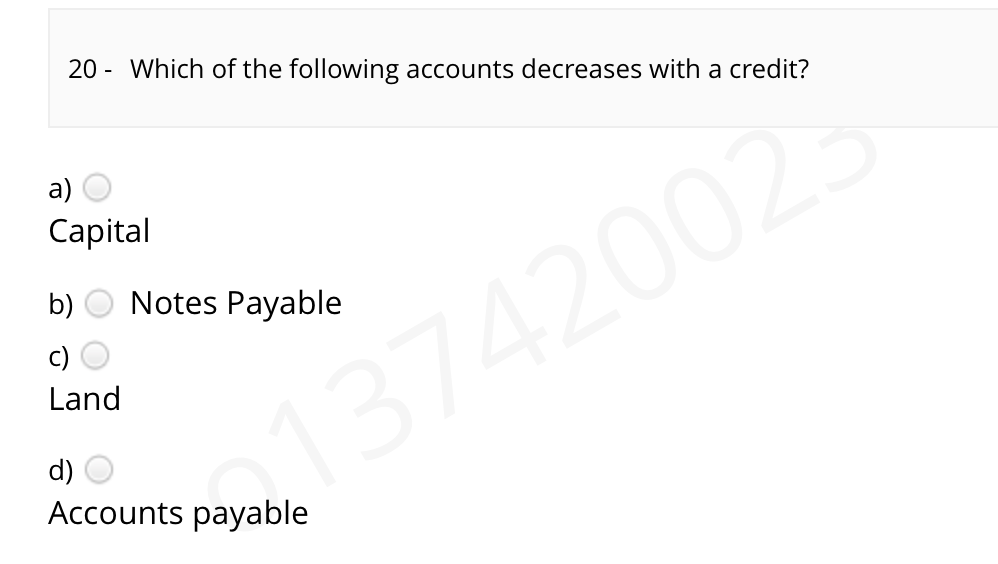

Which of the following accounts decreases with a credit?

What account is decreased with a credit

What is a credit A credit entry increases liability, revenue or equity accounts — or it decreases an asset or expense account.

Cached

What decreases with credit

A credit increases the balance of a liability, equity, gain or revenue account and decreases the balance of an asset, loss or expense account.

Cached

Which of the following is decreased with a credit quizlet

Cash is an asset account and therefore increases with a debit and decreases with a credit. Depreciation Expense is an expense account and therefore increases with a debit and decreases with a credit. Prepaid Rent is an asset account and therefore increases with a debit and decreases with a credit.

Is a decrease to an expense account a credit

for an expense account, you debit to increase it, and credit to decrease it. for an asset account, you debit to increase it and credit to decrease it.

Are asset accounts decreased with credits

Cr. + + Rules of Debits and Credits: Assets are increased by debits and decreased by credits. Liabilities are increased by credits and decreased by debits. Equity accounts are increased by credits and decreased by debits.

Is a decrease in the equity account a credit

In asset accounts, a debit increases the balance and a credit decreases the balance. For liability accounts, debits decrease, and credits increase the balance. In equity accounts, a debit decreases the balance and a credit increases the balance.

What increases or decreases credit

Five major things can raise or lower credit scores: your payment history, the amounts you owe, credit mix, new credit, and length of credit history. Not paying your bills on time or using most of your available credit are things that can lower your credit score.

Does credit decrease capital

for a capital account, you credit to increase it and debit to decrease it.

What decreases debit or credit

A debit decreases the balance and a credit increases the balance.

Is a decrease in an asset a credit

In an accounting journal, increases in assets are recorded as debits. Decreases in assets are recorded as credits.

Is a decrease in accounts receivable a credit

The amount of accounts receivable is increased on the debit side and decreased on the credit side. When cash payment is received from the debtor, cash is increased and the accounts receivable is decreased. When recording the transaction, cash is debited, and accounts receivable are credited.

Do credits decrease accounts receivable

The amount of accounts receivable is increased on the debit side and decreased on the credit side. When cash payment is received from the debtor, cash is increased and the accounts receivable is decreased. When recording the transaction, cash is debited, and accounts receivable are credited.

Does credit decrease both assets and liabilities

The key difference between debits and credits lies in their effect on the accounting equation. A debit decreases assets or increases liabilities, while a credit increases assets or decreases liabilities. In other words, debits always reduce equity while credits always increase it.

Which of the following increases with a credit

The balances in the accounts of liabilities and revenues are increased with a credit.

Is a decrease in capital a debit or credit

debit side

Capital is recorded on the credit side of an account. Any increase is also recorded on the credit side. Any decrease is recorded on the debit side of the respective capital account.

Does a credit always decrease an asset account

A debit increases asset or expense accounts, and decreases liability, revenue or equity accounts. A credit is always positioned on the right side of an entry. It increases liability, revenue or equity accounts and decreases asset or expense accounts.

Which of the accounts are decreased with a debit and increased with a credit

In asset accounts, a debit increases the balance and a credit decreases the balance. For liability accounts, debits decrease, and credits increase the balance. In equity accounts, a debit decreases the balance and a credit increases the balance.

What is decreased with a debit

A debit is an accounting entry that creates a decrease in liabilities or an increase in assets. In double-entry bookkeeping, all debits are made on the left side of the ledger and must be offset with corresponding credits on the right side of the ledger.

Is decrease in liability a credit

A debit to a liability account means the business doesn't owe so much (i.e. reduces the liability), and a credit to a liability account means the business owes more (i.e. increases the liability).

Is a decrease in accounts payable a debit or credit

When you pay off the invoice, the amount of money you owe decreases (accounts payable). Since liabilities are decreased by debits, you will debit the accounts payable. And, you need to credit your cash account to show a decrease in assets.