Where is my IRS refund 2023?

Why have I not received my 2023 tax refund

Reasons why you haven't received your refund can range from simple math errors on your return to identity theft and tax fraud. Or it might simply mean an unusually high processing volume at the IRS.

Cached

Is the IRS still processing 2023 tax returns

We have processed all paper and electronic individual returns received prior to March 2023, and we are opening mail within normal time frames. This means we have processed all returns we've received for tax year 2023 or earlier if those returns had no errors or did not require further review.

How long are 2023 tax refunds taking

The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it's possible your tax return may require additional review and take longer.

Why are 2023 refunds taking so long

In fact the IRS had already announced that there will likely be longer than usual tax refund payment delays due to processing/validation of past year and amended returns, staffing/budget constraints and the ongoing payment and reconciliation of past stimulus payments and tax credits.

What do I do if I haven’t filed taxes since 2023

If you haven't filed your federal income tax return for this year or for previous years, you should file your return as soon as possible regardless of your reason for not filing the required return. If you need help, check our website.

Why is it taking so long for my 2023 tax refund

In fact the IRS had already announced that there will likely be longer than usual tax refund payment delays due to processing/validation of past year and amended returns, staffing/budget constraints and the ongoing payment and reconciliation of past stimulus payments and tax credits.

Can you still get tax refund from previous years

When is the IRS deadline to claim an undelivered tax refund The IRS is required to keep the filing open and hold on to unclaimed income tax refunds for three years. If you don't file for the tax refund after three years, the money becomes property of the US Treasury, and you won't be able to get it back.

How long can the IRS hold your refund for review

After 60 days, you'd need to file an amended return to reverse any errors and get your refund back. If the IRS thinks you claimed erroneous deductions or credits, the IRS can hold your refund.

How do I contact the IRS about my refund

Use Where's My Refund, call us at 800-829-1954 (toll-free) and use the automated system, or speak with a representative by calling 800-829-1040 (see telephone assistance for hours of operation).

Is it too late to file 2023 and 2023 taxes

17 tax extension deadline. IR-2023-163, Reminder: File 2023 and 2023 returns by Sept. 30 to get COVID penalty relief.

How many years back can you file taxes

three years

You can file your federal taxes from a previous year for up to three years after the original due date (usually around April 15). States may have different time frames for their acceptance of late tax returns.

How long can the IRS hold your refund for processing

If you file a missing or late return, the IRS will process your returns and issue your refunds (generally within 90 days).

How many years back will IRS pay refund

three-year

By law, they only have a three-year window from the original due date, normally the April deadline, to claim their refunds.

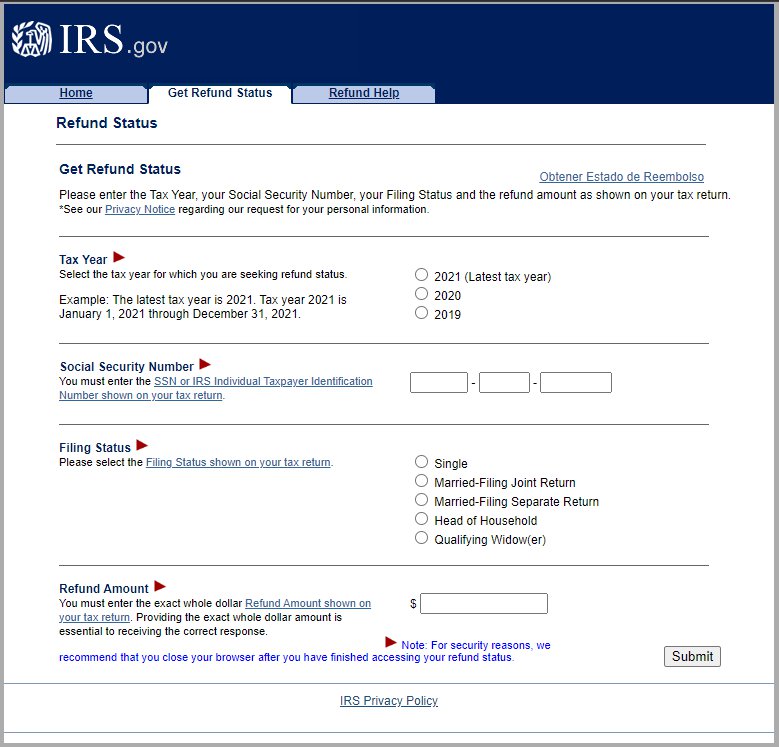

How can I check on my IRS refund from previous years

Telephone Access. If you don't have Internet access, you may call the refund hotline at 800-829-1954 to check on your tax year 2023 refund. To check on an amended return, call 866-464-2050.

What is the longest IRS refund can take

If you file a complete and accurate paper tax return, your refund should be issued in about six to eight weeks from the date IRS receives your return. If you file your return electronically, your refund should be issued in less than three weeks, even faster when you choose direct deposit.

Can I sue the IRS for delaying my refund

You can file a suit in a United States District Court or the United States Court of Federal Claims. However, you generally have only two years to file a refund suit from the date the IRS mails you a notice that denies your claim.

Can I talk to an IRS agent in person

You can visit your local IRS office for in-person tax help. Call for an appointment after you find a Taxpayer Assistance Center near you. IRS Offices are closed on federal holidays.

What do I do if I didn’t file my 2023 taxes

Help Filing Your Past Due Return

For filing help, call 800-829-1040 or 800-829-4059 for TTY/TDD. If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

Can I still file my 2023 taxes electronically in 2023

Eric Smith, an I.R.S. spokesman, said the agency accepts electronically filed returns for the current season and two years prior. For this year, that means you can electronically file returns for tax years 2023, 2023 and 2023.

Can I claim a tax refund from 5 years ago

Statute of limitations

SOL is a time limit imposed by law on the right of taxpayers to file a claim for refund. 4 years after the original return due date . If you filed before the due date , you have 4 years from the original return due date to file a claim. If you filed after the extension, the return is late.