What type of account is issuance of stock?

Is issuance of stock an asset or liability

Common stock is an asset for the company that issued it, but it is not a liability. Common stock represents ownership in a company and represents a claim on the company's assets and earnings.

Cached

What is stock issuance in accounting

Stock issuances are public offerings of shares, also known as partial ownership, in a formerly private company in exchange for money. The company then uses this capital for expansion, debt payment or other purposes.

What type of account is issuance of common stock

equity account

When shares have no par value, the entire amount of the sale price is recorded in the common stock account. This account is classified as an equity account, and so appears near the bottom of a reporting entity's balance sheet.

Where does issuance of stock go on the balance sheet

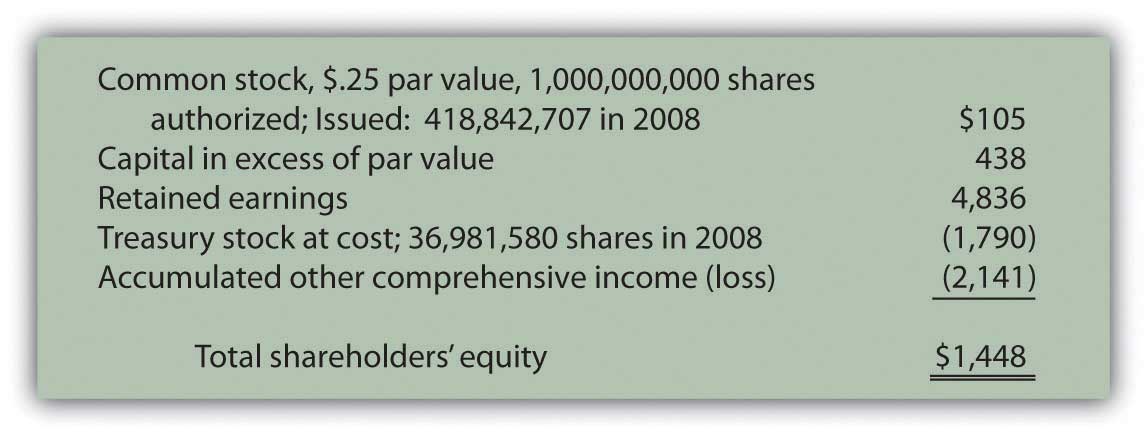

Capital stock is the amount of common and preferred shares that a company is authorized to issue—recorded on the balance sheet under shareholders' equity.

Cached

Are stock issuances an expense

As part of organizational costs

The second way that equity issuance fees can be accounted for is as part of a company's organizational costs. With this method of accounting, issuance fees are viewed as intangible assets. This means that the fees (costs) may be expensed over the course of time.

Is stock a liability or equity

One difference between common stock asset or liability is that common stock is not an asset nor a liability. Instead, it represents equity, which establishes an individual's ownership in a company. A liability is an obligation consisting of an amount owed to another individual.

Is stock issued an expense

Cash or stock dividends distributed to shareholders are not recorded as an expense on a company's income statement. Stock and cash dividends do not affect a company's net income or profit. Instead, dividends impact the shareholders' equity section of the balance sheet.

How do you record issuance of shares

Upon issuance, common stock is recorded at par value with any amount received above that figure reported in an account such as capital in excess of par value. If issued for an asset or service instead of cash, the recording is based on the fair value of the shares given up.

What type of account is common stock quizlet

Common stock is an equity account. Common stock represents the amount of ownership and/or claims the owners have to the business' assets.

How do you record stock issuance costs

There are two ways in which these stock issuance costs can be accounted for under GAAP.Treat the issue costs as a reduction of the amounts paid in.Capitalize the amount as an organizational cost on the balance sheet and amortize the this intangible asset similarly to the amortization of goodwill.

How do you record shares issued in accounting

Journal entry for the issuance of common shares with par value. Common shares with par value are journalized by debiting cash (asset) for the amount received for the shares and crediting common shares (equity) up to the par value, with the balance of the entry credited to additional paid-in capital (equity).

Is stock an asset or owner’s equity

One difference between common stock asset or liability is that common stock is not an asset nor a liability. Instead, it represents equity, which establishes an individual's ownership in a company.

Does stock fall under equity

Equities are the same as stocks, which are shares in a company. That means if you buy stocks, you're buying equities. You may also get “equity” when you join a new company as an employee. That means you're a partial owner of shares in your company.

Are issued shares an expense

Expenses incurred on issue of shares is capital in nature as shares are issued for lifetime of the company and are not day-to-day expenses.

Is common stock an asset or

Common stock is a type of tradeable asset, or security, that equates to ownership in a company.

Is common stock an equity account

Common Stock (Capital contributed by shareholders or issued capital) This is an equity account where the amount contributed initially by shareholders is recorded.

How do you treat the issue of shares in accounting

How do you record shares issued in accounting You can record the issue of shares by debiting your opening balance "capital work-in-progress" account and crediting it to your opening 'paid-up capital' account.

Is issuing common stock an asset

No, common stock is neither an asset nor a liability. Common stock is an equity.

Is a stock an asset or equity

Stocks are financial assets, not real assets. A financial asset is a liquid asset that gets its value from a contractual right or ownership claim.

How do you record stock issuance

Upon issuance, common stock is generally recorded at its fair value, which is typically the amount of proceeds received. Those proceeds are allocated first to the par value of the shares (if any), with any excess over par value allocated to additional paid-in capital.