Where do I send my documents to TransUnion?

How do I upload documents to TransUnion dispute

Currently, we don't support document uploads for online public record disputes, or for updates to personal information like your Social Security number, date of birth, name or address. If you need to add or update personal information on your report, you will need to dispute by mail.

What is the mailing address to TransUnion credit

The address for TransUnion is P.O. Box 1000, Chester, PA 19022. Under federal law, consumers are entitled to receive a copy of their credit report from all three agencies every 12 months, and can obtain a free copy by calling 877-322-8228.

Cached

How do I send documents to the credit bureau

Send your letter by certified mail with “return receipt requested,” so you can document that the credit bureaus got it. Keep your original documents. Include copies of the documents that support your request and save copies for your files.

What documentation should I send in to validate my ID or address TransUnion

Any two of the following documents are acceptable proof of your current mailing address: Drivers license. State ID card. Bank or credit union statement.

Where do I send my credit dispute letter

Here are the mailing addresses for each credit bureau:Equifax. P.O. Box 7404256. Atlanta, GA 30374-0256.Experian. Dispute Department. P.O. Box 9701. Allen, TX 75013.TransUnion. Consumer Solutions. P.O. Box 2000. Chester, PA 19022-2000.

How do I send an email to TransUnion

TransUnion's Global Technology Support Center can be reached at [email protected].

How do you address an envelope to a credit bureau

What should I put in my dispute letterThe date you will mail the letter.The credit bureau's full mailing address.Your information, including full name and address, date of birth, and the relevant account name and/or credit report number.The name of the creditor or collection agency that made the error.

Can you send a letter to the credit bureau

There are a few ways to dispute an issue on your credit report, including mailing a letter to the credit bureaus. Your credit dispute letter should detail the error (or errors) you found on your credit report. Your letter should also include copies of important documents to help the bureaus conduct an investigation.

Does sending letters to credit bureaus work

A credit dispute letter doesn't automatically fix this issue or repair your credit. And there are no guarantees the credit reporting agency will remove an item—especially if you don't have strong documentation that it's an error. But writing a credit dispute letter costs little more than a bit of time.

How do I remove hard inquiries from TransUnion

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous.

How do I submit an address verification

There are several ways to provide location evidence, including a proof of residency letter (Affidavit of Residence). However, the most common way to help prove location is by giving documents that indicate the address, the dates of service and the person's name on the account.

Why is TransUnion not able to verify my identity

If your identity cannot be verified, this indicates that TransUnion is unable to confirm that you are who you say you are. This can happen when you do not have any credit history, or when the information you provided about yourself does not match TransUnion's records.

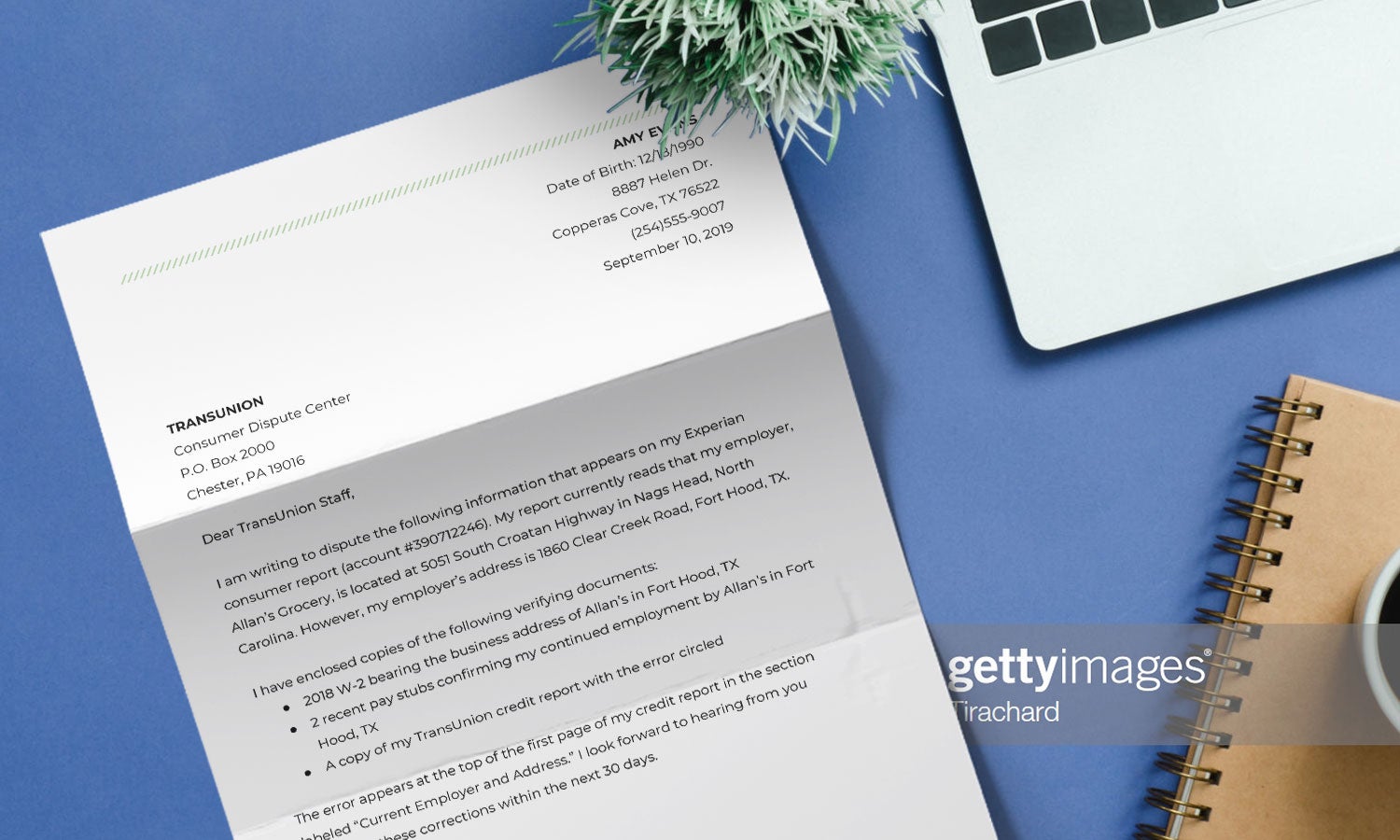

How do I write a dispute letter to TransUnion

MailPersonal Information: Name, DOB, Address, SSN.Name of company that reported the item you're disputing and the partial account number (from your credit report)Reason for your dispute.Any corrections to your personal information (address, phone number, etc.)

What do I need to send with my dispute letter

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Can you email disputes to credit bureaus

You can submit a dispute to the credit reporting company by phone, by mail, or online. Explain the error and what you want changed. Clearly identify each mistake separately, state the facts, explain why you are disputing the information, and request that it be removed or corrected.

Where do I send my dispute letter

Mail your letter to all three credit bureaus if all three of your credit reports contain the error. The credit bureau has between 30 to 45 days to respond to your dispute letting you know the result of their investigation.

How do I send a letter to TransUnion

You can send disputes by mail to TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA 19016-2000. TransUnion recommends including the following in your dispute letter: Your Social Security number and date of birth. Your current address.

Where do I send a letter to the credit bureau

Here are the mailing addresses for each credit bureau:Equifax. P.O. Box 7404256. Atlanta, GA 30374-0256.Experian. Dispute Department. P.O. Box 9701. Allen, TX 75013.TransUnion. Consumer Solutions. P.O. Box 2000. Chester, PA 19022-2000.

Does removing hard inquiries increase credit score

There are definitely some benefits to removing inquiries from your credit report. Your score may improve. Hard inquiries will depress your credit score for the first six to 12 months. If you have them removed before then, you may see a quick boost in your credit score.

Can TransUnion remove hard inquiries over the phone

Dispute hard inquiry errors by phone:

Experian: 888-397-3742. TransUnion: 800-916-8800.