What will happen in the loanable funds model when there is an increase in an investment tax credit quizlet?

What happens to loanable funds when investment increases

Changes in the demand for loanable funds

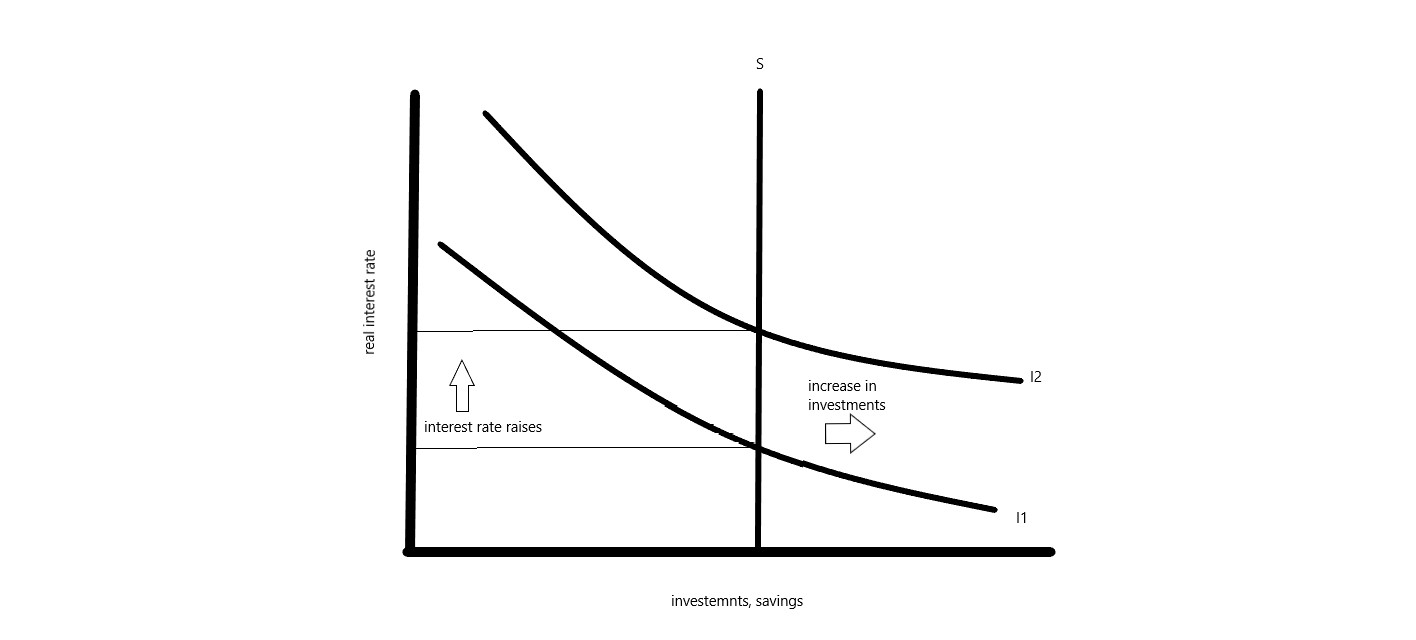

When the economy is doing well, the rate of return on any investment spending will increase. That means the demand for loanable funds will increase, which leads to a higher real interest rate.

What can cause an increase in the demand for loanable funds

A change in the demand for capital affects the demand for loanable funds and hence the interest rate in the loanable funds market. The change in the interest rate leads to a change in the quantity of capital demanded.

What happens to interest rates and investment if Congress instituted an investment tax credit

The correct answer is option (a)

Assume Congress enacted a tax credit for investment. Funds that can be borrowed investment will be much more profitable as a consequence of tax credits. As a result, the demand for loanable cash will rise. Both the interest rate and the quantity of money will rise.

What factors shift the supply of loanable funds

One of the main determinants of the supply of loanable funds is the interest rate. The interest rate provides the return individuals receive for loaning their money to borrowers. Figure 1 shows the supply of loanable funds. Notice, that as the interest rate increases, the quantity of loanable funds supplied increases.

How does an increase in taxes affect loanable funds

An increase in the government tax reduces the disposable income of people. When the disposable income of people falls, savings fall too. This leads to a reduction in supply of loanable funds. So, when taxes are increased the real interest rate associated with the loanable funds increases.

Why does investment increase when interest rate decrease

Lowering rates makes borrowing money cheaper. This encourages consumer and business spending and investment and can boost asset prices.

What may cause an increase in the demand for loanable funds quizlet

All other things unchanged, an increase in loanable funds demand would most likely be caused by a(n): increase in the amount of government borrowing. When government spending is greater than net taxes, there is a budget deficit.

What are the factors affecting the demand of loanable funds

Factors that shift the demand for loanable funds include: investment tax credit. changes in perceived business opportunities. government borrowings.

What is the initial impact of an increase in an investment tax credit

An increase in the investment tax credit, or a reduction in corporate income tax rates, will increase investment and shift the aggregate demand curve to the right. Real GDP and the price level will rise.

Does an investment tax credit increase interest rates

If the passage of an investment tax credit encouraged firms to invest more, the demand for loanable funds would increase. As a result, the equilibrium interest rate would rise, and the higher interest rate would stimulate saving.

What causes shifts in the loanable funds curve

If people want to save more, they will save more at every possible interest rate, which is a shift to the right of the supply curve. If people want to save less (MPS goes down), then the supply of loanable funds shifts to the left.

What causes a shift in the demand curve for loanable funds

All Borrowing, Lending, and Credit: When there is an increase in loans, credit, and borrowing by consumers and firms, we will see the demand for loanable funds increase. When there is a decrease in loans, credit, and borrowing by consumers and firms, we will see the demand for loanable funds decrease.

What factors affect interest rate of loanable funds

Some of these factors for loanable funds include the same factors that affect demand or supply generally, including technology improvements, shift in consumer tastes, substitution possibilities, changes in income of consumers, taxes, etc.

What happens to interest rate if investment increases

An explanation of how the rate of interest influences the level of investment in the economy. Typically, higher interest rates reduce investment, because higher rates increase the cost of borrowing and require investment to have a higher rate of return to be profitable.

When interest rates increase does investment increase

As a general rule of thumb, when the Federal Reserve cuts interest rates, it causes the stock market to go up; when the Federal Reserve raises interest rates, it causes the stock market to go down.

What are other factors affecting the demand for loanable funds

Factors that shift the demand for loanable funds include:investment tax credit.changes in perceived business opportunities.government borrowings.

What happens to loanable funds when taxes decrease

Answer and Explanation: Higher taxes on investment decreased expected profits which shifts demand for loanable funds left. Lower taxes on savings increases the incentive to save which shifts the demand for loanable funds right.

What factor inversely affects the demand curve for loanable funds

The demand for loanable funds is determined by the interest rate and has an inverse relationship with it. The interest rate in the loanable funds market can be expressed both in nominal and real terms.

What would an increase in an investment tax credit do in the loanable funds model

The loanable funds model assumes that there is an equilibrium interest rate. If the investment tax credit increases, then there will be a shortage at this equilibrium interest rate. This shortage will lead to a rise in the interest rate.

What is the effect of investment tax credit

The investment tax credit (ITC) allows firms to reduce their tax liability by an amount related to their expenditures on equipment, and thus reduces the cost of acquiring capital.