Which method of accounting for uncollectible receivables offers two methods of estimating uncollectible accounts?

Which method of accounting for uncollectible receivables offers two methods of

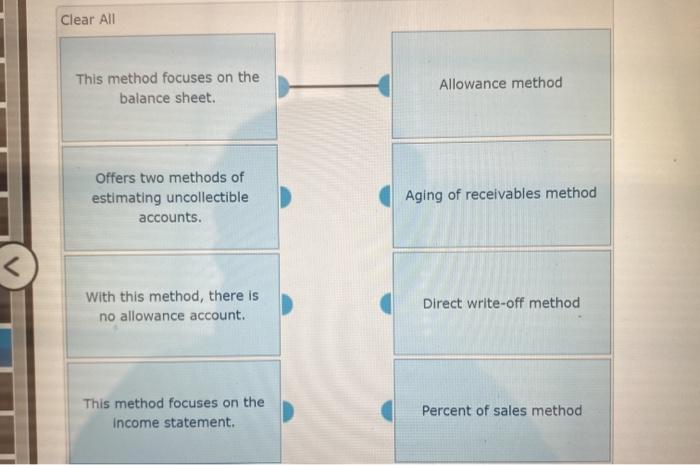

The two methods of accounting for uncollectible receivables are the allowance method and the direct write-off method.

Cached

Which of the two methods of estimating uncollectible accounts would normally be more accurate why

The aging of receivables is the most accurate when estimating the amount of receivables that may become uncollectable in the future. This approach applies a lower percentage to accounts with newer balances and a higher percentage to accounts that are past due.

What are the methods of estimating uncollectible receivables

Two common ways of estimating the amount of uncollectible receivables are:Preparing an aging of accounts receivable to identify the potentially uncollectible accounts.Estimating the amount of uncollectible accounts by simply recording a percentage of the credit sales that occur in each accounting period.

CachedSimilar

Which of the two methods of estimating uncollectible provides for the most accurate estimate of the current net realizable value of the receivables

Answer and Explanation: The allowance method for writing off bad debts provides the most accurate estimate of the current net realizable value of the receivables.

What are the two methods of estimating the uncollectible accounts expense

The first method—percentage-of-sales method—focuses on the income statement and the relationship of uncollectible accounts to sales. The second method—percentage-of-receivables method—focuses on the balance sheet and the relationship of the allowance for uncollectible accounts to accounts receivable.

What are the two methods of accounting for accounts receivable

Business owners know that some customers who receive credit will never pay their account balances. These uncollectible accounts are also called bad debts. Companies use two methods to account for bad debts: the direct write‐off method and the allowance method.

What are the 2 most common methods of estimating uncollectible receivables

The percentage of sales method and the accounts receivable aging method are the two most common ways to estimate uncollectible accounts.

What are the two 2 methods used to estimate bad debts

There are two main ways to estimate an allowance for bad debts: the percentage sales method and the accounts receivable aging method. Bad debts can be written off on both business and individual tax returns.

What are the two methods used to estimate uncollectible accounts are the percent of sales method and analysis of payables method

Answer and Explanation: Explanation: The two basic methods for estimating uncollectible accounts under the allowance method are the percentage of credit sales method and the percentage of receivables. The percentage of sales method estimates uncollectible accounts based on a percentage of credit sales for the period.

What are the 2 types of accounts in accounting

Types of AccountsPersonal Accounts.Real Accounts.Nominal Accounts.

What are the two most common types of receivables

Majorly, receivables can be divided into three types: trade receivable/accounts receivable (A/R), notes receivable, and other receivables.

Are there two methods of accounting for uncollectible accounts

There are two fundamental methods for handling these uncollectible accounts: the direct write-off method and the allowance method.

What are the 2 most common account types

Some allow you to spend or pay bills, while others are designed for short- or long-term savings. The most common types of bank accounts include: Checking accounts. Savings accounts.

What are the two basic types of accounting quizlet

The two basic types of cost accounting systems are: Job order costing and process costing.

What are the 2 accounting methods

There are two primary methods of accounting— cash method and accrual method. The alternative bookkeeping method is a modified accrual method, which is a combination of the two primary methods.

What are the two methods of recording accounting transactions

The two main accounting methods are cash accounting and accrual accounting. Cash accounting records revenues and expenses when they are received and paid. Accrual accounting records revenues and expenses when they occur.

What are the 2 basic accounts that most banks offer

Types of bank accountsChecking account: A checking account offers easy access to your money for your daily transactional needs and helps keep your cash secure.Savings account: A savings account allows you to accumulate interest on funds you've saved for future needs.

What are the 2 main types of accounting methods

There are two primary methods of accounting— cash method and accrual method. The alternative bookkeeping method is a modified accrual method, which is a combination of the two primary methods.

What is 2 way accounting principle

Double-entry accounting is a system of bookkeeping where every financial transaction is recorded in at least two accounts. A double-entry system provides a check and balance for each transaction, which helps ensure accuracy and prevent fraud.

What are the two 2 categories of accounting users

Users of accounting information are generally divided into two categories: internal and external.