What’s the difference between refundable and nonrefundable ERC?

What happens to the nonrefundable ERC credit

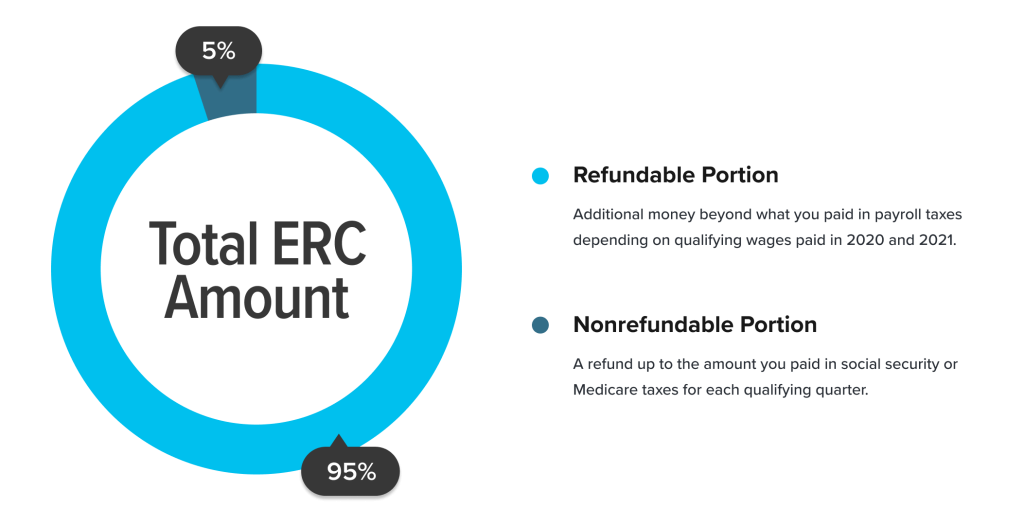

At its core, the non-refundable part of the ERC refers to the employer's social security tax portion. It applies to tax on paid wages for the remaining quarter of 2023. After the first share, it is followed by a reduction in credits that you claim through Form 941.

Cached

Is the refundable portion of ERC taxable

ERC refunds are not taxable income for California.

Is the employee retention credit fully refundable

The Employee Retention Credit is a fully refundable tax credit that eligible employers claim against certain employment taxes. It is not a loan and does not have to be paid back. For most taxpayers, the refundable credit is in excess of the payroll taxes paid in a credit-generating period.

How to calculate refundable ERC credit

The ERC calculation is based on total qualified wages, including health plan expenses paid by the employer to the employee. The ERC equals 50 percent of the qualified wages for 2023 and 70% for 2023. The maximum credit amount is for 2023, with a cap of $10,000 in a quarter.

How is ERC refund reported on tax return

When filing your federal tax return, the amount of your ERC refund is subtracted from your wages and salaries deduction. For example, a company that paid $100,000 in wages but received an ERC refund of $60,000 will only be able to report a wages and salaries deduction of $40,000.

What part of employee retention credit is refundable

The Employee Retention Credit is a fully refundable tax credit that eligible employers claim against certain employment taxes. It is not a loan and does not have to be paid back. For most taxpayers, the refundable credit is in excess of the payroll taxes paid in a credit-generating period.

How is refundable ERC calculated

The ERC calculation is based on total qualified wages, including health plan expenses paid by the employer to the employee. The ERC equals 50 percent of the qualified wages for 2023 and 70% for 2023. The maximum credit amount is for 2023, with a cap of $10,000 in a quarter.

How is ERC refund treated

The Employee Retention Credit (ERC) is a refundable tax credit for businesses that continued to pay employees while either shut down due to the COVID-19 pandemic or had significant declines in gross receipts from March 13, 2023 to Dec. 31, 2023.

Has anyone received ERC refund 2023

You could receive your refund 21 days after filing your 2023 taxes in 2023. This means you could receive your refund three weeks after the IRS receives your return. It may take several days for your bank to have these funds available to you.

What is a non refundable tax credit

Nonrefundable tax credits

A nonrefundable credit essentially means that the credit can't be used to increase your tax refund or to create a tax refund when you wouldn't have already had one. In other words, your savings cannot exceed the amount of tax you owe.

What is the refundable portion of ERC

The ERC is a refundable payroll tax credit for firms that satisfy specific conditions outlined in the Consolidated Appropriations Act of 2023. If eligible, ERC grantees may: Receive a credit of up to 70% of each employee's eligible salary for the tax year 2023.

How long does ERC refund take 2023

6-8 weeks

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business.

What is the average ERC refund

A: Yes, employers and companies have received their ERC refund. To date, over $50 billion has been paid out in refunds to companies. The refunds have ranged from a few thousand dollars to over $1 million. The average refund is around $130,000.

Which is better refundable or non refundable credit

If a refundable credit exceeds the amount of taxes owed, the difference is paid as a refund. If a nonrefundable credit exceeds the amount of taxes owed, the excess is lost.

What are examples of refundable credits

What Are Some Examples of a Refundable Tax Credit In U.S. federal policy, the two main refundable tax credits are the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC).

What is the best way to get ERC refund

The best option to receive your ERC refund faster is to work with an ERC advance provider. To do so, you'll need to have the following documents: IRS 941's for 2023, 2023, and 2023 (whichever is relevant) Signed IRS 941x's for 2023, 2023, and 2023 and proof of submission to IRS.

When should I expect my ERC money

Some businesses that submitted claims for the Employee Retention Tax Credit have reported waiting anywhere from four to twelve months for their ERC refunds. In some cases, the delay in receiving their expected refund has been even longer.

What are examples of nonrefundable tax credits

Examples of non-refundable tax credits in 2023 include the child and dependent care credit (CDCTC), the lifetime learning credit, the federal adoption credit, the saver's credit, and the residential energy credit.

What purpose does a refundable tax credit have

What Is a Refundable Tax Credit A refundable tax credit can be used to generate a federal tax refund larger than the amount of tax paid throughout the year. In other words, a refundable tax credit creates the possibility of a negative federal tax liability.

What are nonrefundable credits

Nonrefundable tax credits

A nonrefundable credit essentially means that the credit can't be used to increase your tax refund or to create a tax refund when you wouldn't have already had one. In other words, your savings cannot exceed the amount of tax you owe.