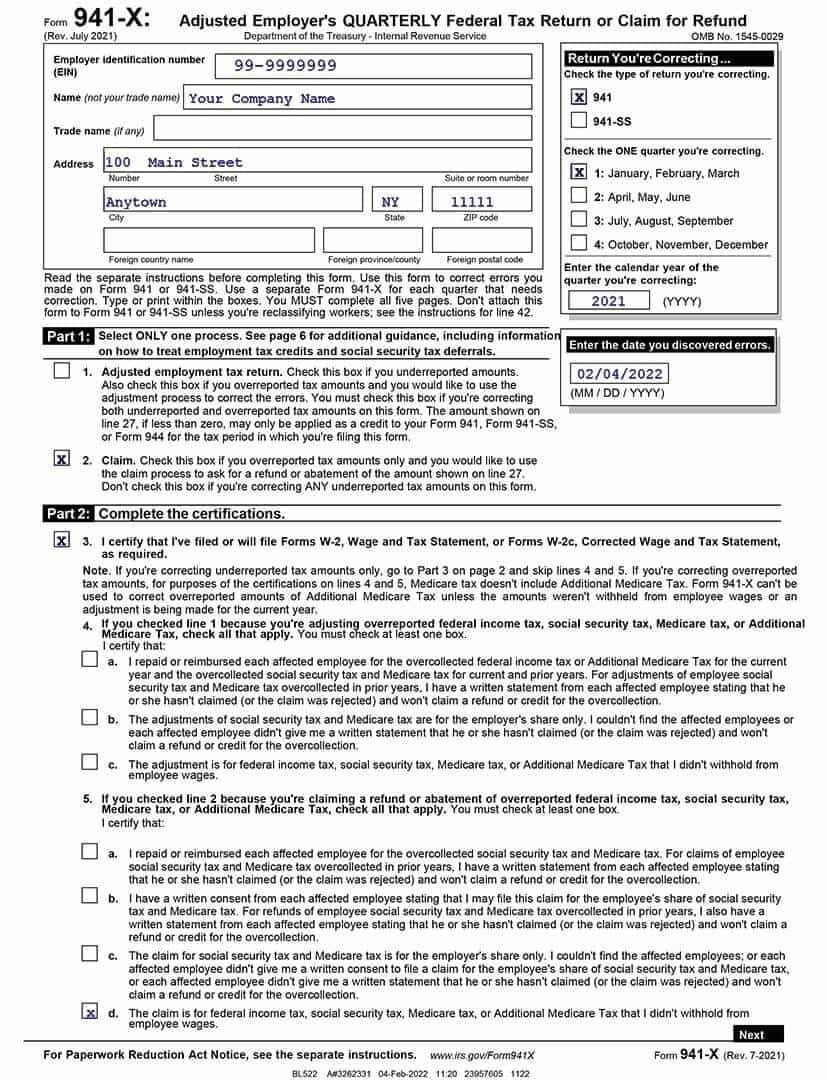

This is how to fill out a 941-X ERC Form.Fill in the required details on the page header, such as the EIN number, quarter, company name, and year.Find which payroll quarters in 2023 and 2023 your association was qualified for.For each quarter you prepare for, gather your earlier 941, payroll logs, and a blank 941-X.

Cached

What information do I need for ERTC tax credit

Companies looking to claim the ERTC must report their total qualified wages, as well as the related health insurance costs, on their quarterly tax returns (Form 941 for most employers). This refundable credit will be taken against the employer's share of Social Security tax.

What documents are needed for the employee retention tax credit

What Documentation Do You Need to ProvideSummary of quarterly revenue (Employer Quarterly Tax Return, Form 941)Payroll tax returns.Employee pay records (including paid by date)Location of your business and employees.Description of your business.Any detailed wage information used for a PPP loan and loan forgiveness.

What is included in employee retention credit

The Employee Retention Credit (ERC) is a refundable tax credit for businesses that continued to pay employees while either shut down due to the COVID-19 pandemic or had significant declines in gross receipts from March 13, 2023 to Dec. 31, 2023.

Is there a worksheet for the employee retention credit

Remember, the IRS created the Employee Retention Credit Worksheets to make it easier for businesses to calculate their qualifying tax credits. However, the IRS states that employers don't have to attach their calculated worksheet on Form 941.

How to fill out 941x for ERC example

As well as the quarter. And year for the quarter. Select the appropriate calendar year choose the date when you first detected the errors on your 941.

How should Ertc be recorded

You can record the transaction by debiting the Income Tax Expense account and crediting the Cash account if you claimed the ERC on your quarterly return. If you filed an amended return to receive a refund, you will record a debit in your Cash account and a debit under the Income Tax Expense account.

Has anyone received ERC refund 2023

You could receive your refund 21 days after filing your 2023 taxes in 2023. This means you could receive your refund three weeks after the IRS receives your return. It may take several days for your bank to have these funds available to you.

Can owners wages be included in employee retention credit

Do Owner Wages Qualify for the ERC In general, wages paid to majority owners with greater than 50 percent direct or indirect ownership of the business do not qualify for the ERC.

How should employee retention credit be reported on tax return

How Does the ERC Affect Your Tax Return Employers can claim the Employee Retention Credit on their federal employment tax returns. This is usually your Quarterly Federal Tax Return, Form 941. You can amend your Form 941 if you didn't claim the ERC and realize later that you qualified.

How should the employee retention credit be recorded

IAS 20 lets you record the ERC on the income statement in two ways. You can show it as a separate credit, such as other income, or by netting it against the related payroll costs. In the latter case, you should include a disclosure explaining the presentation.

How do I calculate my ERC credit

The ERC calculation is based on total qualified wages, including health plan expenses paid by the employer to the employee. The ERC equals 50 percent of the qualified wages for 2023 and 70% for 2023. The maximum credit amount is for 2023, with a cap of $10,000 in a quarter.

HOw do I account for my ERTC refund

You can record the transaction by debiting the Income Tax Expense account and crediting the Cash account if you claimed the ERC on your quarterly return. If you filed an amended return to receive a refund, you will record a debit in your Cash account and a debit under the Income Tax Expense account.

HOw should ERC be reported on taxes

When filing your federal tax return, the amount of your ERC refund is subtracted from your wages and salaries deduction. For example, a company that paid $100,000 in wages but received an ERC refund of $60,000 will only be able to report a wages and salaries deduction of $40,000.

What is the average ERC refund

A: Yes, employers and companies have received their ERC refund. To date, over $50 billion has been paid out in refunds to companies. The refunds have ranged from a few thousand dollars to over $1 million. The average refund is around $130,000.

How long does ERC refund take 2023

6-8 weeks

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business.

What wages are excluded from ERC credit

In general, wages paid to majority owners with greater than 50 percent direct or indirect ownership of the business do not qualify for the ERC. However, there are situations where a business owner's wages can qualify for the ERC.

What disqualifies you from ERC

Only recovery businesses are eligible to claim this tax credit in the fourth quarter of 2023. Another restriction is that, regardless of your eligibility, you cannot claim the ERC on wages that were reported as payroll costs in obtaining PPP loan forgiveness or that were used to claim certain other tax credits.

Will the IRS audit the employee retention credit

If the tax professional they're using raises questions about the accuracy of the Employee Retention Credit claim, people should listen to their advice. The IRS is actively auditing and conducting criminal investigations related to these false claims. People need to think twice before claiming this."

HOw should employee retention credit be reported on tax return

How Does the ERC Affect Your Tax Return Employers can claim the Employee Retention Credit on their federal employment tax returns. This is usually your Quarterly Federal Tax Return, Form 941. You can amend your Form 941 if you didn't claim the ERC and realize later that you qualified.