When was credit first used in America?

When did America start using credit

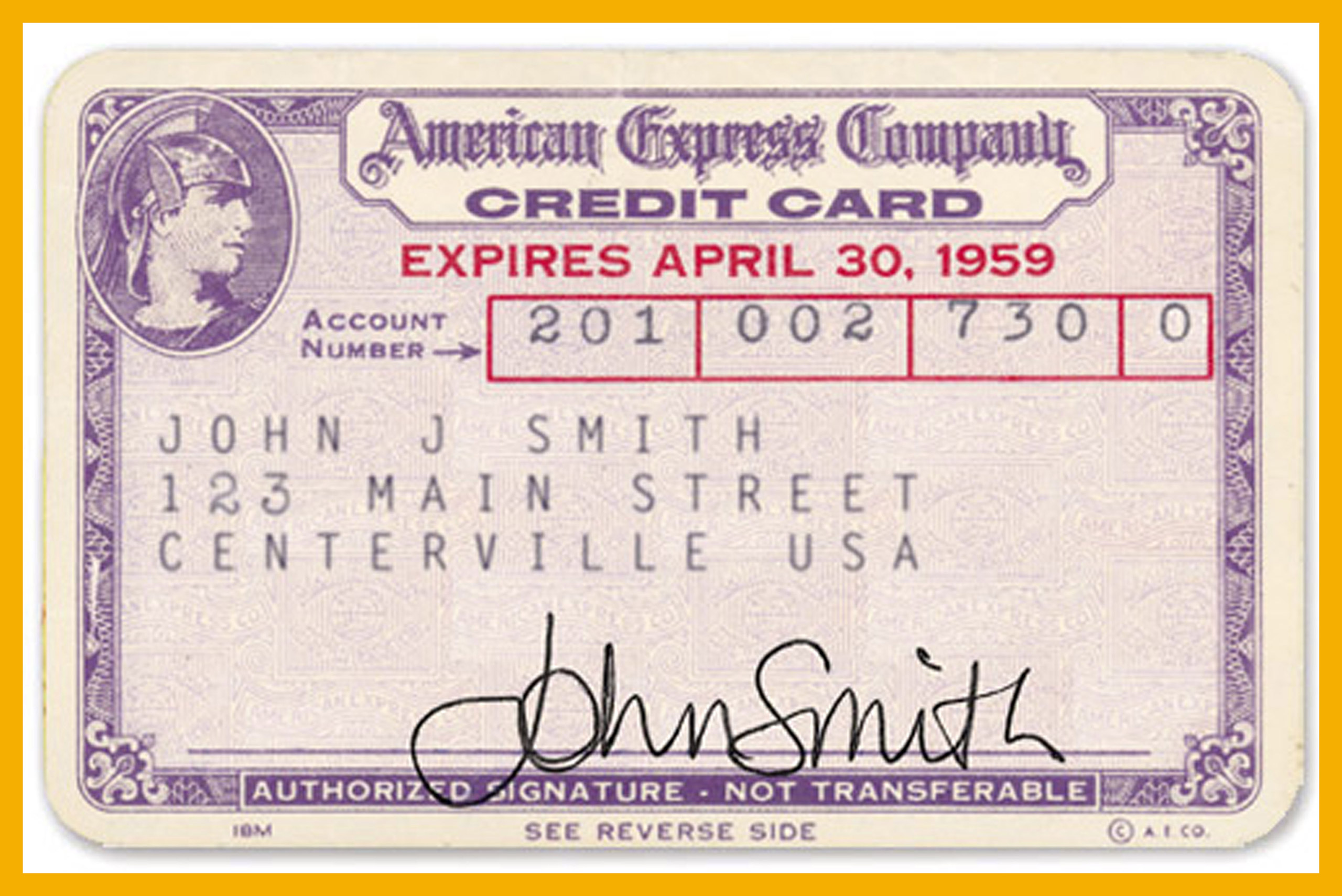

The first credit card as we understand it in the modern sense was created as late as 1950. It was called the Diners' Club card. A man named Frank McNamara came up with the idea in 1949 while having dinner in a New York City restaurant.

Cached

When was the earliest use of credit

The Birth of Modern Consumer Credit

Credit reporting itself originated in England in the early 19th century. The earliest available account is that of a group of English tailors that came together to swap information on customers who failed to settle their debts.

What was credit called in the 1920s

The 1920s saw a rise in buying cars and appliances "on installment," or what we call credit today (image courtesy of the Joliet Public Library).

Is America the only country that uses credit

If you've ever wondered “do other countries have credit scores" the answer is yes, other countries besides the United States have credit scores. Assessments of creditworthiness, however, can differ across the globe, and you may be surprised how someone's creditworthiness is determined. Let's take a look.

What did people use before credit scores

Before credit scoring, lenders assessed prospective customers based on factors such as payment history, word-of-mouth, and home visits. Those reputation-based, qualitative assessments have evolved into quantitative ones based on deep data analysis known as credit scores.

Did credit exist before 1989

Although FICO's first universal credit score was invented in 1989, credit reporting and industry-specific credit scores existed long before.

Did credit exist in the 20s

The expansion of credit in the 1920s allowed for the sale of more consumer goods and put automobiles within reach of average Americans. Now individuals who could not afford to purchase a car at full price could pay for that car over time — with interest, of course!

Was there credit in the 1800s

19th Century: 1801 – 1900

Buying a home was difficult from 1800 – 1850 because many lenders and banks thought mortgage lending was too risky. Instead, credit was extended privately through individuals. Around 1830, financial institutions, such as the building and loan society, (B&L) began offering mortgages.

What country doesn t use credit

Japan

Japan doesn't have a national credit scoring system, so creditworthiness is determined on a bank-by-bank basis.

Is credit an American thing

If you've ever wondered “do other countries have credit scores" the answer is yes, other countries besides the United States have credit scores. Assessments of creditworthiness, however, can differ across the globe, and you may be surprised how someone's creditworthiness is determined. Let's take a look.

What did America do before credit scores

Before there was credit scoring, there was commercial credit reporting. Unlike consumer credit reporting, where individuals are evaluated for their credit risk level, commercial credit reporting was originally used by merchants to evaluate the creditworthiness of potential business customers.

How did people use credit before credit cards

Circa 1800s: Merchants used credit coins and charge plates to extend credit to local farmers and ranchers until they collected profits from harvests. 1946: Charge cards were launched by banker John Biggins with the Charg-It card, used in a two-block radius of his bank in New York City.

How did people get credit before credit scores

Before credit scoring, lenders assessed prospective customers based on factors such as payment history, word-of-mouth, and home visits. Those reputation-based, qualitative assessments have evolved into quantitative ones based on deep data analysis known as credit scores.

Did credit start in the 1920s

The expansion of credit in the 1920s allowed for the sale of more consumer goods and put automobiles within reach of average Americans. Now individuals who could not afford to purchase a car at full price could pay for that car over time — with interest, of course!

How did people pay for things in the 1920s

During the 1920s many Americans bought high-cost items, such as refrigerators and cars, on the installment plan, under which they would make a small down payment and pay the rest in monthly installments. Some buyers reached a point where paying off their debts forced them to reduce other purchases.

When were black people allowed to have credit

While credit cards allowed more people to buy more things, they were not available equally to women and racial minorities until the 1974 Equal Credit Opportunity Act. They remained out of reach for the poor for decades.

How did credit begin in America

The earliest and most common form of credit were loans from local shopkeepers. That's right, hardworking Americans ran tabs to buy groceries, furniture, farm equipment and the like when times were tight. It's also a common myth that borrowing was unheard of during those days.

What country has little to no debt

Countries with the Lowest National DebtBrunei. 3.2%Afghanistan. 7.8%Kuwait. 11.5%Democratic Republic of Congo. 15.2%Eswatini. 15.5%Palestine. 16.4%Russia. 17.8%

Does credit only exist in America

If you've ever wondered “do other countries have credit scores" the answer is yes, other countries besides the United States have credit scores. Assessments of creditworthiness, however, can differ across the globe, and you may be surprised how someone's creditworthiness is determined. Let's take a look.

Who started credit in America

Although various methods of estimating creditworthiness existed before, modern credit scoring models date to 1958, when Bill Fair and Earl Isaac created Credit Application Scoring Algorithms, their first credit scoring system.