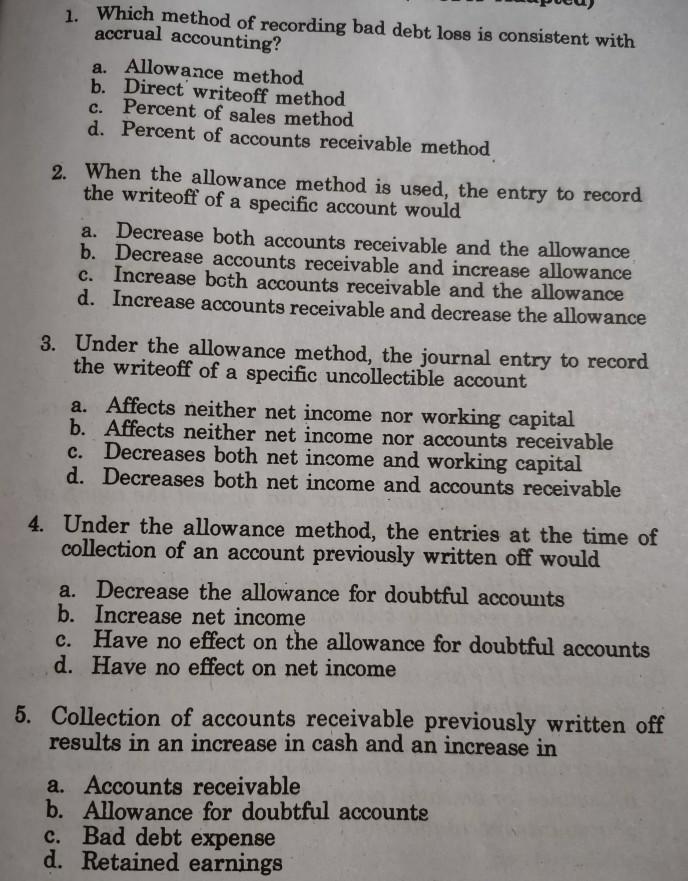

Which method of recording uncollectible accounts expense is consistent with accrual accounting?

Which method of recording credit loss expense accounts receivable is consistent with accrual accounting

Which method of recording credit loss expense accounts receivable is consistent with accrual accounting Database management systems. Improve data consistency by reducing data redundancy.

What is the method for recording uncollectible accounts

Whenever a company is sure a certain account balance is uncollectible, it will debit bad debt expense and credit accounts receivable for the amount.

What method of accounting for uncollectible accounts results in a better matching

In order to provide the best matching, the allowance method is used. Under the allowance method, the uncollectible account expense for the period is matched against the sales for that period. This requires estimating the uncollectible account expense in the period of the sale.

Which method of recording bad debt loss is consistent with accrual accounting a allowance method

The allowance method

The correct option is b. The allowance method is one of the methods of recording the uncollectible accounts expense. Under this method, the provision for estimated uncollectible accounts is recorded, and at the end of the adjustments are recorded for bad debts expense.

Cached

What are the two ways to record accrued expenses

Accrued expenses are recognized by debiting the appropriate expense account and crediting an accrued liability account. A second journal entry must then be prepared in the following period to reverse the entry. For example, a company wants to accrue a $10,000 utility invoice to have the expense hit in June.

How do you record expenses in accrual accounting

When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account, which appears on the balance sheet.

What are the 2 methods of accounting for uncollectible receivables

¨ Two methods are used in accounting for uncollectible accounts: (1) the Direct Write-off Method and (2) the Allowance Method. § When a specific account is determined to be uncollectible, the loss is charged to Bad Debt Expense.

What are the two methods used to treat uncollectible accounts

The two methods of accounting for uncollectible receivables are the allowance method and the direct write-off method. The allowance method estimates and records the amount of uncollectible accounts for a given period using different methods such as the…

Which method of accounting for uncollectible receivables violates the matching principle

The two methods of accounting for uncollectible accounts receivable are the allowance method and the direct write-off method. The direct write-off method violates the matching principle of the Generally Accepted Accounting Principles (GAAP).

Does the allowance method record bad debt expense

Allowance Method

So, an allowance for doubtful accounts is established based on an anticipated, estimated figure. A company will debit bad debts expense and credit this allowance account.

What is the direct method and allowance method

The allowance method requires a small business to estimate at the end of the year how much bad debt they have, while the direct write off method lets owners write off bad debt whenever they decide a customer won't pay an invoice.

What are the different methods of accounting for accruals

Here are the four types of accruals typically recorded on the balance sheet when following the accrual accounting method.Deferred Revenue.Accrued Revenue.Prepaid Expenses.Accrued Expenses.

What is accrued expense expense method

An accrued expense—also called accrued liability—is an expense recognized as incurred but not yet paid. In most cases, an accrued expense is a debit to an expense account. This increases your expenses. You may also apply a credit to an accrued liabilities account, which increases your liabilities.

What accounts are used in accrual accounting

Accrual accounts include, among many others, accounts payable, accounts receivable, accrued tax liabilities, and accrued interest earned or payable.

Why is allowance method better

The allowance method is preferred over the direct write-off method because: The income statement will report the bad debts expense closer to the time of the sale or service, and. The balance sheet will report a more realistic net amount of accounts receivable that will actually be turning to cash.

When using the allowance method of accounting for uncollectible accounts

When an allowance for uncollectible accounts receivables is established or increased based on revised estimates, bad debt expense is charged (debited) in the operating ledger and the balance of the allowance for uncollectible accounts is increased (credited) in the general ledger.

What are the 2 methods of accounting for bad debts and uncollectible accounts receivable

There are two different methods used to recognize bad debt expense. Using the direct write-off method, uncollectible accounts are written off directly to expense as they become uncollectible. On the other hand, the allowance method accrues an estimate that gets continually revised.

Which method of accounting for uncollectible accounts does GAAP require the direct write-off method or the allowance method

the allowance method

The GAAP requires the use of the allowance method.

Are there two methods of accounting for uncollectible accounts

There are two fundamental methods for handling these uncollectible accounts: the direct write-off method and the allowance method.

What type of journal recording of bad debts or allowance for bad debts

Bad Debt Allowance Method

Estimate uncollectible receivables. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. When you decide to write off an account, debit allowance for doubtful accounts and credit the corresponding receivables account.