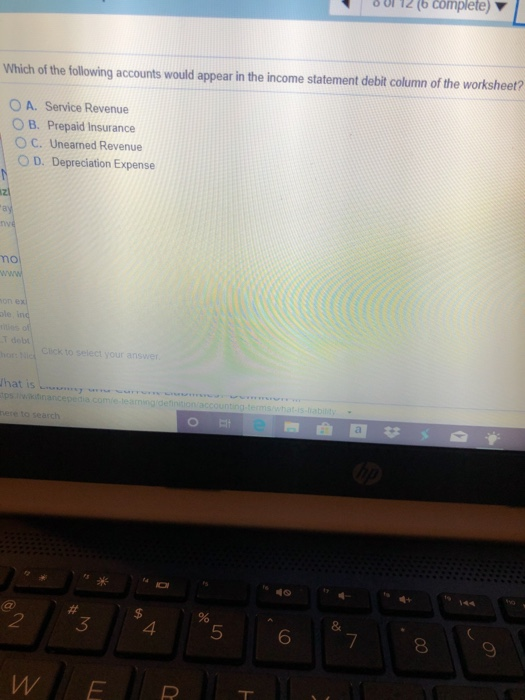

Which of the following accounts would appear on the income statement?

Which accounts would appear on the income statement quizlet

It includes three main sections: revenues, expenses, and net income.

What is shown on an income statement

An income statement shows a company's revenues, expenses and profitability over a period of time. It is also sometimes called a profit-and-loss (P&L) statement or an earnings statement.

Which of the following accounts would not appear on an income statement

(b) Dividends would not be found on an income statement. An income statement shows all the revenues and expenses of a company for a period of time, typically for a year.

Which of the following accounts would appear on an income statement for a merchandiser

Correct Answer: Option a. Cost of Goods Sold. Explanation: The income statement of a merchandise company will report the cost of goods sold which represents the difference between the cost of goods available for sale and the cost of ending inventory.

Which of the following are reported on the income statement quizlet

Only revenue and expenses are recorded on income statement.

Which accounts are found on an income statement indeed

The income statement , or profit-and-loss statement, reports the costs, revenue, expenses, gains and net income for a specific period. Typically, income statements account for financial activities within a year.

What are the 4 parts of an income statement

In brief, The Income statement has the following components:Revenues,Costs of Goods Sold,Gross Profit,Operating Expenses,Operating Income,Other Income/Expenses,Profits.

Which items does not show up in income statement and balance sheet

Off-balance sheet (OBS) assets are assets that don't appear on the balance sheet. OBS assets can be used to shelter financial statements from asset ownership and related debt. Common OBS assets include accounts receivable, leaseback agreements, and operating leases.

Does merchandise go on income statement

While merchandise inventory is represented as an asset on the company's balance sheet, it does not directly appear on the company's income statement, which reports revenue, expenses and profit or loss during a specific accounting period.

What items are included on an income statement of a merchandising business

There are three calculated amounts on the multi-step income statement for a merchandiser – net sales, gross profit, and net income. Net sales is the actual sales generated by a business. It represents everything that “went out the door” in sales minus all that came back in returns and in the form of sales discounts.

Which of the following is reported on the income statement as an expense

Answer and Explanation: D) Cost of goods sold is considered an expense on the income statement.

Which of the following are components of the income statement quizlet

The income statement consists of assets, expenses, liabilities, and revenues.

What accounts are found on an income statement and balance sheet

The balance sheet reports assets, liabilities, and equity, while the income statement reports revenues and expenses that net to a profit or loss. The income statement also notes any tax expense, while the balance sheet contains any unpaid tax liabilities.

Which of the following is an expense on the income statement

Answer and Explanation: D) Cost of goods sold is considered an expense on the income statement.

What are the three 3 types of income statement

What Are the Different Types of Income Statements and How Are They CalculatedSingle-Step Income Statement.Multi-Step Income Statement.Generate Your Income Statement Using Deskera Books.

What items are on a balance sheet or income statement

What's Reported: A balance sheet reports assets, liabilities and equity. An income statement reports revenue and expenses. What They're Used For: A balance sheet is most often used by a company to see if it has enough assets to satisfy its financial obligations.

What items are on the balance sheet and income statement

Line Items Reported: The income statement reports revenue, expenses and profit or loss, while the balance sheet reports assets, liabilities and shareholder equity.

What expense is merchandise

The cost of merchandise sold is the cost of goods that have been sold by a wholesaler or retailer. These entities do not manufacture their own goods, instead buying the goods from third parties and selling them to their customers.

What are 3 examples of items that might appear on a company’s income statement

The most common income statement items include:Revenue/Sales. Sales Revenue is the company's revenue from sales or services, displayed at the very top of the statement.Gross Profit.General and Administrative (G&A) Expenses.Depreciation & Amortization Expense.Interest.Income Taxes.

What are expenses that would appear on a business’s income statement

They include the cost of goods sold (COGS); selling, general, and administrative (SG&A) expenses; depreciation or amortization; and research and development (R&D) expenses. Typical items that make up the list are employee wages, sales commissions, and expenses for utilities such as electricity and transportation.