What transactions are entered if a customer returns merchandise purchased on account and a credit is issued?

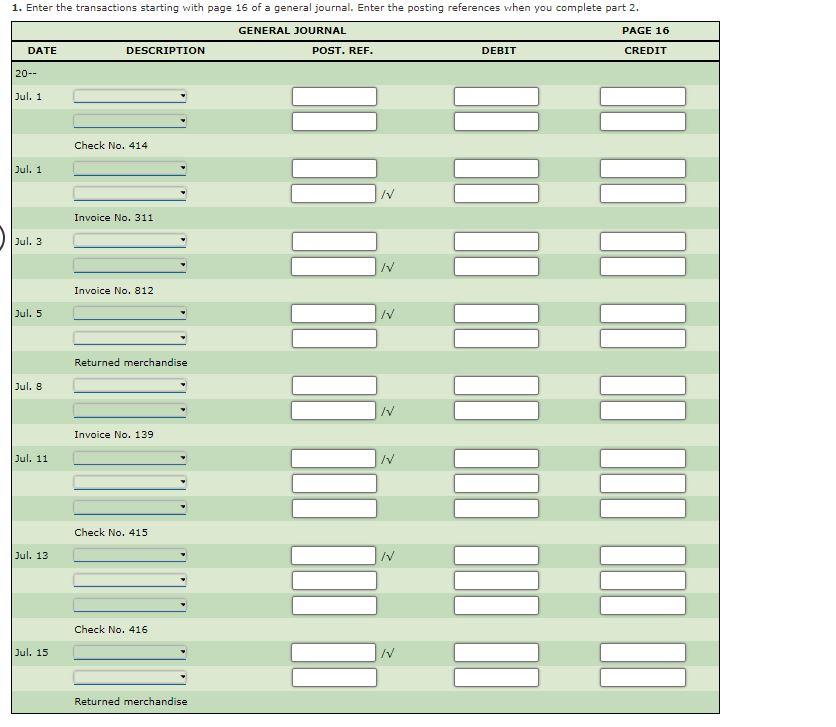

How do I record returned merchandise for credit

When merchandise purchased for cash is returned, it is necessary to make two journal entries. The first entry debits the accounts receivable account and credits the purchase returns and allowances account. The second entry debits the cash account and credits the accounts receivable account.

Cached

When a customer returned merchandise for credit how will the return be recorded

Accounting for a purchase return with store credit is similar to a cash refund. But instead of entering in your Cash account, you credit your Accounts Payable account. Because you are not immediately paying the customer, you must increase the amount you owe through an Accounts Payable entry.

Cached

What is the entry to record the return of merchandise from a customer

Answer and Explanation: Answer: c. debit to Sales Returns and Allowances.

What is the journal entry to record a return of merchandise purchased on account under a perpetual inventory system

Answer and Explanation: Using a perpetual inventory system, the buyer's journal entry to record the return of merchandise purchased on account includes a d) credit to inventory. The purchase of the inventory under the perpetual inventory system means that inventory was debited and accounts payable was credited.

Which account is debited when a customer returns merchandise bought on credit

When merchandise is returned, the sales returns and allowances account is debited to reduce sales, and accounts receivable or cash is credited to refund cash or reduce what is owed by the customer.

What is the journal entry for credit purchase

What is the Purchase Credit Journal Entry Purchase Credit Journal Entry is the journal entry passed by the company in the purchase journal of the date when the company purchases any inventory from the third party on the terms of credit. The purchases account will be debited.

What happens when you return something on credit

Once you have returned the item to the retailer, you will receive a statement credit on your credit card account. This statement credit may show up on your online account within a few days, although the exact time frame will vary depending on both your credit card issuer and the merchant.

What is merchandise returned by a customer for cash or credit called

Any merchandise returned for credit or a cash refund is known as a sales return. A price reduction granted to the customer for damaged goods is known as a sales allowance.

Which journal would be used to record the return of merchandise

Any entry relating to the return of merchandise purchased for cash is recorded in a cash receipts journal.

What account is credited in a purchase return

When the buyer records a purchase return, it can be either as a credit to its inventory account (if there are few such transactions) or to a purchase returns account (if management wants to segregate this information for further analysis). The offsetting debit is to the accounts payable account.

Which journal is used to record a return of goods from a credit purchase

Purchase returns journal

A purchase returns journal (also known as returns outwards journal/purchase debits daybook) is a prime entry book or a daybook which is used to record purchase returns. In other words, it is the journal which is used to record the goods which are returned to the suppliers.

What is an example of a credit purchase transaction

A credit purchase, or to purchase something “on credit,” is to purchase something you receive today that you will pay for later. For example, when you swipe a credit card, your financial institution pays for the goods or services up front, then collects the funds from you later.

Do you credit purchase returns

The purchase returns account frequently has a credit balance in the books. As a result, the credit balance in the purchase account will be offset by the debit balance. Purchase refunds lower the business's expenses and are thus recorded on the trial balance's credit side.

Is returning goods credit or debit

A debit note is issued when the customer or buyer of the goods returns them to the vendor or supplier of those goods. But a credit note is issued when the vendor or supplier of the goods gets products back from the customer to whom they were sold.

When goods are returned by customer which account is credited

Return of goods to the supplier should be credited to purchase return account.

How do I record a return transaction

Record a sales return transaction

For both cash and credit sales, you can record the money in the sales return and allowances account. You can also record where this money comes from to balance the books. For cash refunds, you can reflect a decrease in the cash account.

How do you record returns in accounting

Accounting for a Sales Return

The seller records this return as a debit to a Sales Returns account and a credit to the Accounts Receivable account; the total amount of sales returns in this account is a deduction from the reported amount of gross sales in a period, which yields a net sales figure.

Which document is used to record credits for the return of goods in a customer’s account or to record allowances that will be issue

A debit note is also a document created by a buyer when returning goods received on credit. In the case of returned items, the note will show the credit amount, the inventory of the returned items, and the reason for the return.

Which transactions are recorded in purchase return book

In a purchase return book the items that are returned to the suppliers are recorded. Also read: Cash Book.

What is the entry for credit purchases

What is the Purchase Credit Journal Entry Purchase Credit Journal Entry is the journal entry passed by the company in the purchase journal of the date when the company purchases any inventory from the third party on the terms of credit. The purchases account will be debited.