What type of credit is PayPal Credit?

Is PayPal Credit actual credit

PayPal Credit is a reusable credit line available on purchases at millions of stores that accept PayPal. Plus, it comes with the same security and flexibility you trust from PayPal. If approved, we start you off with a minimum credit line of at least $250.

Cached

Is PayPal Credit a soft or hard pull

Does PayPal check credit PayPal will conduct a soft credit pull when you apply for a payment plan. This doesn't affect your credit score, and there is no minimum credit score requirement to use PayPal.

What is maximum PayPal Credit limit

While the PayPal transfer limit for normal users is $4,000, verified users can send or accept a maximum of $10,000 in a single payment. Additionally, users with a linked bank account can send a maximum of $25,000 per transaction.

Is PayPal Credit bad for credit

Yes, applying for PayPal Credit will lower your credit score. This is because your credit score is affected every time you go through a hard credit check like it is when you apply for any type of credit like car finance for example. PayPal collaborates with a bank that will evaluate and audit your application.

Does PayPal Credit hurt credit

Yes, when you apply for PayPal Credit it will affect your credit profile. This is due to the fact that when you apply, a hard inquiry will be done on your credit report. Synchrony Bank, a financial institution with which PayPal has a partnership, will review your application before completing an audit.

Is PayPal Credit bad for credit score

Because PayPal Credit reports to credit bureaus, your credit score may be affected. However, responsible use of PayPal Credit can improve your credit score. PayPal Credit provides you with a line of credit that you can use for online purchases and money transfers.

How often does PayPal Credit increase limit

We review your credit limit monthly and may invite you to increase your limit once you've been a PayPal Credit customer for at least 6 months. You can always request a credit limit decrease or opt out of receiving offers to increase your credit limit.

How long do you have to pay off PayPal Credit

These instalment offers vary by merchant and allow you to choose a set monthly repayment over a period from 6 to 48 months to help spread the cost of larger purchases in a more manageable way.

What is the downside to PayPal Credit

Two of the biggest downsides of the PayPal Credit Card are its high APR (19.99% – 26.99% (V), depending on creditworthiness) and its 3% foreign transaction fee. Both costs are avoidable, however, if you only use the card in the U.S. and always pay the full balance owed by the due date.

Does increasing PayPal Credit affect credit score

If you seek an increase in your credit limit, PayPal will conduct a soft check that will not appear on your credit report.

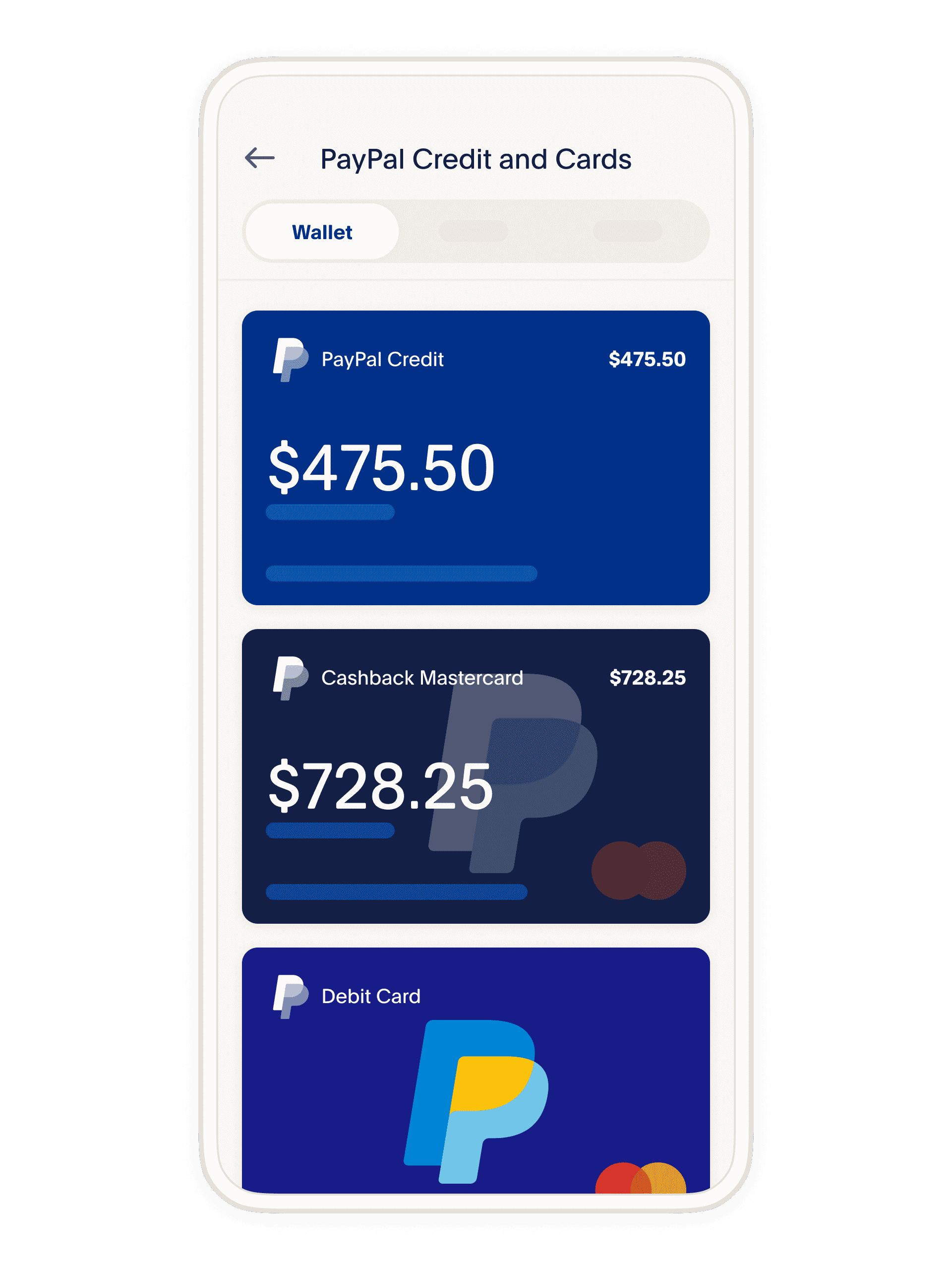

What is the difference between PayPal Mastercard and PayPal Credit

PayPal Credit allows you to take advantage of the interest-free period again and again as long as your transactions are above the $99 threshold. If you are more interested in earning cash back rewards or want more flexibility in using your credit card, the PayPal Cashback Mastercard is the better option.

Will closing PayPal Credit hurt my credit score

Because you'll have less credit available in your accounts, closing your account may temporarily lower your credit score if it causes your credit utilisation rate to rise. If you close your PayPal account without paying the outstanding balance due, this will further harm your credit score.

What happens if you don’t pay off PayPal Credit in 6 months

Interest will be charged to your account from the purchase date if the balance is not paid in full within 6 months.

Will PayPal Credit hurt my credit score

Yes, applying for PayPal Credit will lower your credit score. This is because your credit score is affected every time you go through a hard credit check like it is when you apply for any type of credit like car finance for example. PayPal collaborates with a bank that will evaluate and audit your application.

Is PayPal Credit better than affirm

Affirm rates 4.2/5 stars with 45 reviews. By contrast, PayPal Credit rates 3.7/5 stars with 57 reviews. Each product's score is calculated with real-time data from verified user reviews, to help you make the best choice between these two options, and decide which one is best for your business needs.

What is the highest limit for a PayPal Mastercard

FAQs. What is the credit limit for the PayPal Cashback Mastercard® The credit limit for the PayPal Cashback Mastercard® usually ranges from $300 to $10,000, although some cardholders have reported receiving higher limits.

Is PayPal Credit a Visa or Mastercard

Digitize your cash in store with the reloadable PayPal Prepaid Mastercard. Get all the advantages of a secure, bank-backed card without the overdraft fees.

What happens if you don’t pay off PayPal Credit

If you refuse or cannot make payments with PayPal then will likely sell your debt or refer to you to a debt collector who will continue to contact you until your debt is paid. Your credit score will also be affected.

How often does PayPal increase credit limit

We review your credit limit monthly and may invite you to increase your limit once you've been a PayPal Credit customer for at least 6 months. You can always request a credit limit decrease or opt out of receiving offers to increase your credit limit.

How do I get out of PayPal Credit debt

How do I get rid of PayPal Debt The best way to get rid of PayPal debt is simply start to pay off the debt within 90 days. If you are unable to, then call them at 866-528-3733 to explain your situation and come to a solution with them.