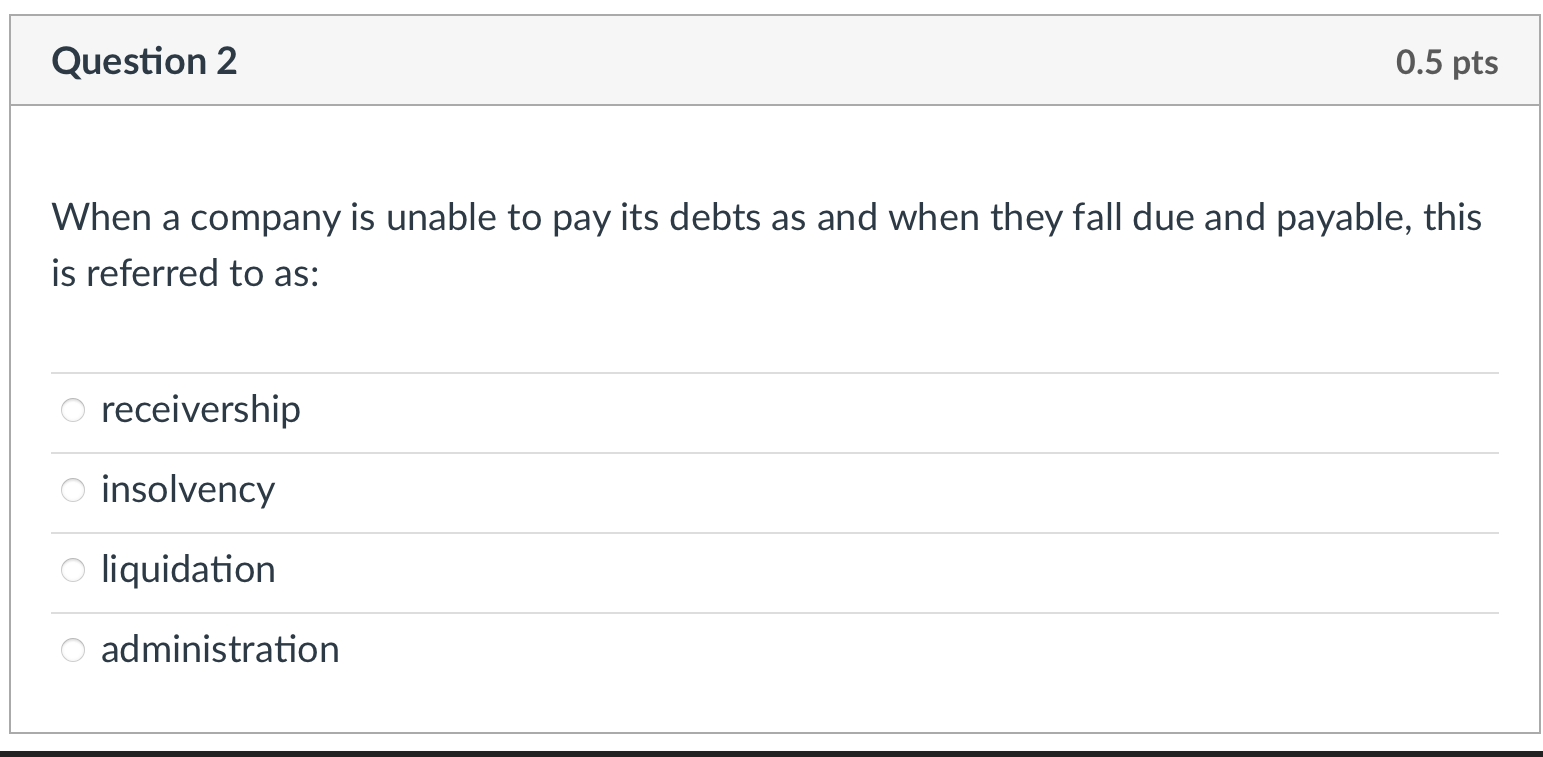

When a company is unable to pay its debts as and when they fall due and payable this is referred to as?

What is the inability to pay debts when they are due called

Generally speaking, insolvency refers to situations where a debtor cannot pay the debts they owe. For instance, a troubled company may become insolvent when it is unable to repay its creditors money owed on time, often leading to a bankruptcy filing.

Cached

What happens when a company is unable to pay its debt

If your company or business has been in the red for a while, and you cannot seem to be able to pay off your business debts, your creditors may start looking for money. They can do this by threatening legal action against you or your business.

What is it called when a company has no debt

But what does debt-free actually mean Basically, the company does not owe money to any supplier, stakeholder or HMRC.

What is it called when a company owes something

What Is a Liability A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services.

What are the 3 types of liabilities

There are three primary classifications for liabilities. They are current liabilities, long-term liabilities and contingent liabilities. Current and long-term liabilities are going to be the most common ones that you see in your business.

What is the legal term for something owed

payable. 1) adj. referring to a debt which is due. A debt may be owed, but not yet payable until a certain date or event.

What are the two 2 types of liabilities

As mentioned above, liabilities are divided into two different categories: current and non-current. Current liabilities have a short term or maturity (1 year or less). Non- current liabilities represent long-term obligations that have a maturity of more than one year.

What is the difference between a liability and a contingent liability

The distinction between a real liability and a contingent liability depends on the certainty of the payment to be made. A real liability exists when it is probable that the payment will be made. A contingent liability exists when it is only possible that the payment will be made.

What is a word that means not paid for

buckshee. free of charge. complimentary, costless, free, gratis, gratuitous.

What is money owed or due called

Debt comes from the Latin word debitum, which means "thing owed." Often, a debt is money that you must repay someone. Debt can also mean the state of owing something — if you borrow twenty dollars from your brother, you are in debt to him until you pay him back.

What are 3 types of liabilities

There are three primary classifications for liabilities. They are current liabilities, long-term liabilities and contingent liabilities. Current and long-term liabilities are going to be the most common ones that you see in your business.

What are 2 short-term liabilities

Short-term debt, also called current liabilities, is a firm's financial obligations that are expected to be paid off within a year. Common types of short-term debt include short-term bank loans, accounts payable, wages, lease payments, and income taxes payable.

What describes a contingent liability

Description: A contingent liability is a liability or a potential loss that may occur in the future depending on the outcome of a specific event. Potential lawsuits, product warranties, and pending investigation are some examples of contingent liability.

What are the two types of contingent liabilities

According to GAAP, there are three types of contingent liabilities – Probable, Possible, and Remote.

What’s another word for missing a payment

On this page you'll find 43 synonyms, antonyms, and words related to overdue, such as: belated, delinquent, outstanding, tardy, unpaid, and behindhand.

What is the word for not paying a loan

Arrears is a debt or payment that is not paid by the due date, or another term for missed payments.

What is it called when you owe a debt

arrears. noun. money that you owe because you have failed to make payments at the correct time.

What are debts owed by a business called

Liabilities are debts or other obligations in which your business owes money, now or in the future.

What are the two types of accounts payable

Business accounts payable can be divided into two types: salaries and expenses. They are typically in the form of supplier invoices, however, accounts payable can also include bills, invoices and checks.

What is short-term liabilities payable

Key Takeaways. Short-term debt, also called current liabilities, is a firm's financial obligations that are expected to be paid off within a year. Common types of short-term debt include short-term bank loans, accounts payable, wages, lease payments, and income taxes payable.