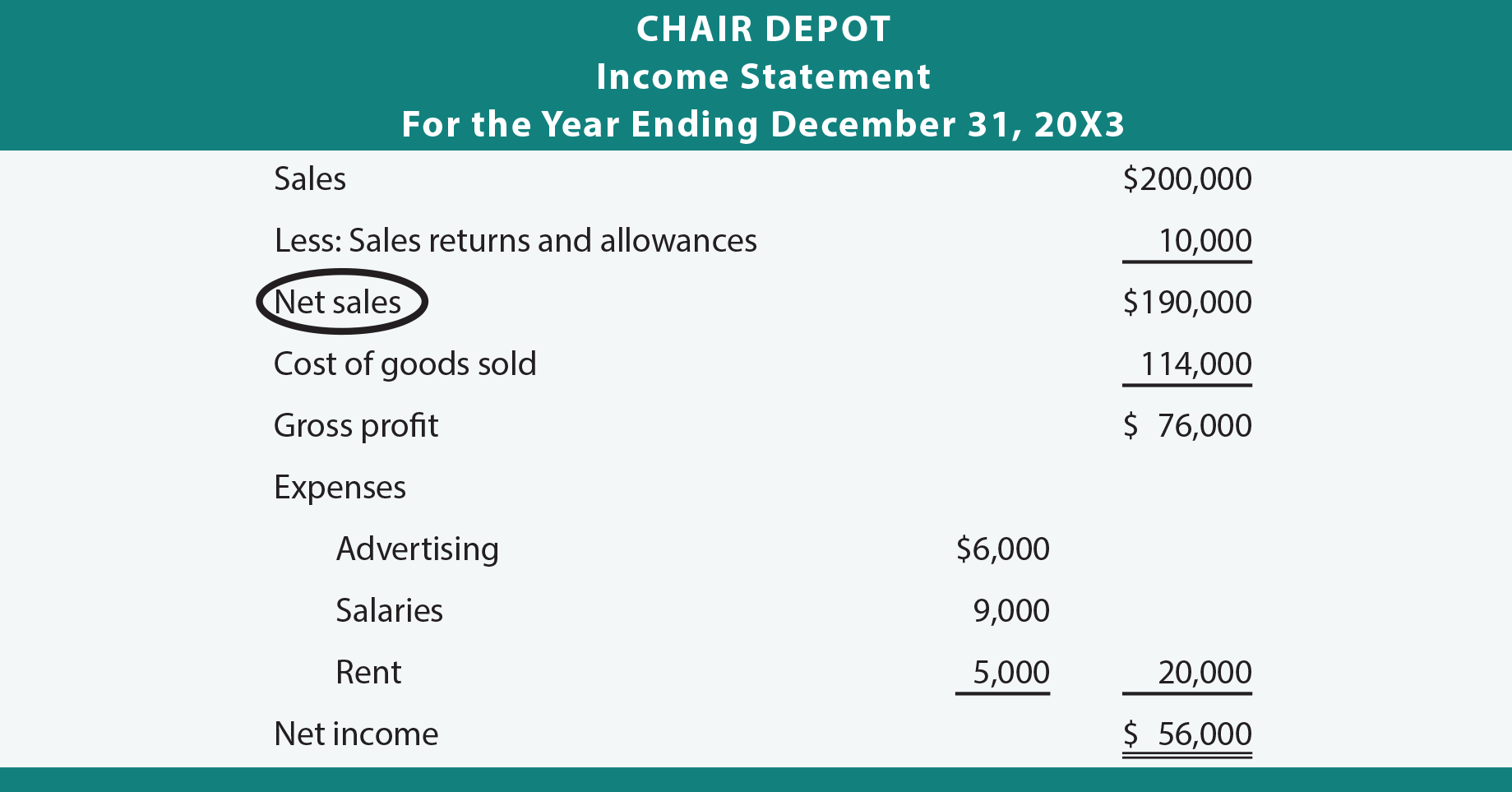

Where is sales returns and allowances on the income statement?

Is sales returns and allowances an expense

No, the sales returns and allowances account is not included as a product or period expense. No. Revenue accounts are used to record the gross sales to customers.

What are sales returns allowances and discounts on the income statement

Sales Discounts, Returns and Allowances are contra revenue accounts, also known as contra sales accounts, with debit balances that reduce the gross Sales Revenue credit balance on an income statement in order report the net Sales Revenue generated by a business for an accounting period.

Cached

How do you record sales returns and allowances

When merchandise is returned, the sales returns and allowances account is debited to reduce sales, and accounts receivable or cash is credited to refund cash or reduce what is owed by the customer. A second entry must also be made debiting inventory to put the returned items back.

Where does returns go on income statement

In the income statement, it comes before a net sales line item, which is a computation that aggregates the gross sales line item and the negative amount in the sales returns and allowances line item.

Where do you record sales returns

For both cash and credit sales, you can record the money in the sales return and allowances account. You can also record where this money comes from to balance the books. For cash refunds, you can reflect a decrease in the cash account. A return for an item purchased on credit decreases accounts receivable.

Where does sales discounts go on the income statement

Reporting the Discount

Report the amount of total sales discounts for an accounting period on a line called “Less: Sales Discounts” below your sales revenue line on your income statement. For example, if your small business had $200 in discounts during the period, report “Less: Sales discounts $200.”

Do sales discounts go on the income statement

The sales discounts are directly deducted from the gross sales at recording in the income statement. In other words, the value of sales recorded in the income statement is the net of any sales discount – cash or trade discount.

Does sales returns and allowances go on a single step income statement

For most companies, sales returns and allowances are not disclosed separately on the income statement. Instead, the company's gross sales are reduced by sales returns and allowance, and this net sales figure is used for the income statement.

Where does sales returns and allowances go on the balance sheet

Where do purchase returns and allowances go Purchase returns and allowances do not appear on the balance sheet as they are not liabilities. Instead, they must be recorded in a type of account known as a contra revenue account.

Are returns included in income statement

For most companies, sales returns and allowances are not disclosed separately on the income statement. Instead, the company's gross sales are reduced by sales returns and allowance, and this net sales figure is used for the income statement.

What is the sales returns and allowances account classified as

contra-revenue account

The Sales Returns and Allowances account is a contra-revenue account that keeps track of all customer returns. A contra revenue account is an account with a debit balance, which is contrary to the normal balance for a revenue account.

What is an example of sales returns and allowances

Sales returns and allowances are deducted from sales revenue when net sales are calculated. For example, if a company had sales revenue of $12,000 and sales returns and allowances of $3,500, its net sales would be $8,500 ($12,000 – $3,500).

Are sales returns reported on the income statement

Sales returns and allowances is a line item appearing in the income statement. This line item is presented as a subtraction from the gross sales line item, and is intended to reduce sales by the amount of product returns from customers and sales allowances granted.

Is sales return part of income statement

In the sales revenue section of an income statement, the sales returns and allowances account is subtracted from sales because these accounts have the opposite effect on net income. Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance.

Where does sales revenue go on an income statement

Sales revenue is the first line of the income statement, which is why it's commonly known as a “top line” metric. It attains this visible spot because it's the starting point for determining a company's net income. To find the gross profit, deduct the cost of goods sold from the sales revenue.

What goes on a single step income statement

Single-Step Income Statements

This straightforward document merely conveys a company's revenue, expenses, and bottom-line net income. All revenues and gains are totaled at the top of the statement, while all expenses and losses are totaled at the bottom.

Are sales returns and allowances an asset or liability

Where do purchase returns and allowances go Purchase returns and allowances do not appear on the balance sheet as they are not liabilities. Instead, they must be recorded in a type of account known as a contra revenue account.

Is sales return an asset or liability or expense or income

Sales returns are known as a contra revenue account and they have a direct effect on the net income, thereby reducing the income. They cannot be considered as an expense but they do contribute to the loss of income. Also read: Cash Book.

Where are sales returns recorded

Recording Sales Returns

If it is a cash sale, the sale return is recorded in the Sales Returns account and also as a debit to the cash sales account. If the sale is a credit sale, then the sales return will be recorded in the Sales Returns account. It is credited to account receivables.

What is on the income statement

An income statement shows a company's revenues, expenses and profitability over a period of time. It is also sometimes called a profit-and-loss (P&L) statement or an earnings statement. It shows your: revenue from selling products or services. expenses to generate the revenue and manage your business.