What year is the 3600 child tax credit?

What tax year is the child credit based on

Normally, the IRS will calculate the payment amount based on your 2023 tax return. Eligible families will receive advance payments, either by direct deposit or check. These payments are an advance of your 2023 Child Tax Credit.

Cached

What is the IRS 3600 Child Tax Credit

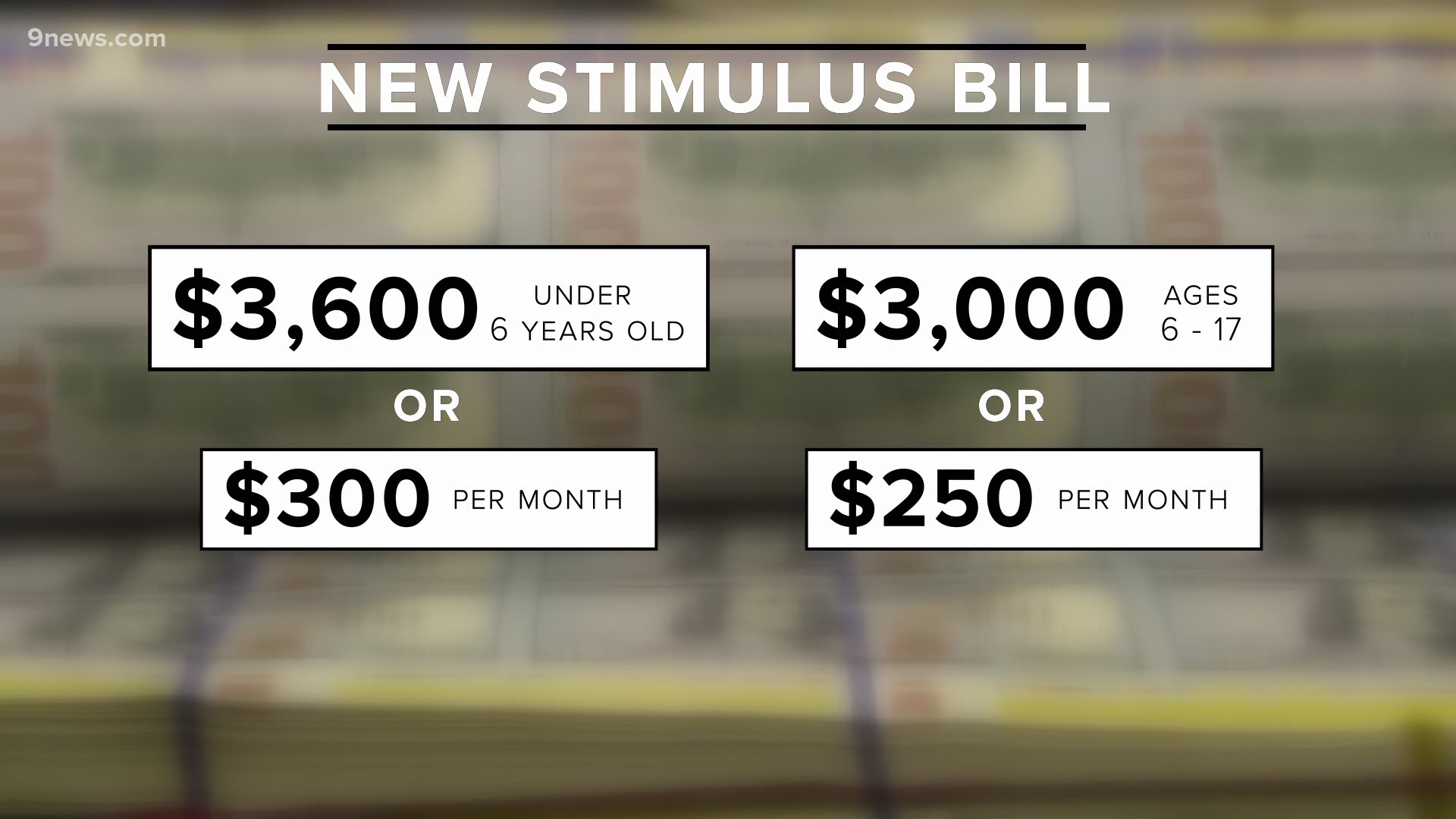

The maximum credit amount has increased to $3,000 per qualifying child between ages 6 and 17 and $3,600 per qualifying child under age 6. If you're eligible, you could receive part of the credit in 2023 through advance payments of up to: $250 per month for each qualifying child age 6 to 17 at the end of 2023.

Is the stimulus check 3600 per child

The three credits include: An expanded Child Tax Credit: Families can claim this credit, even if they received monthly advance payments during the last half of 2023. The total credit can be as much as $3,600 per child.

What is the 2000 Child Tax Credit for 2023

How much is the child tax credit In both 2023 and 2023, the maximum child tax credit is $2,000 for each child under 17. Since it's a credit and not a deduction (which reduces your taxable income), if you owe $10,000 in taxes, by claiming the credit you only have to pay $8,000.

Cached

What year was the first child tax credit

1997

The child tax credit was created in 1997 as part of the Taxpayer Relief Act of 1997. Initially it was a $500-per-child (up to age 16) nonrefundable credit intended to provide tax relief to middle- and upper-middle-income families.

What year did the child tax credit change

The change in the child tax credit, explained

When the American Rescue Plan was approved by Congress in 2023, the child tax credit increased from $2,000 to $3,600 for qualifying children under 6. For kids between ages 6 and 18, the child tax credit increased to $3,000.

What is the child tax credit for 20021

A1. For tax year 2023, the Child Tax Credit increased from $2,000 per qualifying child to: $3,600 for children ages 5 and under at the end of 2023; and. $3,000 for children ages 6 through 17 at the end of 2023.

What is the child tax credit for 2024

The Budget would expand the credit from $2,000 per child to $3,000 per child for children six years old and above, and to $3,600 per child for children under six.

How much is the 3rd stimulus check per child

$1,400

Which of my dependents qualify for the third stimulus check For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

How much was stimulus 3 for children

Eligible families can receive $1,400 per dependent, so an average family of four (two parents and two dependents) could receive a total $5,600.

Is the Child Tax Credit 500 or 2000

How much is the child tax credit worth For the 2023 tax year (returns filed in 2023), the child tax credit is worth up to $2,000 per qualifying dependent. The credit is also partially refundable, meaning some taxpayers may be able to receive a tax refund for any excess amount up to a maximum of $1,500.

How much is the CTC for 2023

$2,000 per qualifying

The Child Tax Credit is worth a maximum of $2,000 per qualifying child. Up to $1,500 is refundable. To be eligible for the CTC, you must have earned more than $2,500.

When did child tax credit payments start and end

When did the Advance Child Tax Credit start Monthly payments started on July 15, 2023, but families can still sign up to receive monthly payments from now until December 2023.

What was the child tax credit in 2016

Tax filers can claim a CTC of up to $3,600 per child under age 6 and up to $3,000 per child ages 6 to 17. There is no cap on the total credit amount that a filer with multiple children can claim. The credit is fully refundable – low-income families qualify for the maximum credit regardless of how much they earn.

Is the child tax credit different this year

The Child Tax Credit is a fully refundable tax credit for families with qualifying children. The American Rescue Plan expanded the Child Tax Credit for 2023 to get more help to more families. The credit increased from $2,000 per child in 2023 to $3,600 in 2023 for each child under age 6.

How do you calculate Child Tax Credit

The credit is calculated by taking 15% of your earned income above $2,500. You get to claim the lesser of this calculated amount or your unused Child Tax Credit amount, up to the 2023 maximum of $1,500 per qualifying child.

How much Child Tax Credit will I get

How much is the child tax credit worth For the 2023 tax year (returns filed in 2023), the child tax credit is worth up to $2,000 per qualifying dependent. The credit is also partially refundable, meaning some taxpayers may be able to receive a tax refund for any excess amount up to a maximum of $1,500.

What is the monthly Child Tax Credit for 2023

For the 2023 tax year (taxes filed in 2024), the maximum child tax credit will remain $2,000 per qualifying dependent. The partially refundable payment will increase up to $1,600.

What is the expanded Child Tax Credit for 2023

ITEP has previously explored the effects of extending the CTC enhancement into 2023. The expansion would benefit 55 million children, and, unlike current law, no children would face a reduced credit because their families earn too little. The President proposes enhancing the CTC in several major ways.

How much was the third stimulus check with 3 dependents

Third round of stimulus checks: March 2023

In addition, families with dependents were eligible for an extra payment of $1,400 per dependent, regardless of the dependent's age – this time, there was no limit to the number of dependents that could be claimed for.