What shows up on a credit check for employment?

What can an employer see on a credit check

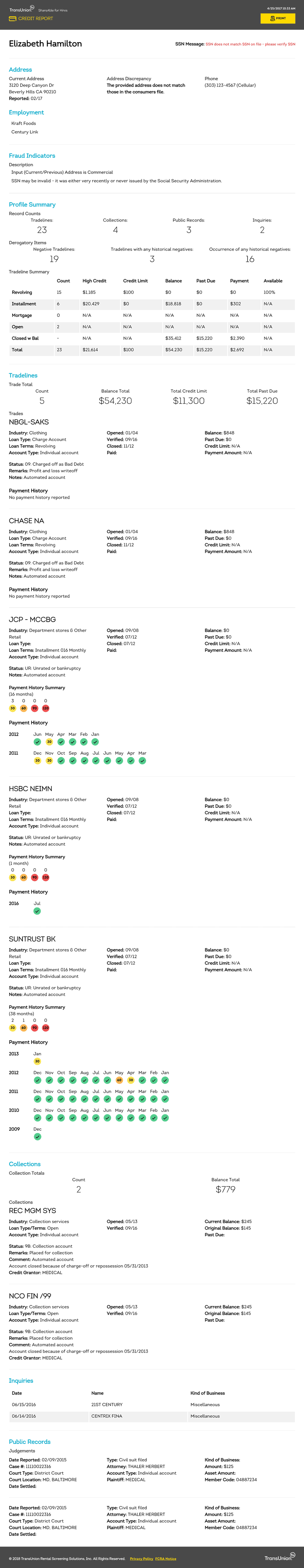

Though prospective employers don't see your credit score in a credit check, they do see your open lines of credit (such as mortgages), outstanding balances, auto or student loans, foreclosures, late or missed payments, any bankruptcies and collection accounts.

Can I be denied a job because of my credit

Generally, yes. Hundreds of companies provide employment background checks and qualify as consumer reporting agencies. Employment reports often include credit checks, criminal background checks, public records – such as bankruptcy filings and other court documents – and information related to your employment history.

Does your employer show up on a credit check

It is possible for current and past employers to show up on your credit report if they were listed on a credit application you submitted. Creditors commonly ask for employment information, which then may get passed along to the national credit reporting agencies and added to your credit file.

What is the minimum credit score for a job

It may be noted that if you are trying to find a job in a bank, a Cibil score of less than 750 will not do. However, if you approach the bank as a customer, the same bank may still consider giving you a loan if your score is between 700-750. 2. What determines your Cibil score

Can you be denied a job because of bad credit in California

The general rule in California is that an employer may not consider acquire or consider a person's credit report in making job decisions except for applicants for or employees in: managerial positions. positions with the state Department of Justice.

Will a default stop me getting a job

Remember though, credit checks for most jobs will not look at your full credit history, so things like late payments or even defaults won't be taken into consideration.

What can keep you from getting a job

The 4 Major Things That Can Stop You Getting A JobLack Of Experience. It can sometimes seem a little harsh, but the fact is that employers generally want people who have a great deal of experience.Criminal Record.Tagscriminal determination experience interview job land offence passion record stop success.

Can my employer check my bank account

Federal law does not prevent employers from asking about your financial information.

What’s the difference between a background check and a credit check

“Credit scores typically do not show up on a background check. Most background checks for employment do not seek credit information, but rather, criminal history. They are typically looking for whether you are dangerous to employ. "Some pre-employment screenings do go deeper and look at credit.

How do I remove my employment history from my credit report

To update the employment on your credit report, simply update the employment on your loan or credit card accounts, through your online account portal or by calling customer service. When your lenders report to the credit bureaus, your personal information – including your employment – will also update.

What is bad credit considered

A bad credit score is a FICO credit score below 670 and a VantageScore lower than 661. If your credit isn't where you would like it to be, remember that a bad credit score doesn't have to weigh you down. Fortunately, you can take simple steps to improve your credit, and you might even see results quickly.

Is 550 a low credit score

A credit score of 550 is considered deep subprime, according to the Consumer Financial Protection Bureau. In fact, any score below 580 falls into the deep subprime category. The Fair Isaac Corporation (FICO), which is one of the most widely used credit scoring methods, categorizes credit scores of 579 or lower as poor.

Should I tell employer about bad credit

Many employers say they welcome a candidate's explanation of their credit history and take it into consideration when hiring. If you have a good explanation for your bad credit, be honest in sharing it with them.

Why would an employer be added to your credit report

Why Your Employment Is in Your Credit Report. You may assume that your bosses have been independently sending information about you to the credit reporting agencies, but that's not the case. In fact, an employer is on your report because you provided that information on an application for credit.

Can debt affect your job

This can be extremely embarrassing and can negatively affect your work relations. While not necessarily a bad thing, debt often determines how you structure your compensation package. For some people, that means rushing to take the first job that pays the bills.

Does it look bad on your resume if you quit

If you like what you do most of the time – and know you're good at it – stay put. Your resume will look worse for quitting. Leaving a job before you've been there for an entire year almost always looks bad on your resume. Great resumes also don't show several years spent bouncing from job to job.

What is a red flag in a background check

While no one is perfect, factual issues will cause managers to not consider a candidate. What constitutes a red flag can vary by company and position, but the most common red flags are criminal records, discrepancies, and derogatory comments.

Why won’t I get hired

Employers often won't hire someone who doesn't have the majority of the skills, education, or job experience necessary for the position. If you need to boost your skill set to be more in line with what companies are looking for, consider going back to school or finding online resources to gain the skills you need.

Can employers discriminate based on credit score

California, Connecticut, Hawaii, Illinois, Maryland, Oregon, Vermont, Delaware, Nevada, Colorado and Washington ban employers from discriminating based on credit in most cases. All 11 states with bans have exceptions. A common one is for jobs at financial institutions or that require handling money.

Can I refuse to show my bank statement

In general, you don't have legal grounds to refuse to show the IRS your bank statements and, in any event, refusing would be pointless because the IRS can easily obtain them from your bank, which will readily comply because they have no interest in getting into trouble with the IRS on your account.