What types of loans are covered by military lending Act?

What type of loans are covered under the military lending Act

These loans include: Residential mortgages (financing to buy or build a home that is secured by the home), mortgage refinances, home equity loans or lines of credit, or reverse mortgages; A loan to buy a motor vehicle when the credit is secured by the motor vehicle you are buying; and.

Cached

What does the military lending Act cover

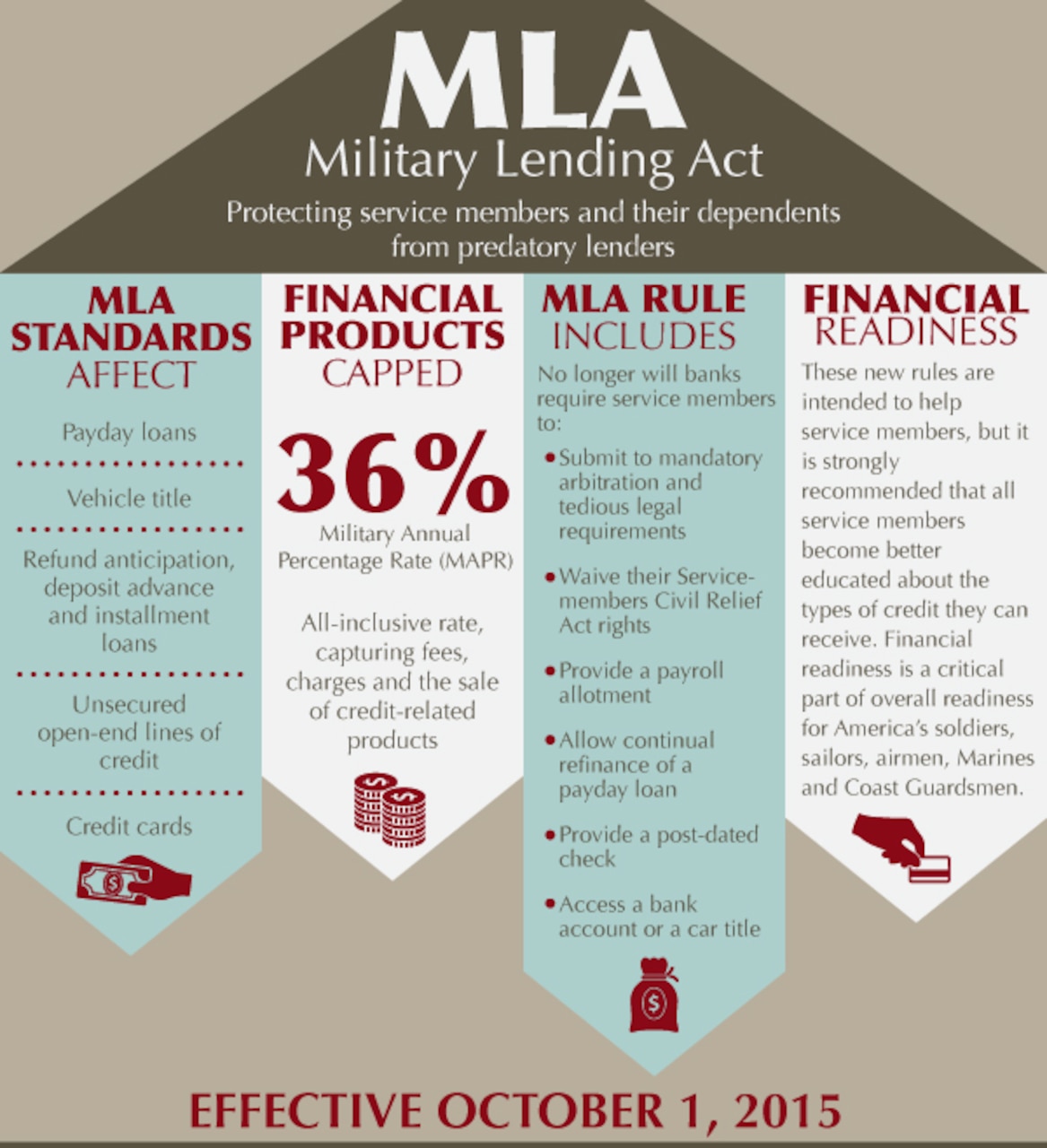

The Military Lending Act1 (MLA), enacted in 2006 and implemented by the Department of Defense (DoD), protects active duty members of the military, their spouses, and their dependents from certain lending practices. restricts loan rollovers, renewals, and refinanc- ings by some types of creditors.

What loans are exempt from MLA

Some loans are exempt from the MLA however. These include: • Residential mortgage loans; • A loan for the purchase of and secured by a motor vehicle; and • A loan for the purchase of and secured by personal property. Is the MLA rule only for open end lending Not necessarily.

Cached

What loans are not covered by SCRA

What doesn't SCRA cover A number of financial transactions are not protected, including: New loans or debt: Contracts entered into during your service are not protected by the SCRA. This act applies specifically to loans taken out prior to active service.

Does military lending Act cover credit cards

The Final Rule covers credit card accounts. Generally, calculating the MAPR for credit card accounts involves including the same fees included in the finance charge for other types of credit covered by the Final Rule. However, certain fees may be excluded if they are bona fide and reasonable.

What are the four main types of loans offered by the federal government

There are four types of Direct Loans:Direct Subsidized Loans.Direct Unsubsidized Loans.Direct PLUS Loans.Direct Consolidation Loans.

What transaction is not covered by MLA

Per 32 CFR 232.2(a)(1), the regulation does not apply to a credit transaction or account relating to a consumer who is not a covered borrower at the time that he or she becomes obligated on a credit transaction or establishes an account for credit.

What types of loans are exempted from bank lending limits

Some loans are not subject to loan limits, such as loans secured by U.S. obligations, bankers' acceptances, or certain types of commercial paper, among others.

What are loan exceptions

Loan exceptions occur any time a loan file does not meet the established standards for a financial institution. Lenders typically have guidelines they must follow, and when those guidelines are not exactly adhered to, an exception occurs.

What loans are eligible for interest rate relief under SCRA

If you took out an automobile, home, or student loan or incurred credit card debt prior to becoming a servicemember (also known as a “pre-service obligation”), or if you took out such a loan jointly with your spouse, then you are entitled to have your interest rate reduced to a maximum of 6 percent per year.

Does SCRA apply to unsecured loans

This law applies to any type of loan the servicemember has entered into before going on active duty. This includes mortgages, car loans, business loans, personal loans and student loans.

What are two things under the MLA that creditors Cannot do

A creditor cannot: • Use the title of a vehicle as security for the obligation involving the consumer credit. prepaying all or part of the consumer credit. after the extension of credit in an account established in connection with the consumer credit transaction.

What are the 3 types of federal loans you can get

Types of federal student loans

Direct Subsidized Loans. Direct Unsubsidized Loans.

Which loans are federal government loans

Federal loan programs include the William D. Ford Federal Direct Loan Program, the Federal Perkins Loan Program, and the Federal Family Education Loan (FFEL) Program.

What types of loans are not subject to Regulation Z

What loans are exempt from Regulation ZFederal student loans.Credit for business, commercial, agricultural or organizational use.Loans that are above a threshold amount.Loans for public utility services that are regulated by a government entity.

What types of loans are classified

A classified loan is a bank loan that is in danger of default. Classified loans have unpaid interest and principal outstanding, but don't necessarily need to be past due. As such, it is unclear whether the bank will be able to recoup the loan proceeds from the borrower.

Does SCRA cover personal loans

This federal law also says lenders cannot charge servicemembers more than 6 percent interest while they are on active duty. This law applies to any type of loan the servicemember has entered into before going on active duty. This includes mortgages, car loans, business loans, personal loans and student loans.

Do car loans fall under SCRA

The SCRA applies to auto loans in two main ways. First, there is a six percent interest rate cap. The six percent interest rate cap applies to individuals that enter military service and their spouses.

What loans are eligible for interest rate relief under the SCRA

The reduced interest rate applies to credit card debts, car loans, business obligations, some student loans and other debts, as well as fees, service charges and renewal fees.

Does SCRA apply to private loans

private student loans

Under the Servicemembers Civil Relief Act (SCRA), servicemembers can reduce their interest rate to 6 percent on all pre-service obligations, including student loans, while they are on active duty.