What stops Social Security benefits?

What would cause Social Security benefits to stop

Benefit suspensions occur when a beneficiary is no longer eligible for SSI benefits. For example, the person has amassed over $2,000 in resources, their work earnings exceed SGA, they are hospitalized for longer than 30 days, or they become incarcerated.

Cached

What disqualifies you from Social Security

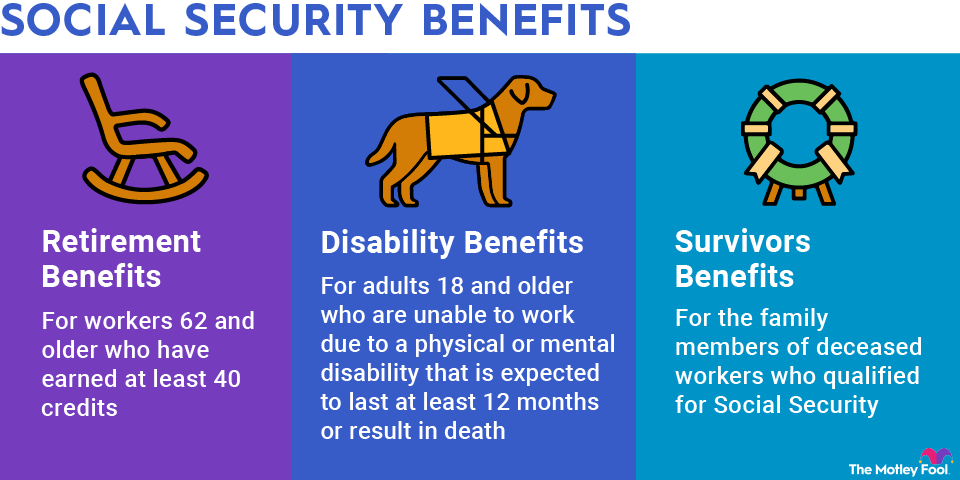

Some American workers do not qualify for Social Security retirement benefits. Workers who don't accrue the requisite 40 credits (roughly ten years of employment) are not eligible for Social Security. Some government and railroad employees are not eligible for Social Security.

Can the government stop your Social Security benefits

(a) General. Under some circumstances, we may stop your benefits before we make a determination. Generally, we do this when the information we have clearly shows you are not now disabled but we cannot determine when your disability ended.

Can Social Security income be taken away

Section 459 of the Social Security Act (42 U.S.C. 659) permits Social Security to withhold current and continuing Social Security payments to enforce your legal obligation to pay child support, alimony, or restitution. By law, we do not make retroactive adjustments.

Does money in the bank affect Social Security retirement

Will withdrawals from my individual retirement account affect my Social Security benefits Social Security does not count pension payments, annuities, or the interest or dividends from your savings and investments as earnings. They do not lower your Social Security retirement benefits.

What is the Social Security 5 year rule

The Social Security disability five-year rule allows people to skip a required waiting period for receiving disability benefits if they had previously received disability benefits, stopped collecting those benefits and then became unable to work again within five years.

What are the four ways you can lose your Social Security

Keep reading to learn about how you could lose some or all of your Social Security benefits.You Forfeit Up To 30% of Your Benefits by Claiming Early.You'll Get Less If You Claim Early and Earn Too Much Money.The SSA Suspends Payments If You Go to Jail or Prison.You Can Lose Some of Your Benefits to Taxes.

What types of income does not affect Social Security benefits

Pension payments, annuities, and the interest or dividends from your savings and investments are not earnings for Social Security purposes. You may need to pay income tax, but you do not pay Social Security taxes.

Does money in the bank affect Social Security

No, money in the bank doesn't affect Social Security disability benefits.

What causes people to lose SSI benefits

The Four Most Common Reasons Disability Benefits May Be Revoked in Los AngelesCourt-Order Continuing Disability Reviews.Making Too Much Income.Retirement or Turning 18.Arrest and Imprisonment.Protect Your Disability Benefits by Working With a California Disability Lawyer.

Does money in the bank affect Social Security benefits

Social Security does not count pension payments, annuities, or the interest or dividends from your savings and investments as earnings. They do not lower your Social Security retirement benefits.

Does it matter how much money you have in bank to collect Social Security

The good news is that you can have a bank account and be eligible to receive Social Security Disability benefits as long as you meet the other eligibility requirements. The Social Security Administration does not limit the number or value of resources or assets you may own.

What is the Social Security 1st year rule

That's why there is a special rule that applies to earnings for 1 year, usually the first year of retirement. Under this rule, you can get a full Social Security check for any whole month you're retired, regardless of your yearly earnings.

What is the max you can make and still collect Social Security 2023

If you will reach full retirement age in 2023, the limit on your earnings for the months before full retirement age is $56,520. Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.

What type of earnings count against Social Security

What income counts…and when do we count it If you work for someone else, only your wages count toward Social Security's earnings limits. If you're self-employed, we count only your net earnings from self-employment.

What money counts against Social Security

We only count your earnings up to the month before you reach your full retirement age, not your earnings for the entire year. If your earnings will be more than the limit for the year and you will receive retirement benefits for part of the year, we have a special rule that applies to earnings for one year.

How much money can you have in a bank account

Generally, there's no checking account maximum amount you can have. There is, however, a limit on how much of your checking account balance is covered by the FDIC (typically $250,000 per depositor, per account ownership type, per financial institution), though some banks have programs with higher limits.

Does bank account affect Social Security

The amount of money that you have in the bank may affect your ability to qualify for or continue to receive Social Security disability benefits .

What is the 4 rule and Social Security

The 4% rule is easy to follow. In the first year of retirement, you can withdraw up to 4% of your portfolio's value. If you have $1 million saved for retirement, for example, you could spend $40,000 in the first year of retirement following the 4% rule.

What Social Security rule changes in 2023

For 2023, the Supplemental Security Income (SSI) FBR is $914 per month for an eligible individual and $1,371 per month for an eligible couple. For 2023, the amount of earnings that will have no effect on eligibility or benefits for SSI beneficiaries who are students under age 22 is $8,950 a year.