Which of the following is a disadvantage of credit cards quizlet?

Which of the following is a disadvantage of credit cards

Credit cards often come with several hidden costs that can add up quickly and cause you to go into debt even faster. These include late fees, annual fees, cash advance fees, or balance transfer fees (if applicable). There are also penalty fees for exceeding your credit limit (over-limit fees) and more.

What are 3 disadvantages of using a credit card

Here are a few disadvantages of using a Credit Card:Habit of Overspending. Although credit cards provide you with adequate credit for a long time, you must be prudent when spending the money.High Rate of Interest.Deception.Hidden Costs.Restricted Drawings.Minimum Due.

Which of the following is usually considered a disadvantage of using credit

Through credit usage, the users cannot able to manage all their financial activities and it may lead to slowing down the financial goals.

What is the greatest disadvantage of using credit cards called

interest. the greatest disadvantage of using credit cards.

What is a disadvantage of credit quizlet

Two disadvantages of having credit include that the purchases cost more over time and it can lead to overspending.

What are 4 disadvantages of using a credit card

ConsInterest charges. Perhaps the most obvious drawback of using a credit card is paying interest.Temptation to overspend. Credit cards make it easy to spend money — maybe too easy for some people.Late fees.Potential for credit damage.

What are 2 disadvantages of credit

Using credit also has some disadvantages. Credit almost always costs money. You have to decide if the item is worth the extra expense of interest paid, the rate of interest and possible fees. It can become a habit and encourages overspending.

Which is not an advantage of credit cards

Answer and Explanation: The correct answer is option d. It often leads to impulsive buying. Having a credit card has both benefits and drawbacks.

What are 5 disadvantages of debit cards

Cons of debit cardsThey have limited fraud protection.Your spending limit depends on your checking account balance.They may cause overdraft fees.They don't build your credit score.

What are 3 advantages of credit cards

Here's a closer look:Earning rewards. Earning rewards can be a great advantage of having a credit card.Help building credit. A good credit score can help you get better interest rates for things like car loans, personal loans and mortgages.Digital tools and account management.Unauthorized charges protection.

What are the disadvantages of using a credit or debit card

Debit vs. credit cards: when to use each

| Debit cards | Credit cards | |

|---|---|---|

| Cons | Limited fraud protection Spending limit depends on checking account balance Possible overdraft fees Don't build your credit | Danger of overspending Interest payments Late payment fees Can hurt your credit score |

What are credit card costs disadvantages

Con: High interest rates and fees

But interest rates aren't the only costs you can incur with a credit card. Many card issuers charge late fees, foreign transaction fees, balance transfer fees and more.

What are advantages and disadvantages of credit cards

Credit cards offer convenience, consumer protections and in some cases rewards or special financing. But they may also tempt you to overspend, charge variable interest rates that are typically higher than you'd pay with a loan, and often have late fees or penalty interest rates.

What are the disadvantages and advantages of credit cards

Credit cards offer convenience, consumer protections and in some cases rewards or special financing. But they may also tempt you to overspend, charge variable interest rates that are typically higher than you'd pay with a loan, and often have late fees or penalty interest rates.

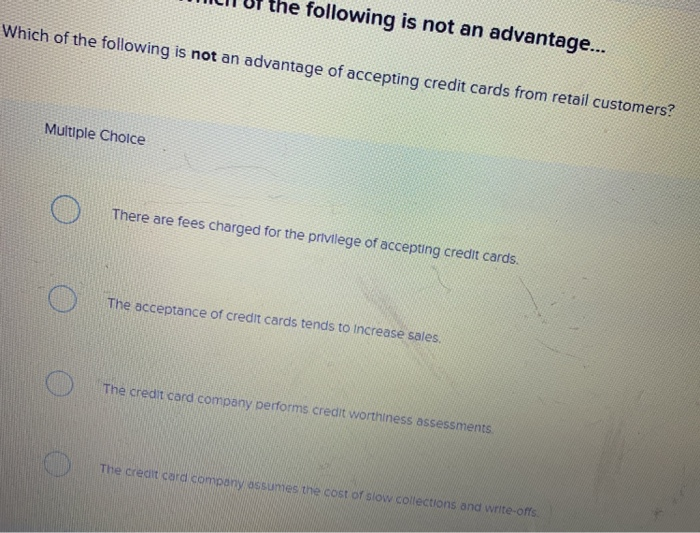

Which one of the following is not an advantage of a credit card

Answer and Explanation: The correct answer is option d. It often leads to impulsive buying. Having a credit card has both benefits and drawbacks.

Which of the following is not an advantage of credit card

Answer and Explanation: The correct answer is option d. It often leads to impulsive buying.

What is one major disadvantage of making credit card purchases

High Interest Rates

One of the biggest disadvantages of credit cards is the fact that you have to pay interest on purchases, and typically, these interest rates are fairly steep (unless you get a special offer or have exceptional credit).

What is a disadvantage of credit card sales

The most significant disadvantage of accepting credit cards is the high transaction fees. Although per-transaction fees can make sense for B2C transactions, there are fewer benefits on the B2B side. It's common for credit card companies to charge around 3% per transaction.

What is the most common problem of using a credit card

Repayments are late or missing

Late or missed payments can lead to higher fees. This is one of the common credit card mistakes and usually happens when you forget to pay your bill on time. Tip: Simply, automate your payments.

What are 3 disadvantages of credit sales

DisadvantagesThere is always a risk of bad debt. read more.It affects the company's cash flow.The company must incur expenses.The company has to maintain separate books of accounts for accounts receivable.There is a notional loss of interest during the credit period because money is blocked.