What should you not do before mortgage closing?

What not to do while closing

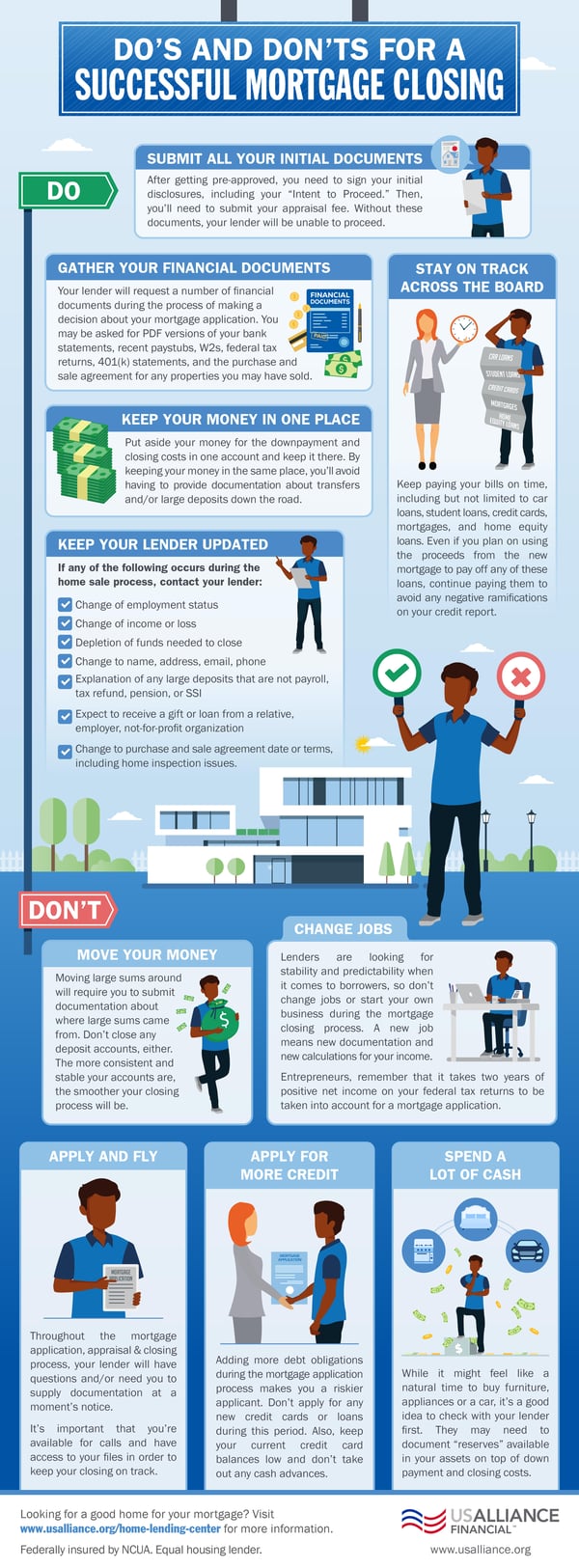

5 Things NOT to Do During the Closing ProcessDO NOT CHANGE YOUR MARITAL STATUS. How you hold title is affected by your marital status.DO NOT CHANGE JOBS.DO NOT SWITCH BANKS OR MOVE YOUR MONEY TO ANOTHER INSTITUTION.DO NOT PAY OFF EXISTING ACCOUNTS UNLESS YOUR LENDER REQUESTS IT.DO NOT MAKE ANY LARGE PURCHASES.

Can I spend money before closing

Lenders will check the borrower's credit report to verify any critical financial details. If the lender spots any big purchases that significantly impact your financial picture, it's possible they won't finalize the mortgage. With that, it is important to wait until after closing day before making any big purchases.

How soon after closing can I spend money

Q: How long should I wait before making major purchases or changes after closing It's generally recommended to wait at least a few months after closing before making any major purchases or changes to the home.

Cached

What can keep you from closing

Pest damage, low appraisals, claims to title, and defects found during the home inspection may slow down closing. There may be cases where the buyer or seller gets cold feet or financing may fall through. Other issues that can delay closing include homes in high-risk areas or uninsurability.

What to do immediately after closing on a house

Make copies of all documents

The first thing to check off your new home to-do list after closing on your new house is to make copies of all your closing documents. Though your county's record clerk should have a copy, it's best to keep a copy for yourself as well. Store them in a fireproof safe or safe deposit box.

What is the best day to close on a house

This delay in itself will not cost you extra money, but if the 3-day delay pushes the repayment of the old loan too close to the weekend, you could end up with a longer overlap in interest payments. You will ideally want to sign your documents on a Tuesday or Wednesday to avoid this issue.

Do they check your bank account before closing

Yes, they do. One of the final and most important steps toward closing on your new home mortgage is to produce bank statements showing enough money in your account to cover your down payment, closing costs, and reserves if required.

Do they run your credit the day of closing

The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.

What is the 3 day closing rule

What Is The Closing Disclosure 3-Day Rule, And What Does It Mean For The Closing Disclosure Timeline Your lender is required by law to give you the standardized Closing Disclosure at least 3 business days before closing. This is what is known as the Closing Disclosure 3-day rule.

What is the 7 day closing rule

Under the TRID rule, the creditor must deliver or place in the mail the initial Loan Estimate at least seven business days before consummation, and the consumer must receive the initial Closing Disclosure at least three business days before consummation.

Can a mortgage be denied at closing

Yes. Many lenders use third-party “loan audit” companies to validate your income, debt and assets again before you sign closing papers. If they discover major changes to your credit, income or cash to close, your loan could be denied.

Do lenders pull credit day of closing

The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.

Can a loan be denied after closing

Can a mortgage be denied after the closing disclosure is issued Yes. Many lenders use third-party “loan audit” companies to validate your income, debt and assets again before you sign closing papers. If they discover major changes to your credit, income or cash to close, your loan could be denied.

Do lenders check bank statements after closing

Yes. A mortgage lender will look at any depository accounts on your bank statements — including checking and savings accounts, as well as any open lines of credit.

Is it better to close at the beginning or end of month

If you close toward the beginning of the month, you won't have a mortgage payment for almost two months, but you will need to bring more money to closing to cover the interest. If you close at the end of the month, you'll make your first payment in a little more than one month.

Can you move in the day of closing

The contract terms will determine when you can move in after closing. In some cases, it will be immediately after the closing appointment. You will receive the keys and head straight to your new home. In other situations, the seller may request 30, 45 or even 60 days of occupancy after the closing of the home.

Do they pull your credit the day of closing

The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.

How many times do they check bank statements before closing

Most lenders will request 2 months of statements for each of your bank, retirement, and investment accounts, though they may request more months if they have questions.

How many times do lenders run credit before closing

While the number of credit checks for a mortgage can vary depending on the situation, most lenders will check your credit up to three times during the application process.

Can you be denied at closing

Yes. Many lenders use third-party “loan audit” companies to validate your income, debt and assets again before you sign closing papers. If they discover major changes to your credit, income or cash to close, your loan could be denied.