What was the income limit for the Child Tax Credit in 2023?

What is the child tax credit limit for 2023

The Tax Cuts and Jobs Act of 2023 doubled the tax credit to $2,000 and made limits to the refundable amount of up to $1,400 per child. It also introduced phase out thresholds and rates for higher-income taxpayers. The act is temporary and will expire on Dec. 31, 2025.

Cached

What is the EITC income limit for 2023

Earned Income Thresholds

You may qualify for the refundable EITC if you have earned income of less than $22,323.

At what income level does the child tax credit phase out per the 2023 tax code for married couples

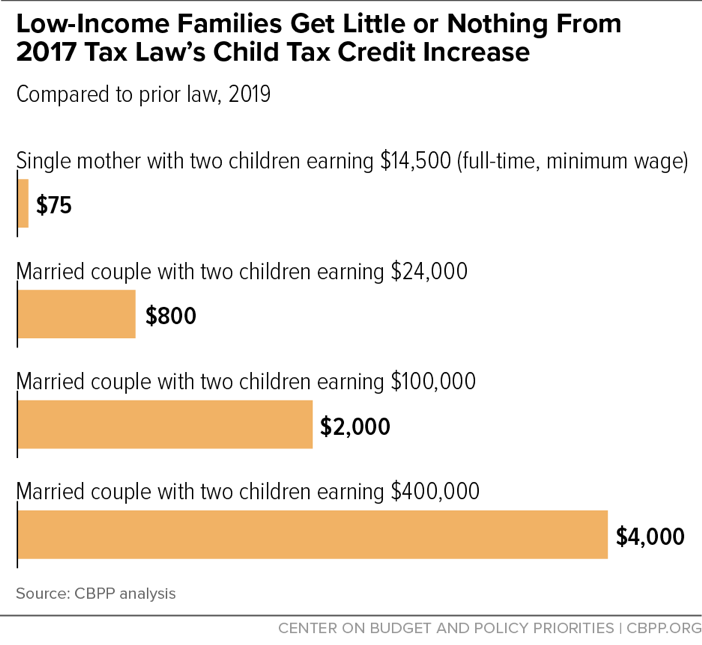

The larger credit amount started phasing out for head of household tax filers at $112,500 and for married couples at $150,000. The underlying $2,000-per-child credit starts phasing out for head of household tax filers at $200,000 and for married couples at $400,000.

What is the child and dependent care credit for 2023

The 20%-35% is taken from up to $3,000 of expenses paid for one Qualifying Person, or from up to $6,000 of expenses paid for two or more Qualifying Persons. Therefore, the maximum Child and Dependent Care Credit is worth $2,100 (based on 2 or more dependents and $6,000 or more of qualifying expenses).

Cached

What is the dependent tax credit for 2023

This may have included yourself, your spouse and any qualifying dependents. In the 2023 tax year, the exemption typically resulted in a $4,050 reduction of taxable income for each one you qualified for. For a family that qualified for four exemptions, the total reduction of taxable income ended up being $16,200.

What is the income limit for Child Tax Credit 2016

Got Tax Questions Ask Them Now!

| Maximum Adjusted Gross Income for the EITC for Tax Year 2016 | ||

|---|---|---|

| Single or Head of Household | $14,880 | $47,955 |

| Married Filing Jointly | $20,430 | $53,505 |

What is the maximum income to qualify for EITC

Basic Qualifying Rules

To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2023. Have a valid Social Security number by the due date of your 2023 return (including extensions)

What is the max income for EITC

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,417 for tax year 2023 as a working family or individual earning up to $30,000 per year.

What is the income scale for child tax credit

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000 if filing a joint return). Parents and guardians with higher incomes may be eligible to claim a partial credit.

At what income level does the child tax credit phase out

Residency Test: The child must have lived with you for more than half of the tax year. Income Test: This is the same requirements as the ones listed earlier. In short, the CTC begins phasing out for families with income above $200,000 (single filers) or $400,000 (joint filers).

How to claim $8,000 Child Tax Credit

A2. To claim the credit, you will need to complete Form 2441, Child and Dependent Care Expenses, and include the form when you file your Federal income tax return. In completing the form to claim the credit, you will need to provide a valid taxpayer identification number (TIN) for each qualifying person.

What was the Child Tax Credit in 2016

Tax filers can claim a CTC of up to $3,600 per child under age 6 and up to $3,000 per child ages 6 to 17. There is no cap on the total credit amount that a filer with multiple children can claim. The credit is fully refundable – low-income families qualify for the maximum credit regardless of how much they earn.

How much is the Child Tax Credit per dependent

A2. For tax year 2023, the Child Tax Credit is increased from $2,000 per qualifying child to: $3,600 for each qualifying child who has not reached age 6 by the end of 2023, or. $3,000 for each qualifying child age 6 through 17 at the end of 2023.

Is there a salary cap for Child Tax Credit

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000 if filing a joint return). Parents and guardians with higher incomes may be eligible to claim a partial credit.

How do you calculate Child Tax Credit

The credit is calculated by taking 15% of your earned income above $2,500. You get to claim the lesser of this calculated amount or your unused Child Tax Credit amount, up to the 2023 maximum of $1,500 per qualifying child.

Can you make too much for earned income credit

The Earned Income Credit income limits

Your earned income and AGI (for 2023) must be less than these limits: With no qualifying children: Maximum AGI $16,480 (filing Single, Head of Household, Widowed, or Married Filing Separately); $22,610 for Married Filing Jointly)

Does EIC go by adjusted gross income

If your AGI (Adjusted Gross Income) is equal to or more than the applicable limit listed above, you cannot claim the EIC. All wage or salary income, as well as any self-employment earnings, count toward the eligibility limits. So do investment earnings.

Is EIC based on gross or net income

The EITC allows you to keep more of your hard-earned money. The credit is based on your total earned income or your total Adjusted Gross Income (AGI), whichever is higher.

Who qualifies for the additional Child Tax Credit

You must have earned income in 2023 or, if you have three or more qualifying children, have paid some Social Security taxes in 2023. The Additional Child Tax Credit increases when your earned income is higher. The Additional Child Tax Credit cannot be more than $1,400 per qualifying child.

What are the income limits for the advanced Child Tax Credit

Nearly all families with children qualify. Families will get the full amount of the Child Tax Credit if they make less than $150,000 (two parents) or $112,500 (single parent). There is no minimum income, so families who had little or no income in the past two years and have not filed taxes are eligible.