What you mean by creditors?

What are examples of creditors

What is an example of a creditor Here are some common creditors you may encounter: Friend or family member you owe money to. Financial institution, like a bank or credit union, that extends you a personal loan, installment loan, or student loan.

Cached

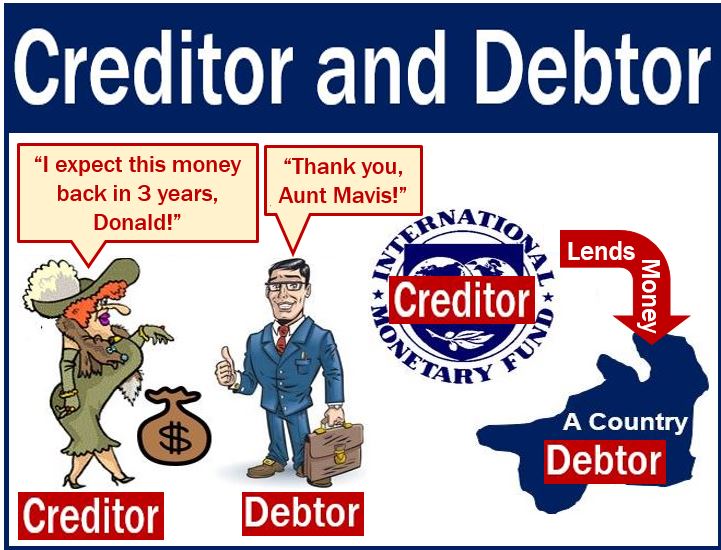

Who is the creditor and debtor

The difference between a debtor and a creditor is that the creditor is the one who lends money in a credit relationship, and the debtor is the one who borrows it.

Cached

Is a creditor someone you owe

Simply put, a creditor is an individual, business or any other entity that is owed money because they have provided a service or good, or loaned money to another entity.

Who is the creditor to pay

The “creditor to pay” for a balance transfer is the name of the lender or credit card company that owns the debt before the balance transfer. The reason it's called the creditor “to pay” is that a balance transfer is essentially a payment made to that creditor by the credit card company taking on the debt.

What are the three types of creditors

Personal creditors: These are friends or family you owe money. Secured creditors: These lenders have a legal right — often through a lien — to property you used as collateral to secure the loan. Unsecured creditors: A credit card issuer is a good example of this type of creditor.

How do you identify creditors

Payments or the owed money are received from debtors while loans are made to creditors. Debtors are shown as assets in the balance sheet under the current assets section, while creditors are shown as liabilities in the balance sheet under the current liabilities section.

Am I debtor or creditor if I owe someone money

Debtors are individuals or businesses that owe money, whether to banks or other individuals.

What is an example of a debtor

'Debtor' refers not only to a goods and services client but also to someone who borrowed money from a bank or lender. For example, if you take a loan to buy your house, then you are a debtor in the sense of borrower, while the bank holding your mortgage is considered to be the creditor.

What happens if you owe creditors

If You Owe Money

The creditor will sell your debt to a collection agency for less than face value, and the collection agency will then try to collect the full debt from you. If you owe a debt, act quickly — preferably before it's sent to a collection agency.

How do you know who your creditor is

Review your credit report

Your credit report may contain the details of the company that bought the debt from your original creditor. You can access your credit report from major credit bureaus such as Equifax, Experian, and TransUnion.

Who would be my creditor

According to the Consumer Financial Protection Bureau (CFPB), a creditor is “any person who offers or extends credit creating a debt or to whom a debt is owed.” A financial institution, individual or nonprofit could all be examples of creditors, so long as they lend money to another party.

What are the most common creditors

Examples of common creditorsReal creditors: A real creditor is a financial institution, such as a bank or credit card issuer, that has a right to be repaid.Personal creditors: These are friends or family you owe money.

Who does a creditor belong to

Creditors are the parties to whom debtors should pay back. Debtors are mentioned under the category known as accounts receivable as a current asset, while creditors come under accounts payable as a current liability.

Can creditors access your bank account

If a debt collector has a court judgment, then it may be able to garnish your bank account or wages. Certain debts owed to the government may also result in garnishment, even without a judgment.

How do I know if I owe creditors

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228. You get one free report from each credit reporting company every year.

What are examples of debtors and creditors

For example, if you have borrowed money from a bank to buy a house or study abroad, you are a debtor. The bank is the creditor as it has loaned the money. Other examples of debtors include businesses and governments that borrow funds to meet their financial requirements.

What happens if you ignore creditors

Ignoring or avoiding the debt collector may cause the debt collector to use other methods to try to collect the debt, including a lawsuit against you. If you are unable to come to an agreement with a debt collector, you may want to contact an attorney who can provide you with legal advice about your situation.

Should I pay off creditors

A fully paid collection is better than one you settled for less than you owe. Over time, the collections account will make less difference to your credit score and will drop off entirely after seven years. Finally, paying off a debt can be a tremendous relief to your mental health.

Is your bank your creditor

A creditor is the original lender because they made the loan to you. Debt collectors purchase delinquent loans from the original creditor, such as a bank, usually at a discount, and aim to then collect on that loan.

Is my customer a creditor

In general, if a person or entity have loaned money then they are a creditor. Usually, each creditor has a specific agreement with their debtors about the terms of payment, discounts, etc.