Where to get a personal loan with 630 credit score?

Is it possible to get a loan with a 630 credit score

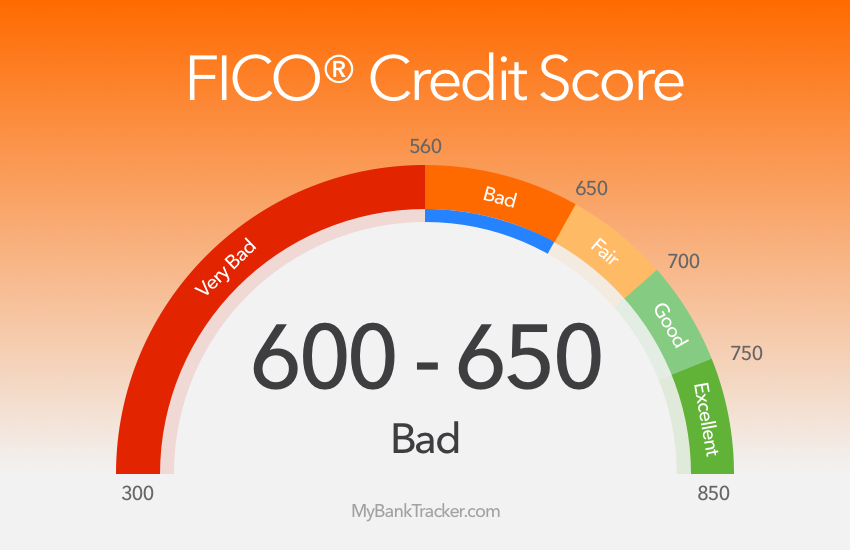

Your credit score is a key factor that determines whether you qualify for a personal loan. Applicants with fair credit scores — generally from 630 to 689 — may have a harder time qualifying for a loan than those with good or excellent credit. But it's still possible.

What interest rate can I get on a personal loan with a 630 credit score

Average personal loan interest rates by credit score

| Credit score | Average loan interest rate |

|---|---|

| 720–850 | 10.73%-12.50% |

| 690–719 | 13.50%-15.50% |

| 630–689 | 17.80%-19.90% |

| 300–629 | 28.50%-32.00% |

Can I get a personal loan with a credit score of 6 30

The typical minimum credit score to qualify for a personal loan is 560 to 660, according to lenders surveyed by NerdWallet. Some lenders may require a higher score. A high credit score doesn't guarantee you'll qualify or get a low interest rate.

Can I get a personal loan with a 635 credit score

Generally, borrowers need a credit score of at least 610 to 640 to even qualify for a personal loan. To qualify for a lender's lowest interest rate, borrowers typically need a score of at least 690.

What can I get approved for with a 630 credit score

What Does a 630 Credit Score Get You

| Type of Credit | Do You Qualify |

|---|---|

| Secured Credit Card | YES |

| Unsecured Credit Card | YES |

| Home Loan | YES (FHA Loan) |

| Personal Loan | MAYBE |

Will a bank give you a loan with 600 credit score

Yes, you can get a personal loan with a 600 credit score — there are even lenders that specialize in offering fair credit personal loans. But keep in mind that if you have a credit score between 580 and 669, you'll generally be considered a “subprime” borrower — meaning lenders might see you as a more risky investment.

How high of a credit score do you need for a personal loan

Personal loans can be used for just about anything, like consolidating credit cards, financing a home project and paying off medical bills. The minimum credit score needed for a personal loan is typically 580, though the best loan terms are usually reserved for people with a credit score of 640 and above.

What are the easiest loans to get approved for

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they're available to people with bad credit. They're also very expensive in most cases.

Can I get a personal loan if my credit score is a 620

Yes, you can get a personal loan with a 620 credit score. The best personal loans for a 620 credit score are from LendingPoint, FreedomPlus and Avant, as they offer the most competitive APRs and fees.

Can I get an unsecured credit card with a 630 credit score

Yes, you can get a credit card with a 630 credit score, and there are both secured and unsecured options. One of the best credit cards for a 630 score is the Capital One Quicksilver Secured Cash Rewards Credit Card because it offers rewards and a $0 annual fee.

Can I get a loan with a 631 credit score

Credit Rating: 631 is considered a bad credit score. Borrowing Options: Most borrowing options are available, but the terms are unlikely to be attractive. For example, you could borrow a small amount with certain unsecured credit cards or a personal loan for damaged credit, but the interest rate is likely to be high.

How big of a loan can you get with a 600 credit score

The amount you can borrow will vary by lender, but you can typically take out a loan between $1,000 and $50,000 with a 600 credit score. Keep in mind that the more you borrow, the more you'll pay in interest.

What credit score does LendingTree use

While many creditors look at your FICO Score, some lenders use VantageScore instead, a credit score model created by the three credit bureaus. LendingTree provides you with the most recent version of your VantageScore 3.0.

What is the minimum credit score to get a loan

Minimum CIBIL score for a personal loan

Typically, the higher your CIBIL score, the better. However, the minimum CIBIL score for quick unsecured personal loan approval is 750. It indicates that you have experience managing credit responsibly and will make payments on time.

Which lender is easiest to get a personal loan from

Easiest Personal Loans To Get Ratings

| Company | Forbes Advisor Rating | Minimum credit score |

|---|---|---|

| LendingPoint | 4.0 | 600 |

| Universal Credit | 3.5 | 580 |

| Upstart | 3.5 | 600 |

| Avant | 3.5 | 580 |

What is the easiest type of loan to get with bad credit

The easiest loans to get approved for with bad credit are secured, co-signed and joint loans because you can use collateral or another person's creditworthiness to make up for your bad credit score. Payday loans, pawnshop loans and car title loans also are easy to get, but they're extremely expensive.

What is the best high limit credit card for 630 credit score

The Petal 2 Visa Credit Card, issued by WebBank, is the best high-limit credit card for people with average, fair or limited credit — typically a credit score between 580 and 669. The card comes with a variable interest rate and a credit limit that's based on your creditworthiness, but it can be up to $10,000.

What is the minimum credit score for a loan

Ans. No lender specifies a minimum CIBIL score requirement for a personal loan application. However, a score of 750 and above is preferred by lenders for loan applications. This score reflects the creditworthiness of the borrower and the chances of lenders approving the loan application with this score increases.

What is the minimum credit score for most lenders

620

Most lenders require a minimum credit score of 620 to buy a house with a conventional mortgage. Other types of mortgages have different credit score requirements: FHA home loans typically require a credit score of at least 500 if you put 10% down or 580 if you put 3.5% down.

What is the lowest credit score lenders will accept

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.