What’s a good CreditWise score?

What is an excellent score on CreditWise

781 to 850

Excellent credit

VantageScore rates any score from 781 to 850 as Excellent. FICO calls its highest range Exceptional, and that applies to any score between 800 and 850.

Cached

Is CreditWise my real credit score

Your CreditWise score is a good measure of your overall credit health, but it is not likely to be the same score used by creditors. The availability of the CreditWise tool depends on our ability to obtain your credit history from TransUnion.

What is the average CreditWise score

The average credit score in the US is a 714, based on FICO data provided by credit reporting company Experian. The average VantageScore is 701. Credit scores, which are like a grade for your borrowing history, fall in the range of 300 to 850. The higher your score, the better.

Cached

Is a 480 credit score bad

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 480 FICO® Score is significantly below the average credit score. Many lenders choose not to do business with borrowers whose scores fall in the Very Poor range, on grounds they have unfavorable credit.

Is CreditWise or Credit Karma more accurate

Services such as CreditWise pull from all relevant major credit bureaus whereas Credit Karma pulls from fewer, thus resulting in the potential for less precise credit score reporting.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Why is my CreditWise score higher than FICO

How Credit Scores are Calculated. Both FICO and CreditWise use one of the three nationwide consumer credit reporting companies: Equifax, Experian, TransUnion. FICO uses Equifax, whereas CreditWise uses TransUnion. Checking your score on different platforms can result in differing scores.

Is Credit Karma or CreditWise more accurate

Services such as CreditWise pull from all relevant major credit bureaus whereas Credit Karma pulls from fewer, thus resulting in the potential for less precise credit score reporting.

Is Capital One CreditWise score accurate

The Capital One CreditWise score is pretty accurate, considering that it monitors your TransUnion VantageScore 3.0 score. As for how accurate is CreditWise from Capital One vs. FICO, it's really hard to determine.

How bad is a 579 credit score

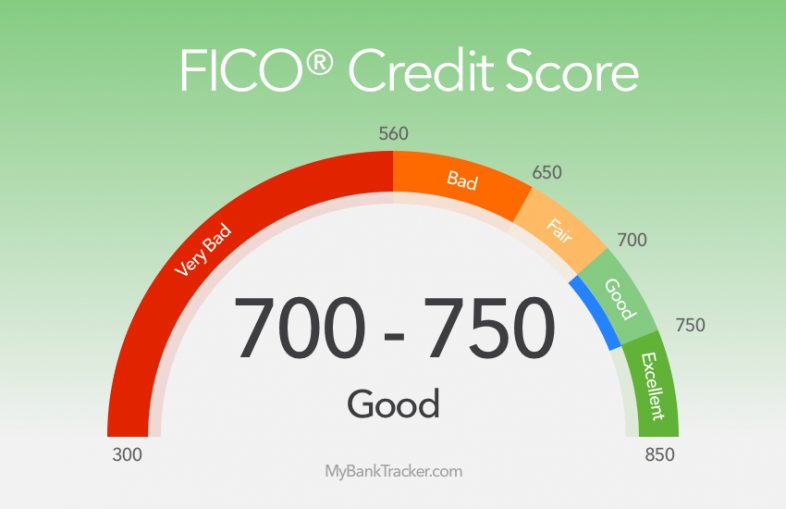

Here's how the FICO credit scoring system ranks credit scores: Poor: 300-579. Fair: 580-669. Good: 670-739.

Can I buy a house with a 480 credit score

FHA loan. FHA loans are insured by the Federal Housing Administration (FHA) and allow lenders to accept a credit score as low as 580 with a 3.5 percent down payment, or as low as 500 with a 10 percent down payment. These loans have rates comparable to other mortgage types.

Which credit score is the hardest

Here are FICO's basic credit score ranges:Exceptional Credit: 800 to 850.Very Good Credit: 740 to 799.Good Credit: 670 to 739.Fair Credit: 580 to 669.Poor Credit: Under 580.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

How does CreditWise score compare to FICO

How Credit Scores are Calculated. Both FICO and CreditWise use one of the three nationwide consumer credit reporting companies: Equifax, Experian, TransUnion. FICO uses Equifax, whereas CreditWise uses TransUnion. Checking your score on different platforms can result in differing scores.

Is 621 a bad credit score

A FICO® Score of 621 places you within a population of consumers whose credit may be seen as Fair. Your 621 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Is a 600 credit score terrible

Your score falls within the range of scores, from 580 to 669, considered Fair. A 600 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

Can a person with a 500 credit score buy a 45k house

Anyone with a minimum credit score of 500 can apply for an FHA loan. But if you already have a 620 or higher credit score, it makes more sense to go for a conventional mortgage.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

Which of the 3 credit scores is usually the highest

As noted earlier, the credit score that matters the most is your FICO Score, since it's used in the vast majority of lending decisions.