What type of credit is service credit?

What is a service credit

Service credit is credit for time worked. It is one of the factors used to calculate when you can retire and how much your annuity will be. As a state agency employee, you earn credit for each eligible payroll period in which you work and a retirement contribution is made.

Cached

What are the 4 types of credit

Four Common Forms of CreditRevolving Credit. This form of credit allows you to borrow money up to a certain amount.Charge Cards. This form of credit is often mistaken to be the same as a revolving credit card.Installment Credit.Non-Installment or Service Credit.

What is an example of service credit

Examples of service credit include heat, electricity, water, phones, and similar services. Why is service credit important Most families use service credit every day.

What is a service credit in accounting

Service Credit is a financial obligation levied on a Supplier as a consequence of their failure to comply with an agreed SLA during a measurement period.

Cached

Is service a type of credit

Service credit is a type of credit that allows you to use services, such as utilities, cable and cell phones, now and pay for them later. Paying your service credit bills on time doesn't usually affect your credit score, but it can if you use Experian Boost.

What does it mean to purchase service credit

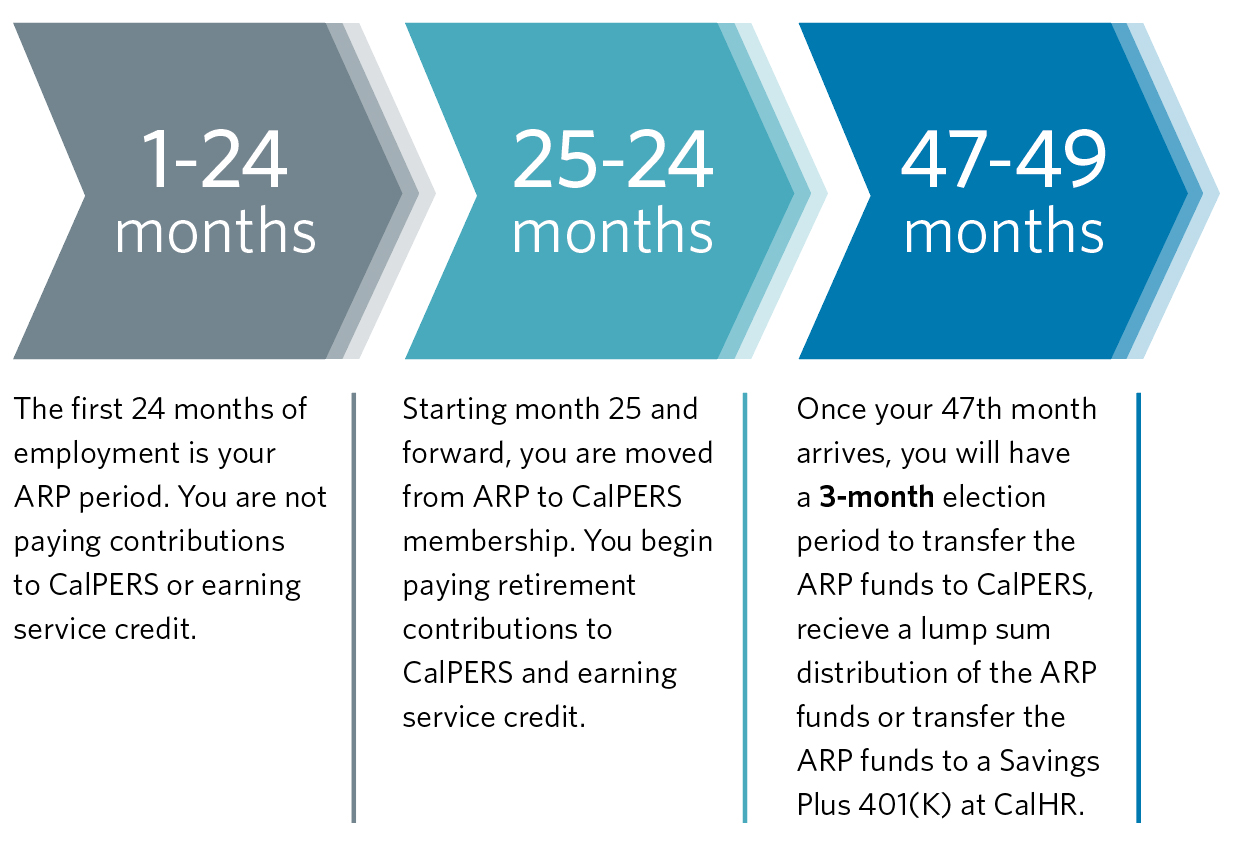

A service credit purchase is the purchase of additional time to increase your CalPERS service credit. Your service retirement benefit under CalPERS is based on your total years of service credit (earned and purchased), benefit factor (e.g. 2 percent at 55), age at retirement, and your final compensation.

What are the 7 types of credits

Trade Credit, Consumer Credit, Bank Credit, Revolving Credit, Open Credit, Installment Credit, Mutual Credit, and Service Credit are the types of Credit.

What are the 5 classification of credit

Called the five Cs of credit, they include capacity, capital, conditions, character, and collateral. There is no regulatory standard that requires the use of the five Cs of credit, but the majority of lenders review most of this information prior to allowing a borrower to take on debt.

What are 3 examples of types of credit

Types of CreditTrade Credit.Trade Credit.Bank Credit.Revolving Credit.Open Credit.Installment Credit.Mutual Credit.Service Credit.

What are examples of direct credit

When you have funds paid directly into any of your Credit Union SA accounts from an external source, this facility is called a 'direct credit'. This could be your salary, for example, or a tax refund, share dividend, superannuation payment, social security payment or a pension.

What are the different types of credit in accounting

The three main types of credit are revolving credit, installment, and open credit. Credit enables people to purchase goods or services using borrowed money. The lender expects to receive the payment back with extra money (called interest) after a certain amount of time.

What is a service classified as

Services are classified as people-based services or equipment-based services. And within those classifications, there are subcategories (see Figure 11.3).

What are the 3 credit types

There are three types of credit accounts: revolving, installment and open. One of the most common types of credit accounts, revolving credit is a line of credit that you can borrow from freely but that has a cap, known as a credit limit, on how much can be used at any given time.

How many service credits do I need to retire

You must earn at least 40 Social Security credits to qualify for Social Security benefits. You earn credits when you work and pay Social Security taxes. The number of credits does not affect the amount of benefits you receive.

What are the 3 main types of credit

The different types of credit

There are three types of credit accounts: revolving, installment and open. One of the most common types of credit accounts, revolving credit is a line of credit that you can borrow from freely but that has a cap, known as a credit limit, on how much can be used at any given time.

What are the 7 types of credit

Trade Credit, Consumer Credit, Bank Credit, Revolving Credit, Open Credit, Installment Credit, Mutual Credit, and Service Credit are the types of Credit.

What are the three 3 types of credit

The different types of credit

There are three types of credit accounts: revolving, installment and open. One of the most common types of credit accounts, revolving credit is a line of credit that you can borrow from freely but that has a cap, known as a credit limit, on how much can be used at any given time.

What are the different types of credit classification

Types of Bank Credit

Bank credit comes in two different forms—secured and unsecured. Secured credit or debt is backed by a form of collateral, either in the form of cash or another tangible asset. In the case of a home loan, the property itself acts as collateral.

What does services fall under

The service sector, also known as the tertiary sector, is the third tier in the three-sector economy. Instead of product production, this sector produces services maintenance and repairs, training, or consulting.

How do you classify goods and services

Product or commodity is anything that is used to satisfy needs and wants of a society. Products are either Goods (tangible and visible) or Services (intangible and invisible). Goods and services can be classified into two basic categories, i.e., free goods and Economic goods.