When did the child tax credit begin and end?

When did the child tax credit start and end

2023–2025, excluding 2023

Under the Tax Cuts and Jobs Act of 2023 (TCJA), for the years 2023–2025 (excluding 2023, see below section Temporary Expansion in 2023) the CTC allows taxpayers to reduce their federal tax liabilities by $2,000 per qualifying child (see Eligibility).

Cached

When did the child tax credit begin

1997

Historically, the federal child tax credit has had bipartisan support. It was established as a part of the 1997 Taxpayer Relief Act. Eligible recipients subtract the credit amount from their owed federal income taxes. Originally, the tax credit was $400 per child younger than age 17 and nonrefundable for most families.

Cached

When did the child tax credit end

The reason why is that the enhancements that Congress made to the child tax credit were temporary. They all expired on December 31, 2023, including the monthly payments, higher credit amount, letting 17-year-olds qualify, and full refundability.

Cached

How long was the child tax credit in effect

Enacted in 1997 and expanded multiple times with bipartisan support since 2001, the Child Tax Credit helps families manage the cost of raising children. Under current law the credit is worth up to $2,000 per eligible child (under age 17 at the end of the tax year).

Cached

When did Biden change the child tax credit

These changes were only in effect for the 2023 tax year, and since the law making these changes – the American Rescue Plan Act (ARPA) of 2023 – was passed by Congress in March 2023, the advance monthly payments only took effect in July 2023.

What is the $1,000 child tax credit

What is Child Tax Credit The Child Tax Credit program can reduce the Federal tax you owe by $1,000 for each qualifying child under the age of 17. Important changes to the Child Tax Credit will help many families receive advance payments of the credit starting in summer 2023.

Why did I get a $250 check from the IRS

If you had a tax liability last year, you will receive up to $250 if you filed individually, and up to $500 if you filed jointly.

Is the $300 child tax credit monthly

$250 per month for each qualifying child age 6 to 17 at the end of 2023. $300 per month for each qualifying child under age 6 at the end of 2023.

How much child tax credit was given

Overview. The Young Child Tax Credit (YCTC) provides up to $1,083 per eligible tax return. California families qualify with earned income of $30,000 or less.

How much was the Biden child tax credit

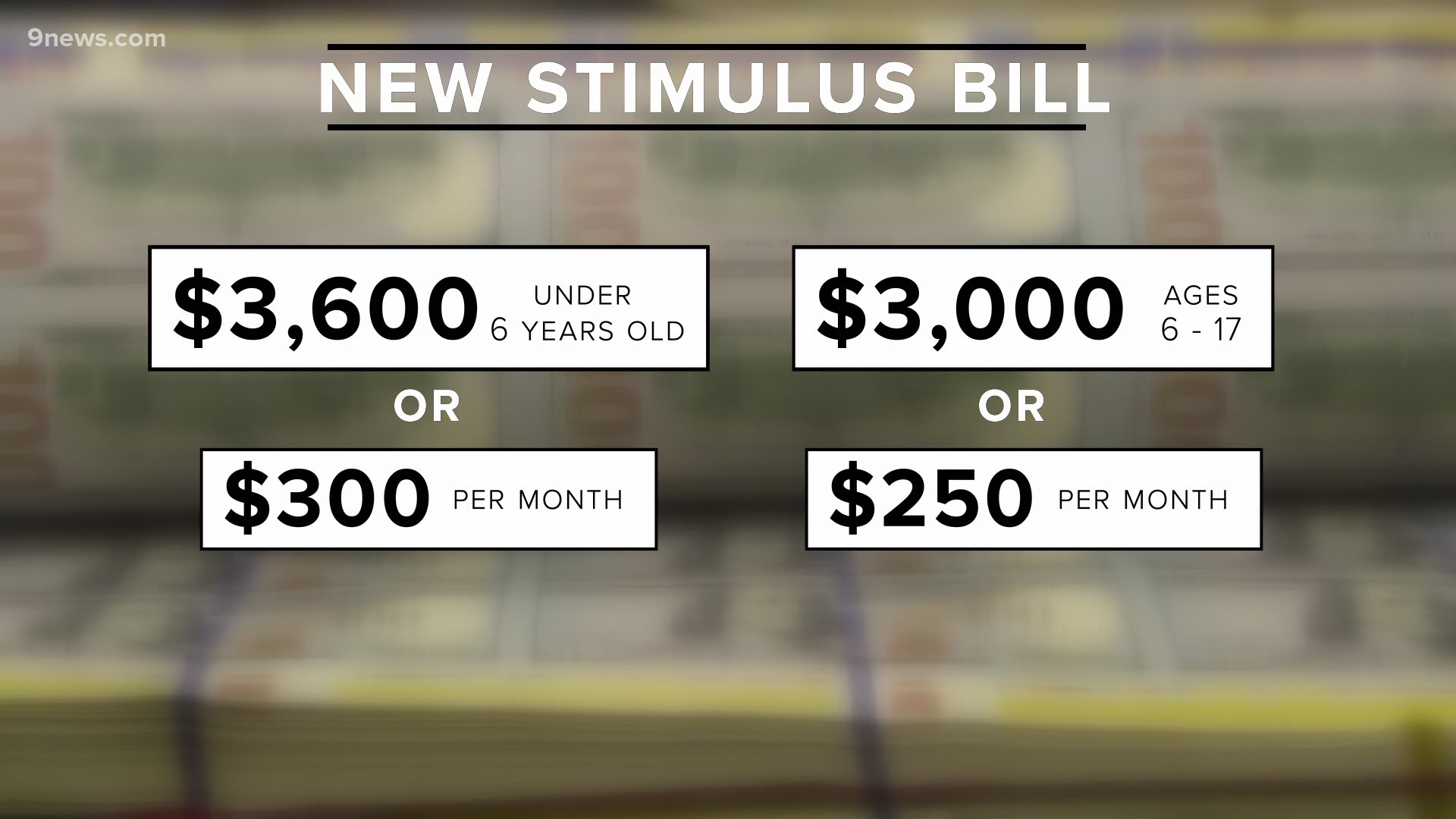

Biden's plan calls for raising the current maximum child credit from $2,000 per child to $3,600 per child under age 6 or to $3,000 per child ages 6 and up.

How much is the monthly child tax credit

$250 per month for each qualifying child age 6 to 17 at the end of 2023. $300 per month for each qualifying child under age 6 at the end of 2023.

What is the $450 per child

First Lady Casey DeSantis announced last week that $35.5 million in DeSantis' budget will "support nearly 59,000 Florida families with a one-time payment of $450 per child, which includes foster families."The American Rescue Plan Act created a $1 billion fund to assist needy families affected by the pandemic within the …

Will I get 8000 for Child Tax Credit

The expanded tax break lets families claim a credit worth 50% of their child care expenses, which can be up to $16,000 for two or more kids. In other words, families with two kids who spent at least $16,000 on day care in 2023 can get $8,000 back from the IRS through the expanded tax credit.

Why did i get $2,800 from IRS today

You were issued the full amount of the Recovery Rebate Credit if your third Economic Impact Payment was $1,400 ($2,800 if married filing jointly for 2023) plus $1,400 for each qualifying dependent reported on your 2023 tax return.

Why did I get a $500 check from IRS

Who received this $500 check If you receive this check, it may have come as a surprise. The reason You may not have been required to file a tax return and used the Non-Filer tool on the IRS website to provide information on your dependent children age 17 and younger.

How many Child Tax Credit payments were there

The IRS reports that nearly 61 million children received the payments in August 2023, which constitutes a large share of the target population but falls short of the estimated number of children eligible for the credit.

How much was the first Child Tax Credit

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2023 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

Why did I get $166 from the IRS

These people will qualify for at least $2,000 of Child Tax Credit (CHILDCTC), which comes out to $166 per child each month: Married couples with income under $400,000. Families with a single parent (also called Head of Household) with income under $200,000. Everyone else with income under $200,000.

How much is the $300 child credit per month

$250 per month for each qualifying child age 6 to 17 at the end of 2023. $300 per month for each qualifying child under age 6 at the end of 2023.

How much Child Tax Credit was given

Overview. The Young Child Tax Credit (YCTC) provides up to $1,083 per eligible tax return. California families qualify with earned income of $30,000 or less.