Where does COGS go on a balance sheet?

Does COGS go on the balance sheet

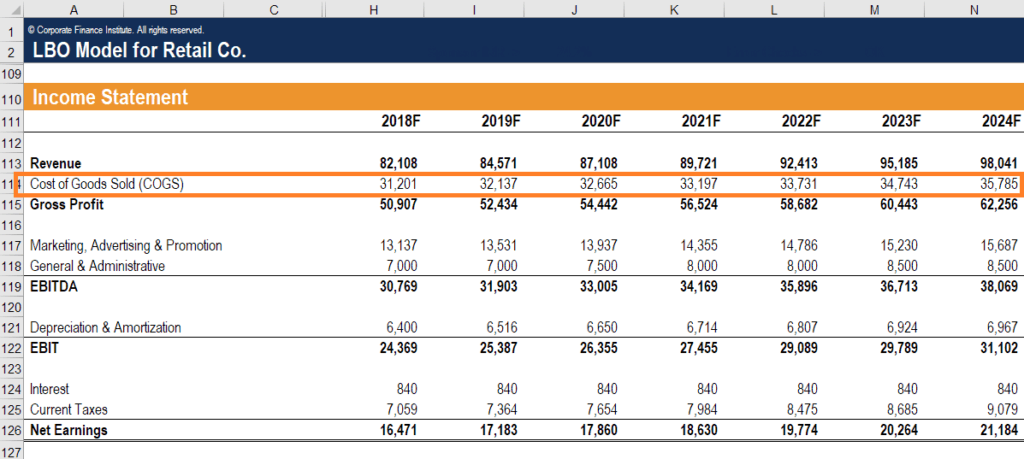

On your income statement, COGS appears under your business's sales (aka revenue). Deduct your COGS from your revenue on your income statement to get your gross profit. Your COGS also play a role when it comes to your balance sheet. The balance sheet lists your business's inventory under current assets.

Cached

Is COGS on the balance sheet or income statement

The cost of goods sold (COGS) is the sum of all direct costs associated with making a product. It appears on an income statement and typically includes money mainly spent on raw materials and labour. It does not include costs associated with marketing, sales or distribution.

Is COGS an asset or liability

Cost of goods sold is not an asset (what a business owns), nor is it a liability (what a business owes). It is an expense.

Cached

Where do you record COGS

income statement

You should record the cost of goods sold as a business expense on your income statement. Under COGS, record any sold inventory. On most income statements, cost of goods sold appears beneath sales revenue and before gross profits.

Is COGS part of accounts payable

For purposes of forecasting accounts payable, A/P is tied to COGS in most financial models, especially if the company sells physical goods – i.e. inventory payments for raw materials directly involved in production.

Is COGS part of retained earnings

Retained earnings are directly impacted by the same items that impact net income. These include revenues, cost of goods sold, operating expenses, and depreciation.

What if COGS is not shown on income statement

Exclusions From Cost of Goods Sold (COGS) Deduction

If COGS is not listed on the income statement, no deduction can be applied for those costs. Examples of pure service companies include accounting firms, law offices, real estate appraisers, business consultants, professional dancers, etc.

Is it a COGS account or expense account

Cost of goods sold refers to the business expenses directly tied to the production and sale of a company's goods and services. Simply put: COGS represents expenses directly incurred when a transaction takes place.

How do you present COGS

It's a more detailed formula that includes components such as returns, freight charges, discounts, and allowances. So, the extended COG formula is: COGS = Beginning inventory + purchases + Freight In – Ending inventory – Purchase Discounts – Purchase Returns and Allowances.

Is COGS part of selling expense

Selling expenses are different from the expenses that make up the cost of goods sold (COGS) or cost of sales. Selling expenses are an area that should be monitored closely for growth opportunities and cost savings.

What is the relationship between COGS and accounts payable

Here, COGS refers to beginning inventory plus purchases subtracting the ending inventory. Accounts payable, on the other hand, refers to company purchases that were made on credit that are due to its suppliers.

How does COGS affect retained earnings

Income (revenues, etc.) increases retained earnings: reflected as a credit to retained earnings. Expenses (COGS, SG&A, etc.) decrease retained earnings: reflected as debits to retained earnings.

Do you include COGS in net income

You can calculate net income by subtracting the cost of goods sold and expenses from your business's total revenue.

Where does cost of goods sold go on P&L

In accounting, COGS is a standard item in the expense section of a company's profit and loss statement (P&L).

How do you account for inventory and COGS

When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference between your COGS Expense and Purchases accounts. Your COGS Expense account is increased by debits and decreased by credits.

Is COGS considered an expense

Cost of goods sold refers to the business expenses directly tied to the production and sale of a company's goods and services. Simply put: COGS represents expenses directly incurred when a transaction takes place.

How do I report COGS

For partnerships and multiple-member LLCs, the cost of goods sold is part of the partnership tax return (Form 1065). For corporations and S corporations, the cost of goods sold is included in the corporate tax return (Form 1120) or the S corporation tax return (Form 1120-S).

How do you calculate COGS on a balance sheet example

You can apply the following formula to calculate the cost of goods sold:COGS = beginning inventory + purchases – ending inventory.COGS = Beginning inventory + purchases + Freight In – Ending inventory – Purchase Discounts – Purchase Returns and Allowances.COGS Ratio.Inventory Turnover.Gross Profit Margin.

What is the difference between COGS and selling expense

Selling expenses include the costs associated with getting orders for the products or services as well as getting those things into the hands of the customer, as opposed to COGS, the explicit costs of producing the product or service.

Is COGS the same as operating expense

Is COGS an operating cost The difference between cost of goods sold and OPEX is that COGS directly relates to a specific product a business is selling—or a service a company is delivering. OPEX are costs incurred in day-to-day operations, regardless of whether any product is sold or not.