What shows up on BrokerCheck?

How long does information stay on BrokerCheck

ten years

b. Consistent with rules, policies and procedures approved by the SEC, FINRA will disclose data on individuals, through BrokerCheck, for ten years after the termination of the individual's FINRA registration and, in certain cases, indefinitely.

Does BrokerCheck show failed exams

Such information is not given to investors, but the Financial Industry Regulatory Authority (Finra) may review the findings. A Finra website, called BrokerCheck, currently shows only when brokers passed exams. When it comes to the Series 63 exams, about 14% of brokers failed the test at least once.

Why use BrokerCheck

Advantages of BrokerCheck

BrokerCheck provides information on individual brokers, brokerage firms and even former brokers that are no longer registered. Investors can use BrokerCheck to easily verify a broker's credentials and access any customer complaints or allegations of misconduct.

Cached

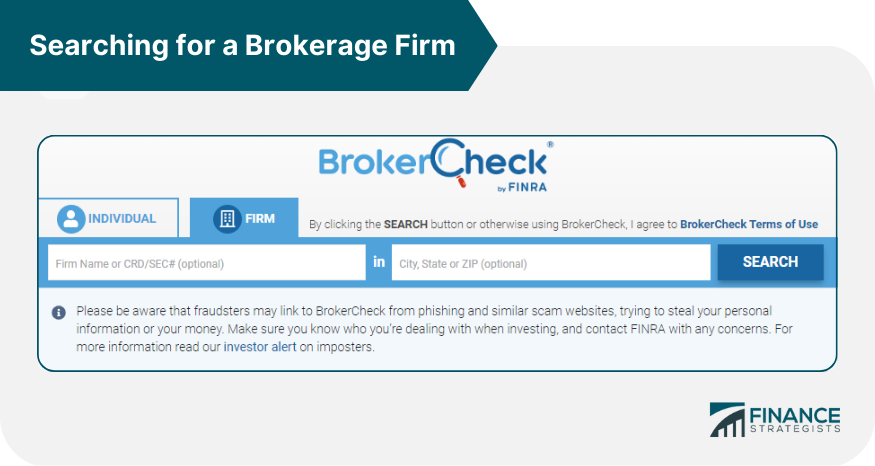

How do you check if a broker is regulated

Visit FINRA BrokerCheck or call FINRA at (800) 289-9999. Or, visit the SEC's Investment Adviser Public Disclosure (IAPD) website. Also, contact your state securities regulator.

What triggers a FINRA investigation

FINRA inquiries are primarily triggered by disclosures on the Forms U4 and U5. Many of these disclosures stem from allegations made by a customer or broker-dealer. Some disclosures are financial, and they reference liens or disputes. Others reference arbitrations or judgements against the advisor.

Does FINRA check employment history

What Shows up on a FINRA Background Check A member firm's obligation to thoroughly investigate an applicant includes verifying professional licenses and employment history, screening for evidence of criminal conduct or sanctions, and conducting an extensive search of public records.

What happens if you get caught cheating on a FINRA exam

While the means and methods to cheat on FINRA exams have varied greatly, the results have not—cheating on a FINRA exam almost always ends with a permanent bar from the broker-dealer industry.

What is the toughest FINRA exam

the Series 7 exam

Clocking in at 125 questions to be answered in three hours and 45 minutes, the Series 7 exam is considered the most difficult of all the securities licensing exams.

What is a disclosure on BrokerCheck

The disclosure section, which contains information about certain criminal, civil, or customer complaints involving brokers, as well as certain types of employment termination disclosures.

What does it mean to be barred from FINRA

The individuals listed below have a FINRA bar in effect, which means FINRA has permanently prohibited them from association with any member in any capacity. The list comprises individuals who were associated with a FINRA registered firm on or after FINRA launched Web CRD on August 16, 1999.

What happens when a broker is not regulated

When a broker is unregulated, this means that there is no regulatory organization or group of persons monitoring them, in other words, they can take your money and disappear. This is the reason why you see lists of online brokers described as scams or frauds.

Can brokers see your indicators

The broker cannot "SEE" what you have on your charts.

What disqualifies you on a FINRA background check

FINRA Disqualification Criteria

Felony convictions for 10 years following the conviction date. Certain misdemeanor convictions for 10 years from the conviction date. Temporary or permanent injunctions for unlawful securities or investment banking activities.

What do you have to disclose to FINRA

FINRA Rule 4530 requires firms to report specified events; quarterly statistical and summary information regarding written customer complaints; and copies of specified criminal and civil actions.

What is the easiest FINRA exam

As a result, the Series 66 exam is considered by most to be an easier test. Like the Series 65 exam, it qualifies the individual to act as an IAR and fulfills the requirements for state registration.

Is the Series 7 harder than the bar

Clocking in at 125 questions to be answered in three hours and 45 minutes, the Series 7 exam is considered the most difficult of all the securities licensing exams.

What is the disclosure rule

The Disclosure Rule asks if you would be comfortable with all your family and friends knowing about the action you propose to take. Would you be comfortable reading about what you are about to do on the front page of The Wall Street Journal or the local paper, or seeing it on Facebook

What is the difference between a regulated and unregulated broker

When you have a dispute with a regulated broker, the relevant regulatory agency will act as the mediator. In contrast, if you have a dispute with an unregulated broker, the company will act as both the defendant and judge. The lack of any just recourse means that you will not be guaranteed any fair judgment.

What is an illegal broker

Illegal Information Brokering means the practice by which an individual or entity approaches a contractor, subcontractor, vendor or other supplier, and offers confidential information or illegal or illicit influence in order to obtain business through bribery, fraud, corruption of competitive bidding processes or other …

Does pro traders use indicators

Professional traders combine market knowledge with technical indicators to prepare the best trading strategy. Most professional traders will swear by the following indicators. Indicators offer essential information on price, as well as on trend trade signals and give indications on trend reversals.