What triggers FCRA requirements?

What requirements does the Fair Credit Reporting Act FCRA impose on credit reporting agencies

Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

Cached

What does it mean when a collection says meets FCRA requirements

"Account information disputed by consumer meets FCRA requirements" simply means that an investigation into a dispute is complete, and the bureau believes the account has no errors.

What is one of the reasons that Congress enacted the Fair Credit Reporting Act FCRA

The Fair Credit Reporting Act (FCRA), Public Law No. 91-508, was enacted in 1970 to promote accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Cached

In which situation do you not need to provide an adverse action notice under FCRA

In the case of a withdrawn application, no notice of adverse action is required since technically no action is being taken by the creditor or credit-related decision maker.

When must each credit bureau provide your credit score under FCRA

1. Credit bureaus must provide your credit report to you when you ask for it. If you ask for a copy of your credit report and verify your identity, a credit bureau must provide it to you. Consumers are entitled to one free credit report every 12 months from each of the three nationwide credit bureaus.

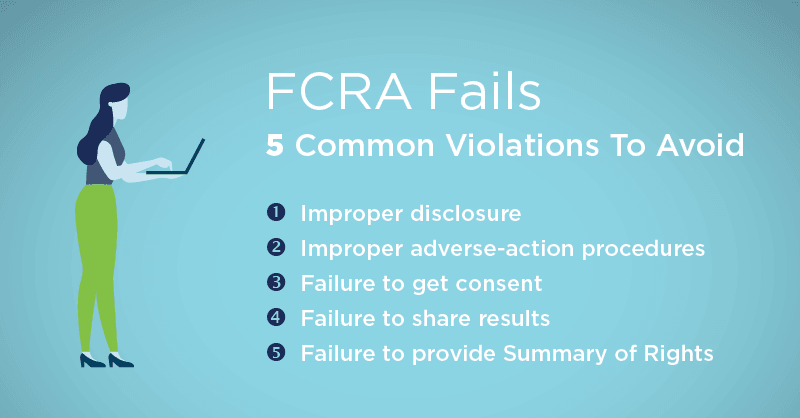

What are the most common FCRA violations

Some of the common violations include:Furnishing and Reporting Old Information.Mixing Files.Debt Dispute Procedures for Credit Bureaus.Debt Dispute Violations for Creditors.Privacy Violations.Withholding Notices.Willful FCRA Violations.Negligent FCRA Violations.

How do I remove a collection from my credit report

Successfully disputing inaccurate information is the only surefire way to get collections removed from your credit report. If you've repaid a debt and the collection account remains on your credit report, you can request a goodwill deletion from your creditor, though there's no guarantee they'll grant your request.

What does FCRA look for

The background reports regulated under the FCRA include the consumer's credit standing, but they can extend to matters of character, general reputation, personal characteristics, mode of living, and similar information—all of which can determine a person's eligibility for credit, insurance, or a job.

What responsibilities and limits does the Fair Credit Reporting Act FCRA impose on furnishers

FAIR CREDIT REPORTING ACT/REGULATION V. Section 623 of the FCRA and Regulation V generally provide that a furnisher must not furnish inaccurate consumer information to a CRA, and that furnishers must investigate a consumer's dispute that the furnished information is inaccurate or incomplete.

What are common violations of the FCRA

Most Frequent Violations of the Fair Credit Reporting ActReporting outdated information.Reporting false information.Accidentally mixing your files with another consumer.Failure to notify a creditor about a debt dispute.Failure to correct false information.

What are examples of adverse action as defined by the FCRA

What is an adverse action as defined by FCRA The term “adverse action” includes several different actions that can be taken against you by a bank or lender, including the denial of a loan application, revocation of a line of credit, or changes in terms of a loan that are less favorable to you.

Does the FCRA apply to all credit bureaus

The FCRA applies to any company that collects and sells data about you to third parties. Such companies, known as consumer reporting agencies, must follow the stipulations of the FCRA. The three most well-known consumer reporting agencies in the U.S. are Equifax, TransUnion and Experian.

What is an example of a Fair Credit Reporting Act violation

Common violations of the FCRA include:

Failure to update reports after completion of bankruptcy is just one example. Agencies might also report old debts as new and report a financial account as active when it was closed by the consumer. Creditors give reporting agencies inaccurate financial information about you.

What is the 11 word credit loophole

In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its “Please cease and desist all calls and contact with me immediately.”

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

What falls under FCRA

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

What is a credit furnisher required to do to be in compliance with FCRA

FAIR CREDIT REPORTING ACT/REGULATION V. Section 623 of the FCRA and Regulation V generally provide that a furnisher must not furnish inaccurate consumer information to a CRA, and that furnishers must investigate a consumer's dispute that the furnished information is inaccurate or incomplete.

What must a plaintiff prove for a willful violation of the FCRA

Burr that willfulness under the FCRA requires a plaintiff to show that the defendant's conduct was “intentional” or “reckless.” Willful violations can lead to recovery of statutory damages ranging from $100 to $1,000 per violation.

What does the FCRA prohibit

Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act. Companies that provide information to consumer reporting agencies also have specific legal obligations, including the duty to investigate disputed information.

What would not be considered an adverse action

A refusal or failure to authorize an account transaction at the point of sale or loan is not adverse action except when the refusal is a denial of an application, submitted in accordance with the creditor's procedures, for an increase in the amount of credit.