When can you issue a credit note?

What are the rules of credit note

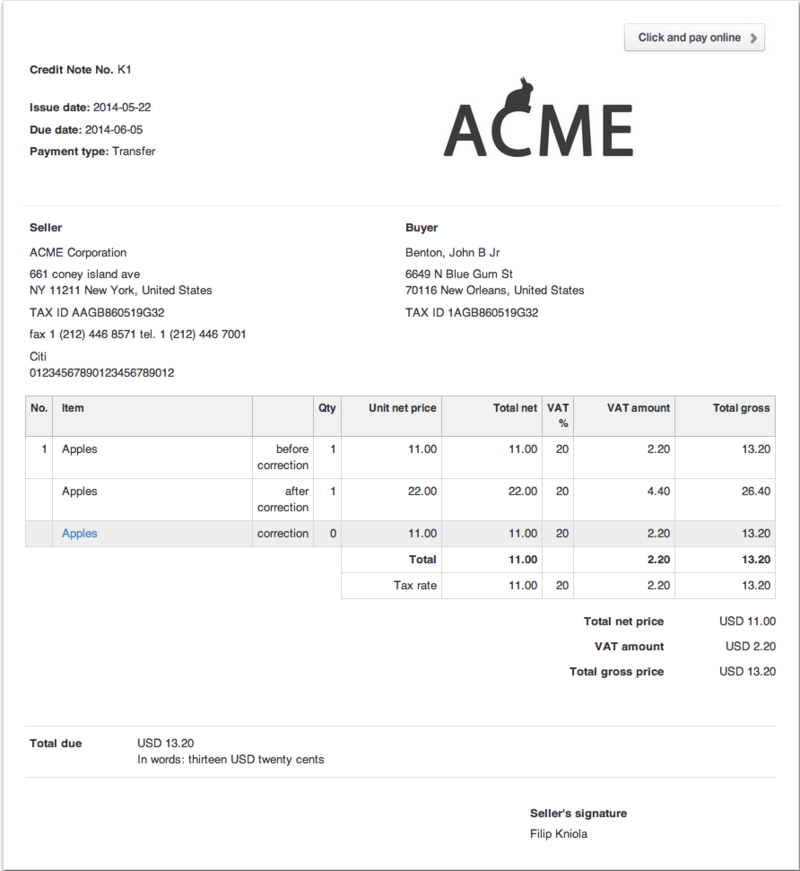

A credit note is a document given by one party to another mentioning that the sender credits the other party's account in his books. After the supplier's issue of the tax invoice, if there is any reduction in the taxable value of the goods supplied, he may issue a credit note mentioning the prescribed particulars.

What are the reasons for issuing credit note

As a seller, you may issue a credit note when there's a need to cancel all or part of an invoice for a variety of reasons, including: Changes to an order after an invoice is issued. Goods returned or services rejected.

What are the conditions for issuing credit note and debit note

Debit note is to be issued when the taxable value or tax charged in the tax invoice is less as compared to actual taxable value or tax payable. Credit note is to be issued when the taxable value or tax charged in the tax invoice is more as compared to actual taxable value or tax payable.

How do I issue a credit note against an invoice

Information to include.The words “credit note” at the top.Customer information.Your business information.Date issued.Credit note number.Original invoice reference number.Item descriptions, quantities, and prices.Total amount credited.

What is the difference between a credit note and an invoice

A credit note is effectively a negative invoice – it's a way of showing a customer that they don't have to pay the full amount of an invoice. A credit note might either cancel an invoice out completely if it's for the same amount as the invoice, or it might be for less than the invoice.

What is a credit note instead of a refund

What is a credit note A credit note is a paper or electronic note issued by a business to a customer in place of a refund. A credit note acts like a voucher that can only be used for the particular shop, chain of shops or business that issued the credit note.

What are 4 circumstances why a credit note is issued to a trader

When the buyer has been overcharged due to overpricing / or calculation errors in the invoice. When some goods have been returned / due to damage to the seller. Where the buyer was charged for goods not supplied. Where goods not ordered are delivered.

What is credit note and when it is issued

A credit note, also known as a credit memo, is a commercial document issued by the seller and sent to the buyer when there is a reduction in the amount payable to the seller. By issuing a credit note, the seller promises to pay back the reduced amount or adjust it in a subsequent transaction.

Under what circumstances debit note is issued

Some common scenarios of when to issue a debit note include: The goods received are damaged or defective. The purchaser has been overcharged. The invoice value is incorrect (due to extra goods being delivered, or goods are charged at a lesser value, etc.)

Can I issue a credit note for an unpaid invoice

Cancelling an unpaid invoice with a credit note

Often, an invoice can be cancelled with a credit note. Simply put, issuing a credit note will let you enter a form of payment on an invoice that cancels out the amount that is due.

Can you issue credit note without invoice

Since the amount received in the form of credit note is actually a discount and not a supply by the applicant to the authorised supplier, the applicant need not issue tax invoice for this transaction.

Can you issue a credit note on a paid invoice

You can issue a credit note for open, paid and uncollectible invoices. When you issue a credit note for an open invoice, it decreases the amount due on the invoice. When you issue one for a paid invoice, it's usually because you need to refund or credit a specified amount to the customer.

What is the difference between a sales return and a credit note

In a supplier and buyer transaction, the supplier issues a "credit note" as a sales return. By doing so, the supplier informs the buyer that the purchase returns are accepted. A credit note, also called a "sales return credit note", is given by the supplier in exchange for a debit note.

What is an example of a credit note

For example, if a product originally priced at Rs. 100 is incorrectly invoiced at Rs. 150, then a credit note of Rs. 50 will be issued by the vendor.

Why a supplier may send a credit note to a customer

A credit note is furnished by the supplier when the goods supplied are damaged or when a wrong item is delivered to the buyer. When a seller charges more than the actual price of the goods or services being rendered, he/she issues a memo to reverse the extra sum, which is known as a credit note.

What are the four conditions that would necessitate the writing of a credit note

Circumstances under which a credit note is issued include;When the buyer has been overcharged due to overpricing / or calculation errors in the invoice.When some goods have been returned / due to damage to the seller.Where the buyer was charged for goods not supplied.Where goods not ordered are delivered.

What are three circumstances under which a credit note may be issued

When the buyer has been overcharged due to overpricing / or calculation errors in the invoice. When some goods have been returned / due to damage to the seller. Where the buyer was charged for goods not supplied. Where goods not ordered are delivered.

What is the difference between a credit note and a debit note

A debit note is a notification and request for a debt obligation to be paid. A credit note is issued to correct errors or changes made to an existing invoice or order. The issuance of both types of notes helps to maintain accounting records and provide clarification on the negative or positive amount owed.

Can I issue credit note for bad debt

You must notify the customer you're claiming bad debt relief. Alternatively, reduce the value of the sales and so the corresponding VAT liability by issuing a credit note to your customer. A credit note must be issued within 14 days from the date the reduction in your invoice is agreed.

Can you issue a credit note for an overpayment

If the invoice is from a regular supplier, the easiest solution is often to apply the overpayment to a new or existing invoice. Other options include refunding the overpayment or being given a credit note that you can allocate against a future invoice.