What type of account is equity?

What type of account is the equity account

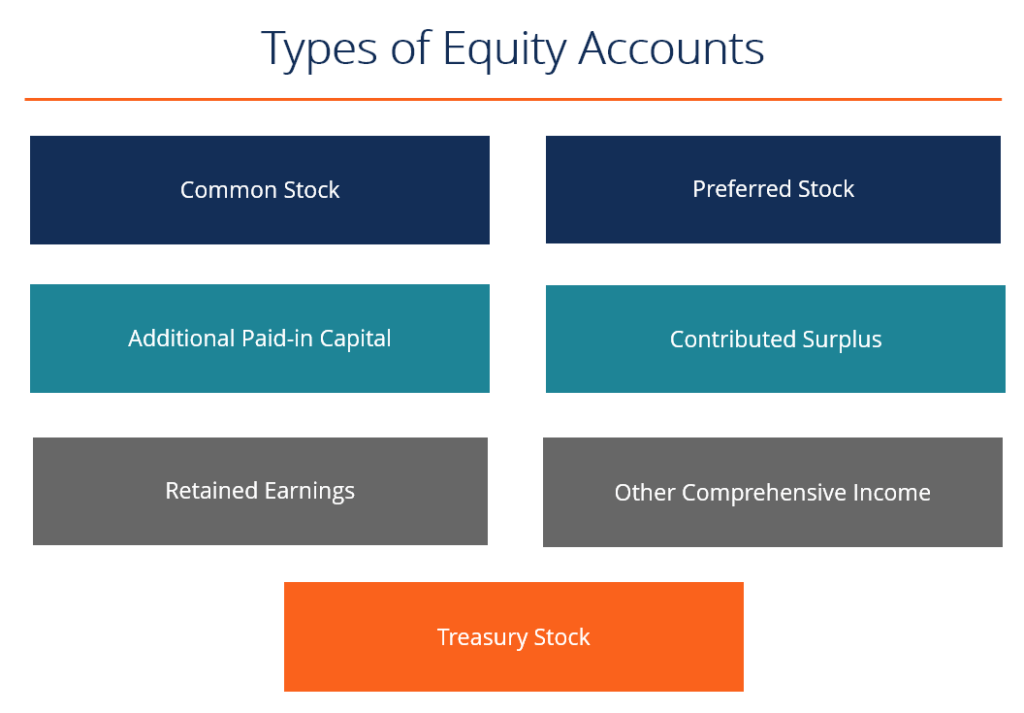

Equity accounts represent the financial ownership in a company and are visible in the balance sheet immediately after the liability accounts. There are different kinds of equity accounts that are aggregated to form shareholder's equity. Almost all equity accounts have credit balances.

Cached

What type of asset is equity

The primary difference between Equity and Assets is that equity is anything invested in the company by its owner. In contrast, the asset is anything that the company owns to provide economic benefits in the future.

Cached

Is equity an asset or an expense

Assets are everything your business owns. Liabilities and equity are what your business owes to third parties and owners. To balance your books, the golden rule in accounting is that assets equal liabilities plus equity.

Cached

What type of balance is equity

Equity is equal to total assets minus its total liabilities. These figures can all be found on a company's balance sheet for a company. For a homeowner, equity would be the value of the home less any outstanding mortgage debt or liens.

Cached

What is equity on the balance sheet

The balance sheet (also referred to as the statement of financial position) discloses what an entity owns (assets) and what it owes (liabilities) at a specific point in time. Equity is the owners' residual interest in the assets of a company, net of its liabilities.

What are the two types of equity accounts

10 equity account typesCommon stock.Preferred stock.Retained earnings.Contributed surplus.Additional paid-in capital.Treasury stock.Dividends.Other comprehensive income (OCI)

What is equity in accounts

Equity is the amount of money that a company's owner has put into it or owns. On a company's balance sheet, the difference between its liabilities and assets shows how much equity the company has. The share price or a value set by valuation experts or investors is used to figure out the equity value.

What is equity in a balance sheet

The balance sheet (also referred to as the statement of financial position) discloses what an entity owns (assets) and what it owes (liabilities) at a specific point in time. Equity is the owners' residual interest in the assets of a company, net of its liabilities.

Is equity always an asset

Equity is money that the Owners of the Company buy for running the business, whereas Assets are things bought by the company and have a value attached to them. Equity is always represented as the Net worth of a Company, whereas Assets of the Company are valuable things or Property.

How is equity accounted

The equity method is a method of accounting whereby the investment is initially recognised at cost and adjusted thereafter for the post-acquisition change in the investor's share of the investee's net assets.

Is equity a debit or credit account

In asset accounts, a debit increases the balance and a credit decreases the balance. For liability accounts, debits decrease, and credits increase the balance. In equity accounts, a debit decreases the balance and a credit increases the balance.

Is equity a credit or debit

Equity is a credit as revenues earned are recorded on the credit side. These credit balances are closed at the end of every financial year and are transferred to the owner's equity account.

Where does equity sit on the balance sheet

Total liabilities and owners' equity are totaled at the bottom of the right side of the balance sheet. Remember —the left side of your balance sheet (assets) must equal the right side (liabilities + owners' equity).

What is another name for equity in accounting

shareholders’ fund

Equity is also known as shareholders' fund, owner's funds, or net worth.

Is equity considered an expense

No, expenses are neither assets, liabilities or equity. Expenses are shown on the income statement to offset revenue whereas, assets, liabilities and equity are shown on the balance sheet. Liabilities on the balance sheet usually offset assets; that is assets= liabilities + equity.

Where do you record equity

An equity method investment is recorded as a single amount in the asset section of the balance sheet of the investor. The investor also records its portion of the earnings/losses of the investee in a single amount on the income statement.

Is equity a liabilities

Equity is considered a type of liability, as it represents funds owed by the business to the shareholders/owners. On the balance sheet, Equity = Total Assets – Total Liabilities. The two most important equity items are: Paid-in capital: the dollar amount shareholders/owners paid when the stock was first offered.

Is equity a debt or credit

Debt and equity financing are two very different ways of financing your business. Debt involves borrowing money directly, whereas equity means selling a stake in your company in the hopes of securing financial backing.

Why is equity a debit

In equity accounts, a debit decreases the balance and a credit increases the balance. The reason for this disparity is that the underlying accounting equation is that assets equal liabilities plus equity. So, a company may only “have” assets if they were paid for with liabilities or equity.

Is equity an asset or liability on balance sheet

Equity, often called “shareholders equity”, “stockholder's equity”, or “net worth”, represents what the owners/shareholders own. Equity is considered a type of liability, as it represents funds owed by the business to the shareholders/owners. On the balance sheet, Equity = Total Assets – Total Liabilities.