What’s considered a+ credit?

What is considered a plus credit score

A score of 720 or higher is generally considered excellent credit. A score of 690 to 719 is considered good credit. Scores of 630 to 689 are fair credit. And scores of 629 or below are bad credit.

Cached

Is A+ a good credit rating

A+/A1 are credit ratings produced by ratings agencies S&P and Moody's. Both A+ and A1 fall in the middle of the investment-grade category, indicating some but low credit risk. Credit ratings are used by investors to gauge the creditworthiness of issuers, with better credit ratings corresponding to lower interest rates.

What are the 5 levels of credit scores

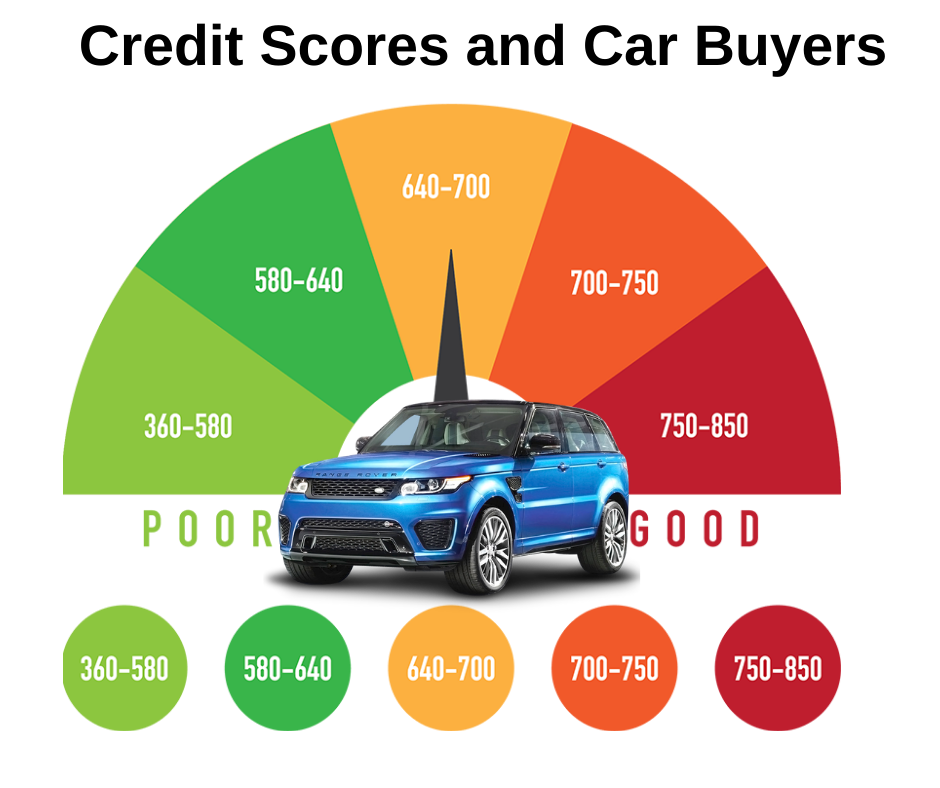

Credit scores typically range from 300 to 850. Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and excellent.

What credit score is considered A1

By credit standards, only credit scores close to or higher than 700 will be considered for Tier 1 credit. This means credit scores between 680 and 719 so long as the credit report shows few negative marks. If you have a credit score of 620-679, this is still considered subprime credit.

Cached

How rare is a 750 credit score

Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. You are one of the 46% of Americans who had a score of 750 or above in 2023, according to credit scoring company FICO. Here's how your 750 credit score can affect your financial life.

Is 740 a good credit score at 21

A credit score between 740 to 799 is considered very good. Credit scores 800 and up are considered excellent. Someone with a VantageScore that's 600 or less is considered to have poor or very poor credit. A fair credit rating is anywhere between 601 and 660.

How to get 850 credit score

I achieved a perfect 850 credit score, says finance coach: How I got there in 5 stepsPay all your bills on time. One of the easiest ways to boost your credit is to simply never miss a payment.Avoid excessive credit inquiries.Minimize how much debt you carry.Have a long credit history.Have a good mix of credit.

Is IT possible to have a credit score of 900

A 900 credit score may be the highest on some scoring models, but this number isn't always possible. Only 1% of the population can achieve a credit score of 850, so there's a certain point where trying to get the highest possible credit score isn't realistic at all.

Can you have a 900 credit score

FICO® score ranges vary — either from 300 to 850 or 250 to 900, depending on the scoring model. The higher the score, the better your credit.

What is an A2 credit score

A2. The sixth highest rating in Moody's Long-term Corporate Obligation Rating. Obligations rated A2 are considered upper-medium grade and are subject to low credit risk. Rating one notch higher is A1. Rating one notch lower is A3.

What is the difference between A1 and A+

A+ and A1 are actually two ratings from different ratings agencies: Standard & Poor's uses the A+ rating, and Moody's uses the A1 rating. Both ratings indicate a relatively high level of creditworthiness.

How rare is 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

Is A 900 credit score good

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

How many people have an 800 credit score

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Can a 25 year old have a 750 credit score

Regardless of your age, those who are initially building their credit score can start from 500 to 700, with those in their 20s having an average score of 660.

Can you get a 900 credit score

FICO® score ranges vary — either from 300 to 850 or 250 to 900, depending on the scoring model. The higher the score, the better your credit.

Is it hard to get 800 credit score

But exceptional credit is largely based on how well you manage debt and for how long. Earning an 800-plus credit score isn't easy, he said, but “it's definitely attainable.”

Has anyone gotten a 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2023.

Who gets 850 credit score

Your 850 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates.

How rare is an 800 credit score

23%

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.