Where do I report recovery rebate credit on tax return?

Is recovery rebate credit included in tax return

Your 2023 Recovery Rebate Credit will reduce any tax you owe for 2023 or be included in your tax refund.

Cached

Where in TurboTax do I enter recovery rebate credit

When you are ready to file the tax return for the year, you will complete the Recovery Rebate Credit by following these steps: Go to the Federal Section (on left side navigation panel) Select COVID-19 Relief (on left side navigation panel) Select Recovery Rebate Credit.

Cached

Is the recovery rebate credit the same as a stimulus check

The income requirements for the recovery rebate tax credit are the same as for the stimulus payments. So if a stimulus check missed you or you received a partial payment, you may be eligible for additional cash if you file a federal tax return and claim the credit.

Cached

What is the $1,400 recovery rebate credit

The 2023 Recovery Rebate Credit includes up to an additional $1,400 for each qualifying dependent you claim on your 2023 tax return. A qualifying dependent is a dependent who has a valid Social Security number or Adoption Taxpayer Identification Number issued by the IRS.

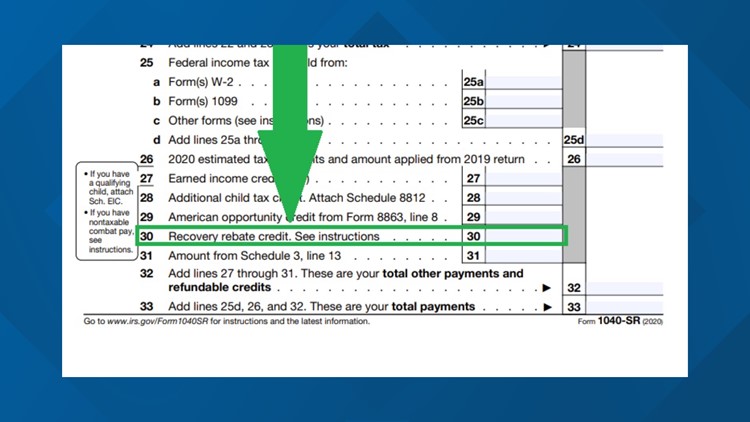

What is the line 30 on the 1040

Line 30 on 2023 Form 1040 and Form 1040-SR is used to claim the Recovery Rebate Credit. File a complete and accurate return – even if you don't usually file taxes – to avoid processing delays that slow your tax refund.

How much was the 3rd stimulus check

$1,400

Third round of stimulus checks: March 2023

The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800.

Where do I enter RRC in to TurboTax

If you're completing your tax return on your own, the credit can be claimed on line 30 of Form 1040 or Form 1040-SR. Instructions for completing this line are included in Form 1040's instructions.

How do I use my recovery rebate credit

Your Recovery Rebate Credit will reduce the amount of any tax you may owe for 2023 or be included in your tax refund, and can be direct deposited into your financial account. You can use a bank account, prepaid debit card or alternative financial products for your direct deposit.

What is recovery rebate credit on Form 1040

Your Recovery Rebate Credit will reduce the amount of any tax you may owe for 2023 or be included in your tax refund, and can be direct deposited into your financial account. You can use a bank account, prepaid debit card or alternative financial products for your direct deposit.

How much is the 3rd recovery rebate credit

You were issued the full amount of the Recovery Rebate Credit if your third Economic Impact Payment was $1,400 ($2,800 if married filing jointly for 2023) plus $1,400 for each qualifying dependent reported on your 2023 tax return.

What is line 35a on 1040

Line 35a lists the amount you want paid to you. Line 36 lists the amount you want credited to next year's tax liability. If your tax payments (Line 33) are less than your Total Tax (Line 24), you owe tax. The amount you owe is shown on Line 37.

What do I put in line 16 on 1040

The next section is all about your refund. If the number on Line 19 (your total payments) is greater than the number on Line 16 (your total tax) then you have overpaid the government and are due a refund. Subtract Line 16 from Line 19 to get the amount by which you overpaid and enter it on Line 20.

How do I know if I got my 3rd stimulus check

Find Out Which Payments You Received

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the “Economic Impact Payment Information” section on the Tax Records page.

What is the 1040 form for stimulus check

You can include additional changes to your originally filed return on the “Stimulus Payment” Form 1040X. However, the only information that will be used to figure your stimulus payment amount is the information on your original return and the qualifying income you reported on this Form 1040X.

What form is the recovery rebate credit calculated using

You will need the tax year(s) and amount(s) of the Economic Impact Payments you received to accurately calculate the Recovery Rebate Credit. Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit.

Where do I enter Form 5695 in TurboTax

To add or remove this form:Open or continue your return.Inside TurboTax, search for this exact phrase including the comma and spaces: 5695, residential energy credit.Select the Jump to link in your search results.At the bottom of the Energy-Saving Home Improvements screen, answer Yes, then select Continue.

How do I enter recovery rebate credit on 1040

If you're eligible, you'll need to file a 2023 tax return to claim the 2023 Recovery Rebate Credit even if you aren't required to file a tax return. Line 30 on 2023 Form 1040 and Form 1040-SR is used to claim the Recovery Rebate Credit.

Where on 1040 do you claim stimulus

From tax professionals to do-it-yourself software, all eyes will be on Line 30 of IRS Form 1040.

How do I know if I received the third recovery rebate credit

IRS Notices : We mailed these notices to the address we have on file. Letter 6475: Through March 2023, we'll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2023.

What section is line 30 on 1040

Line 30 on 2023 Form 1040 and Form 1040-SR is used to claim the Recovery Rebate Credit. File a complete and accurate return – even if you don't usually file taxes – to avoid processing delays that slow your tax refund.