Which of the following accounts follow the same debit and credit rules as liabilities?

What are the debit and credit rules for liabilities

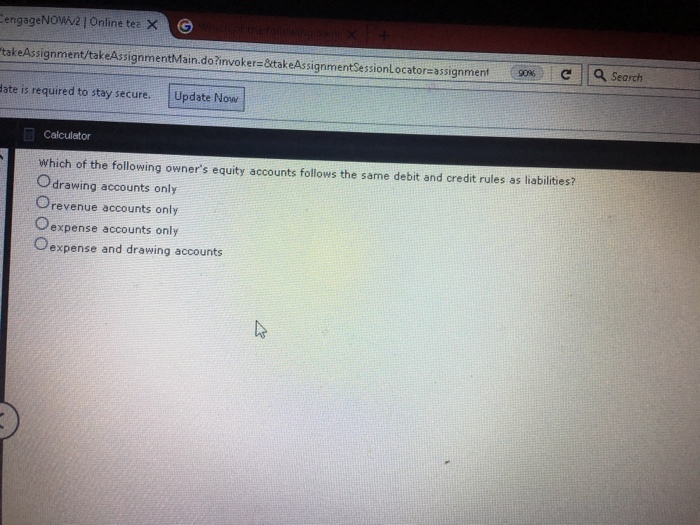

Liabilities are increased by credits and decreased by debits. Equity accounts are increased by credits and decreased by debits. Revenues are increased by credits and decreased by debits. Expenses are increased by debits and decreased by credits.

Cached

Which of the following accounts follows the rules of debit and credit

The correct choice is option 1: Salary expense & Notes payable. Explanation: Assets, dividends, and expenses have normal debit balances while liability, revenue, and equity have normal credit balances. Thus, both have follows debit credit rules and debits and credits in the opposite manner.

Cached

Are the rules of debit and credit for liability accounts the same as the rules for asset accounts

Answer and Explanation: It is false that the rules of debits and credits for liability accounts are the same as the rules for asset accounts. In an asset account, a debit entry increases the balance and a credit entry decreases the balance of the account.

Why is the rule of debit and credit the same for liability and owner’s equity

The rules of debit and credit are the same for both liability and capital because capital is also considered a liability with the viewpoint of business.

Is a liability a debit or credit

Typically, when reviewing the financial statements of a business, Assets are Debits and Liabilities and Equity are Credits.

Does liabilities have a debit or credit balance

Liabilities, revenues, and equity accounts have natural credit balances. If a debit is applied to any of these accounts, the account balance has decreased. For example, a debit to the accounts payable account in the balance sheet indicates a reduction of a liability.

Is a liability account a debit or credit

Liability accounts are categories within the business's books that show how much it owes. A debit to a liability account means the business doesn't owe so much (i.e. reduces the liability), and a credit to a liability account means the business owes more (i.e. increases the liability).

Should a liability account have a debit or credit balance

credit balances

Liability accounts will normally have credit balances and the credit balances are increased with a credit entry. Recall that credit means right side. In the accounting equation, liabilities appear on the right side of the equal sign.

Are debits assets and credits liabilities

Drilling down, debits increase asset, loss and expense accounts, while credits decrease them. Conversely, credits increase liability, equity, gains and revenue accounts, while debits decrease them.

Do liabilities have both normal debit and credit balances

Liability accounts will normally have credit balances and the credit balances are increased with a credit entry. Recall that credit means right side. In the accounting equation, liabilities appear on the right side of the equal sign.

What in the balance sheet must always equal liabilities and owners equity

A balance sheet should always balance. Assets must always equal liabilities plus owners' equity. Owners' equity must always equal assets minus liabilities. Liabilities must always equal assets minus owners' equity.

Which of the accounts is a liability

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses.

What type of account is liability

A liability account is a general ledger account in which a company records the following which resulted from business transactions: Amounts owed to suppliers for goods and services received on credit. Principal amounts owed to banks and other lenders for borrowed funds.

What accounts are considered liabilities

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. Liabilities can be contrasted with assets. Liabilities refer to things that you owe or have borrowed; assets are things that you own or are owed.

What type of account is a liability account

A liability account is a general ledger account in which a company records the following which resulted from business transactions: Amounts owed to suppliers for goods and services received on credit. Principal amounts owed to banks and other lenders for borrowed funds.

What are 5 examples of liabilities

Examples of liabilities are -Bank debt.Mortgage debt.Money owed to suppliers (accounts payable)Wages owed.Taxes owed.

Do all liability accounts normally have a credit balance quizlet

Liability. All liability accounts normally have a credit balance. A revenue account is closed by debiting Income Summary and crediting Service Revenue. The statement of financial position and the income statement are one and the same.

What type of balance does a liability account have

credit balances

Balances in liability accounts are usually credit balances. This means that debit entries are made on the left side of the T-account which decrease the account balance, while credit entries on the right side will increase the account balance.

Are liabilities recorded as credits or debits on the worksheet

How Debits and Credits Work

| Table 1 | ||

|---|---|---|

| Liabilities | Credit | Debit |

| Shareholder's Equity | Credit | Debit |

| Revenue | Credit | Debit |

| Expenses | Debit | Credit |

What is the statement of account debits credits assets and liabilities called

Trial balance is a list of all the balances of each of the account. It includes all accounts of expenses, incomes, assets, liabilities, personal account.