Which date is best for credit card payment?

What is the best date to make a credit card payment

The best time to pay your credit card bill is before it's late. You can avoid late payment fees when you make at least your minimum payment by the due date. And if you can pay your full balance before the due date, you can avoid accruing interest charges.

Cached

Is it better to pay credit card on due date or statement date

To avoid paying interest and late fees, you'll need to pay your bill by the due date. But if you want to improve your credit score, the best time to make a payment is probably before your statement closing date, whenever your debt-to-credit ratio begins to climb too high.

CachedSimilar

What are the 3 important dates for credit cards

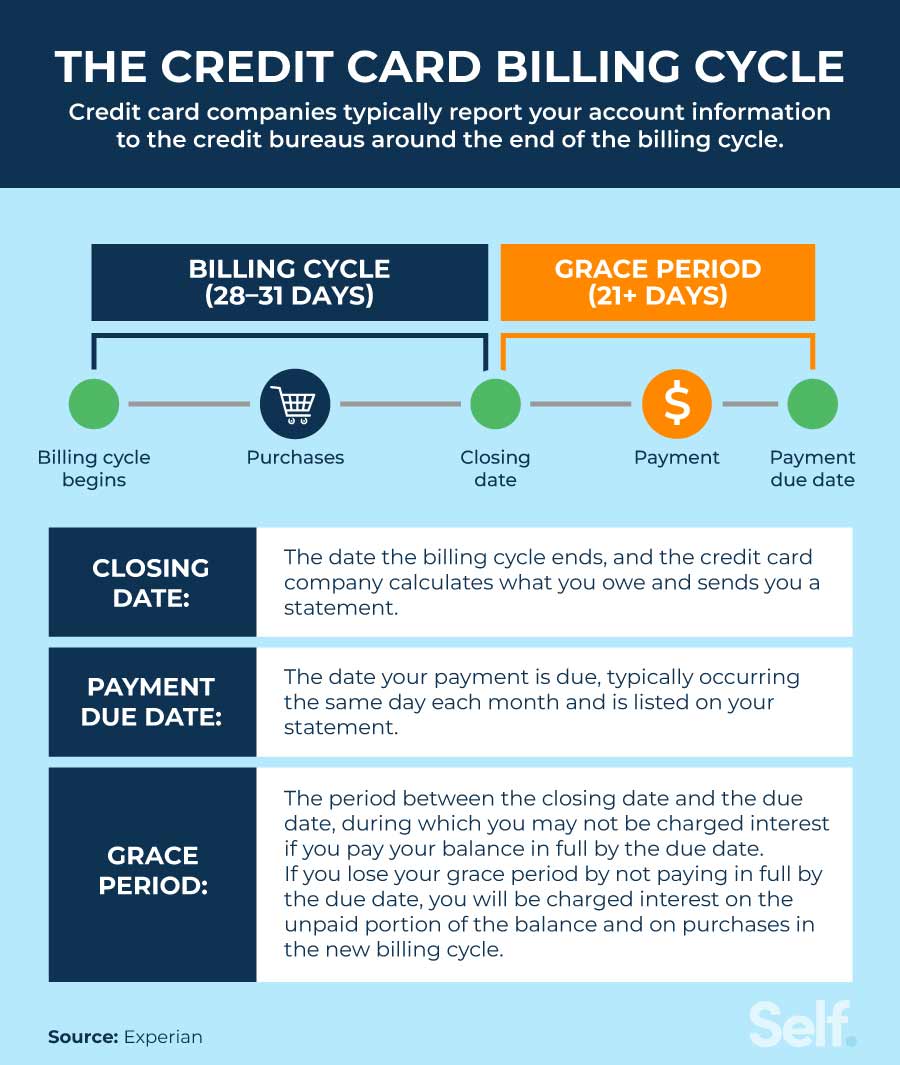

Here are 4 important dates to remember on your credit cards:Credit card billing cycle:Credit card statement closing date:Credit card payment due date:Annual fees due dates:

Should I pay my credit card on the due date or the day before

You should always pay your credit card bill by the due date, but there are some situations where it's better to pay sooner. For instance, if you make a large purchase or find yourself carrying a balance from the previous month, you may want to consider paying your bill early.

What is the 15 3 rule

The 15/3 credit card payment rule is a strategy that involves making two payments each month to your credit card company. You make one payment 15 days before your statement is due and another payment three days before the due date.

What are the two most important dates in your credit card billing cycle

If you have a credit card, there are two very important dates you'll want to keep track of—the statement closing date and the payment due date.

How to pay your credit card bill to boost your credit score

Just pay off your credit card bill in full and on time each month, and the card issuer will report your payments to the credit bureaus. By paying in full, you also won't have to pay interest. Your payment history makes up 35% of your FICO credit score, so this is one of the best things you can do to build your credit.

What is the 15 3 rule for credit card payment

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

What is the 2 3 4 rule for credit cards

2/3/4 Rule

Here's how the rule works: You can be approved for up to two new credit cards every rolling two-month period. You can be approved for up to three new credit cards every rolling 12-month period. You can be approved for up to four new credit cards every rolling 24-month period.

Does paying credit card early help credit score

Increases your available credit

So, if you make payments to your card before your due date, you'll have a lower balance due (and higher available credit) at the close of your cycle. That means less credit card debt gets reported to the credit bureaus, which could help your credit score.

Why does the 15 3 credit hack work

The 15/3 hack can help struggling cardholders improve their credit because paying down part of a monthly balance—in a smaller increment—before the statement date reduces the reported amount owed. This means that credit utilization rate will be lower which can help boost the cardholder's credit score.

How do you avoid the 5 24 rule

How to bypass the Chase 5/24 rule If you've been approved for five cards in the past 24 months, you will not be approved for another Chase card thanks to the 5/24 rule. There have been reports of “Selected for you” and “Just for you” offers being exempt from the 5/24 rule.

What should be the ideal billing cycle

Your credit card billing cycle will typically last anywhere from 28 to 31 days, depending on the card issuer. The amount of days in your billing cycle may fluctuate month to month, since the number of days in each month varies, but there are regulations to ensure that they are as “equal” as possible.

What is the most important rule in using a credit card

The most important principle for using credit cards is to always pay your bill on time and in full. Following this simple rule can help you avoid interest charges, late fees and poor credit scores. By paying your bill in full, you'll avoid interest and build toward a high credit score.

How to get your credit score up 100 points in 30 days

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Does paying twice a month increase credit score

While making multiple payments each month won't affect your credit score (it will only show up as one payment per month), you will be able to better manage your credit utilization ratio.

What is the golden rule of credit cards

Only have a credit card if you pay in full each month.

This is the single most important rule of credit cards. Your best financial move is to repay your credit card balance in full each month. Otherwise, you will be subject to high interest charges.

What is the golden rule of credit card use

The golden rule of responsible credit card use is to pay off balances in full and on time to avoid paying interest on revolving balances. If you are unable to pay your statement balances in full, then pay as much as you can; experts caution not to only pay the minimum payment that's due.

Is there a disadvantage to paying credit card early

Is it good or bad to pay your credit card bill early It's not a bad idea to pay your credit card bill early. Making a payment a few days, or even a couple weeks, before your due date can ensure you aren't late. The only bad time to make a card payment is after the due date.