What was the Child Tax Credit in 2016?

What was the child tax credit for 2023

to $2,000 per child

The 2023 Tax Cuts and Jobs Act increased the standard deduction, eliminated personal exemptions, doubled the maximum child tax credit (CTC) from $1,000 to $2,000 per child under age 17, and added a $500 nonrefundable credit for children ineligible for the $2,000 credit.

How much was the child tax credit per child

$3,600 for each qualifying child who has not reached age 6 by the end of 2023, or. $3,000 for each qualifying child age 6 through 17 at the end of 2023.

What is the maximum EIC amount for 2016

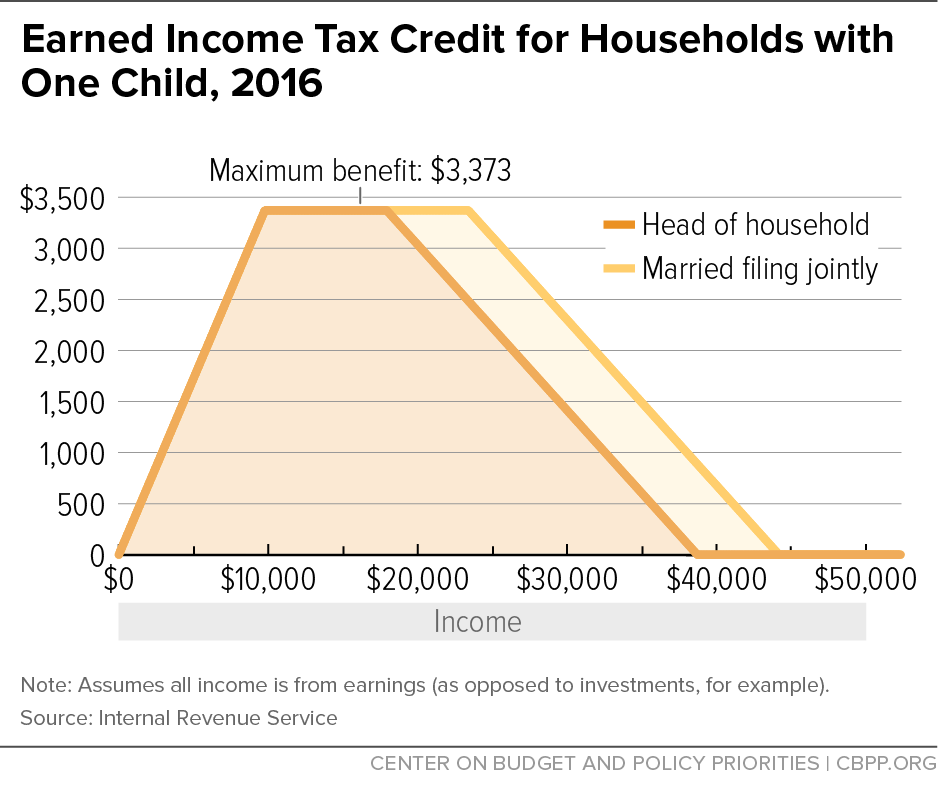

Once you determine if you are eligible for the EITC, here are the maximum credit amounts that you might qualifiy for in 2016: $506 with no Qualifying Children. $3,373 with 1 Qualifying Child. $5,572 with 2 Qualifying Children.

Cached

What is the child tax credit for 2014

The maximum amount of credit for Tax Year 2014 is: $6,143 with three or more qualifying children. $5,460 with two qualifying children. $3,305 with one qualifying child.

What is the child tax credit for 2015

Child Tax Credit

The maximum amount you can claim for the credit is $1,000 for each qualifying child.

What is the child tax credit for 2013

For families with one child, the maximum credit was $3,169 in tax year 2012, and it will increase to $3,250 in 2013. For families with two children, in tax year 2012 the maximum was $5,236, and it will increase to $5,372 in 2013. The American Recovery and Reinvestment Act of 2009 (ARRA; P.L.

How much was the first child tax credit

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2023 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

How much was the Biden child tax credit

Biden's plan calls for raising the current maximum child credit from $2,000 per child to $3,600 per child under age 6 or to $3,000 per child ages 6 and up.

What was the earned income credit for 2016

Tax Year 2016 maximum credit: $6,289 with three or more qualifying children. $5,572 with two qualifying children. $3,373 with one qualifying child.

What was the Child Tax Credit in 2015

Child Tax Credit

The maximum amount you can claim for the credit is $1,000 for each qualifying child.

How much was the Child Tax Credit in 2013

Revenue loss estimates of the EITC and CTC (billions of dollars), 2012–2023

| Fiscal year | Earned income tax credit | Child tax credit |

|---|---|---|

| Total | Total | |

| 2012 | $59.0 | $56.8 |

| 2013 | 60.9 | 57.3 |

| 2014 | 67.0 | 57.9 |

What is the Child Tax Credit 2013

For families with one child, the maximum credit was $3,169 in tax year 2012, and it will increase to $3,250 in 2013. For families with two children, in tax year 2012 the maximum was $5,236, and it will increase to $5,372 in 2013. The American Recovery and Reinvestment Act of 2009 (ARRA; P.L.

What was the child tax credit in 2015

Child Tax Credit

The maximum amount you can claim for the credit is $1,000 for each qualifying child.

How much was the child tax credit in 2010

$1,000

$1,000 for each qualifying child. applies. 1. The amount on Form 1040, line 46; Form 1040A, line 28; or Form 1040NR, line 44, is less than the credit.

How much was the Biden Child Tax Credit

Biden's plan calls for raising the current maximum child credit from $2,000 per child to $3,600 per child under age 6 or to $3,000 per child ages 6 and up.

How much is the $300 child credit per month

$250 per month for each qualifying child age 6 to 17 at the end of 2023. $300 per month for each qualifying child under age 6 at the end of 2023.

Is the maximum Child Tax Credit $2000 per child in 2023

The American Rescue Plan, signed into law on March 11, 2023, expanded the Child Tax Credit for 2023 to get more help to more families. It has gone from $2,000 per child in 2023 to $3,600 for each child under age 6. For each child ages 6 to 16, it's increased from $2,000 to $3,000.

What is the maximum child tax credit

How has the Child Tax Credit changed over the years The American Rescue Plan raised the maximum Child Tax Credit in 2023 to $3,600 per child for qualifying children under the age of 6 and to $3,000 per child for qualifying children ages 6 through 17.

What’s the difference between EIC and child tax credit

The Bottom Line

The Earned Income Tax Credit is a refundable tax credit intended to reduce poverty. This tax credit is primarily available for families with children, and it phases out as you earn more money. The Child Tax Credit is a partially refundable tax credit intended to help parents pay for raising children.

How much was the child tax credit in 2013

Revenue loss estimates of the EITC and CTC (billions of dollars), 2012–2023

| Fiscal year | Earned income tax credit | Child tax credit |

|---|---|---|

| Total | Total | |

| 2012 | $59.0 | $56.8 |

| 2013 | 60.9 | 57.3 |

| 2014 | 67.0 | 57.9 |